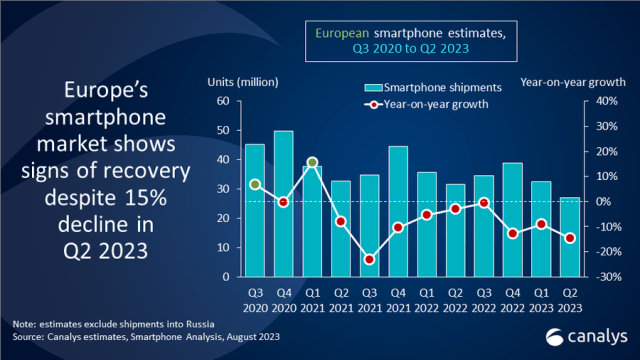

In a recent report, research firm Canalys has forecasted that the European smartphone market, excluding Russia, will witness a resurgence in 2024, with shipments set to increase by 7 percent to reach 132 million units.

While the market faces challenges throughout 2023, including constraints on shipments due to extended device lifetimes, increasing competition from secondhand markets, and high channel inventory levels, conditions are expected to improve.

Runar Bjorhovde, an Analyst at Canalys, noted that despite the ongoing difficulties, signs of optimism have emerged. Falling inflation and improved inventory levels are setting the stage for market growth to return in 2024. Several factors will contribute to this recovery, including an upcoming refresh cycle and easing economic pressures.

Bjørhovde pointed out that Central and Eastern Europe, Italy, Spain, and Portugal present significant short-term opportunities for smartphone vendors due to shorter refresh cycles and a positive attitude among retailers towards new offerings and emerging brands.

Additionally, markets that predominantly feature smartphones in the US$800+ segment, such as Germany, France, and the Nordics, are expected to start growing in the second half of 2024 as economic pressures subside. These markets, despite experiencing the largest declines in the second quarter, have substantial installed bases that will drive a resurgence in shipments as devices reach the end of their lifecycles and require replacement, with expectations of a rebound during the shopping holiday season in 2024.

Given the intense competition at the high-end segment dominated by Apple and Samsung, Canalys advises ambitious vendors to explore different segments to establish their presence. Opportunities have arisen in the sub-US$200 price range, as Samsung has deprioritized it and other vendors struggle with profitability. However, success in this segment requires economies of scale and close collaboration with the channel.

Given the intense competition at the high-end segment dominated by Apple and Samsung, Canalys advises ambitious vendors to explore different segments to establish their presence. Opportunities have arisen in the sub-US$200 price range, as Samsung has deprioritized it and other vendors struggle with profitability. However, success in this segment requires economies of scale and close collaboration with the channel.

To strengthen their positions for future growth, several vendors are expanding their reach. Samsung and Google, for example, are investing further in the B2B segment to match Apple’s Distributor Partner Program. Motorola, on the other hand, is prioritizing growth in the consumer segment and investing in marketing development funds for the channel.

Bjørhovde emphasized that the vendor landscape in Europe is shrinking, making it essential for vendors to offer strong omnichannel sales support across a wide channel. This must be combined with product portfolios that align with local requirements in terms of pricing and specifications.

Looking at the long-term outlook, Canalys anticipates moderate cyclical growth in the European smartphone market, which will challenge current revenue models for vendors and the channel. Factors such as longer device lifetimes, regulatory efforts to reduce new device volumes, and increasing demand for used and refurbished devices will require vendors to identify new revenue opportunities. This may involve selling original spare parts, supporting the channel in driving device trade-ins, and offering vendor-refurbished devices.

Ultimately, vendors that display resilience in the current market environment and adapt quickly to new regulations are likely to establish themselves as strong long-term partners for the channel, according to Canalys. The year-on-year growth rate in the European smartphone market is projected to reach 7 percent in 2024 and then gradually slow to 2 percent by 2027, with volumes eventually recovering to 2022 levels.