Pay-TV service revenue in Japan is anticipated to experience sluggish growth over the next few years, with a projected increase from $6.1 billion in 2022 to $6.4 billion in 2027. This modest growth is expected to reflect a meager compound annual growth rate (CAGR) of just 1 percent, as reported by GlobalData, a prominent data and analytics company.

GlobalData’s latest forecast for the Japanese pay-TV landscape, released in the first quarter of 2023, highlights a concerning trend in the decline of subscriptions, particularly for cable TV and direct-to-home (DTH) services.

GlobalData’s latest forecast for the Japanese pay-TV landscape, released in the first quarter of 2023, highlights a concerning trend in the decline of subscriptions, particularly for cable TV and direct-to-home (DTH) services.

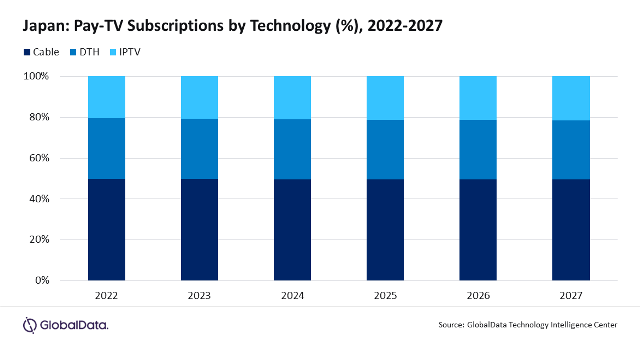

The analysis reveals a projected CAGR decline of 0.2 percent for cable TV and 0.7 percent for DTH pay-TV accounts between 2022 and 2027. This decline can be attributed to the rising popularity of over-the-top (OTT) video platforms, driving a phenomenon known as “cord-cutting.”

One significant factor contributing to the sustained pay-TV service revenue over this period is the projected growth in aggregate pay-TV average revenue per user (ARPU). From $26 in 2022, the ARPU is anticipated to rise to $29.2 in 2027. This increase will play a pivotal role in supporting the overall growth in pay-TV service revenue, despite the challenges posed by declining subscriptions.

Although subscriptions are on a downward trajectory, cable TV is expected to retain the largest share of total pay-TV subscriptions throughout the forecast period. On the other hand, internet protocol television (IPTV) is set to expand its share of total pay-TV subscriptions, projected to reach 22 percent by 2027. This growth is bolstered by the increased coverage of fiber networks across the country, which facilitates the provision of high-quality IPTV services.

Leading the pay-TV services market in terms of subscriptions in 2022 was KDDI, a prominent player in the Japanese telecommunications sector. KDDI is poised to maintain its position as the foremost pay-TV service provider up to 2027. This is attributed to the company’s robust presence in the cable TV segment, as well as its growing emphasis on IPTV services. KDDI has strategically introduced bundled packages that combine pay-TV services with fixed broadband and telephony offerings. These packages are designed to mitigate churn rates and effectively compete with the rising influence of OTT service providers.

As the Japanese pay-TV landscape evolves, the industry is gearing up to navigate challenges posed by shifting consumer preferences and technological advancements. The integration of IPTV services and innovative packaging strategies are expected to be crucial in maintaining revenue growth in the face of declining subscriptions and intensifying competition from digital streaming platforms.