Telecom Regulatory Authority of India (TRAI) has received several recommendations on 5G spectrum auction from stakeholders including Reliance Jio, Airtel, Vodafone, Idea Cellular, BSNL, MTNL, GSA, GSMA, COAI, Ericsson, among others.

Telecom Regulatory Authority of India (TRAI) has received several recommendations on 5G spectrum auction from stakeholders including Reliance Jio, Airtel, Vodafone, Idea Cellular, BSNL, MTNL, GSA, GSMA, COAI, Ericsson, among others.

The focus of the main inputs was on timing of 5G spectrum auction, bandwidth for the sale, block-size, roll out obligations, price of 5G spectrum, among others.

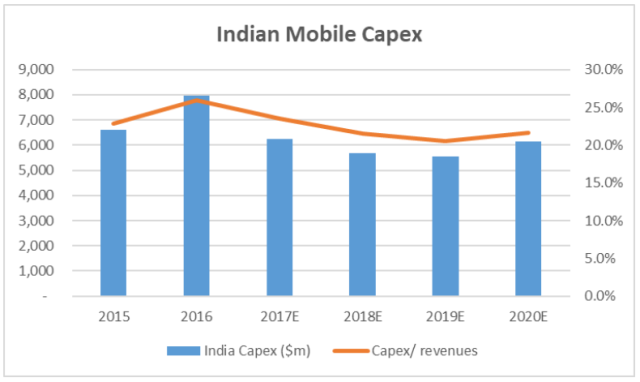

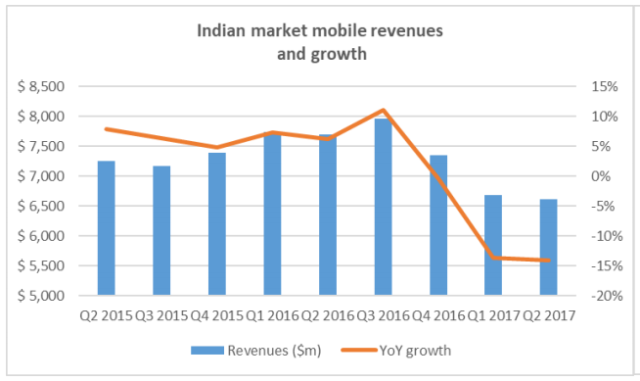

Most of the comments from Indian telecom operators came with a caution that Indian telecom industry is in a weak position to spend on 5G at this point in time.

Most of the comments indicated that TDD arrangement may be adopted by TRAI. All comments say that there should not be any mandatory roll-out obligations in expanding 5G networks.

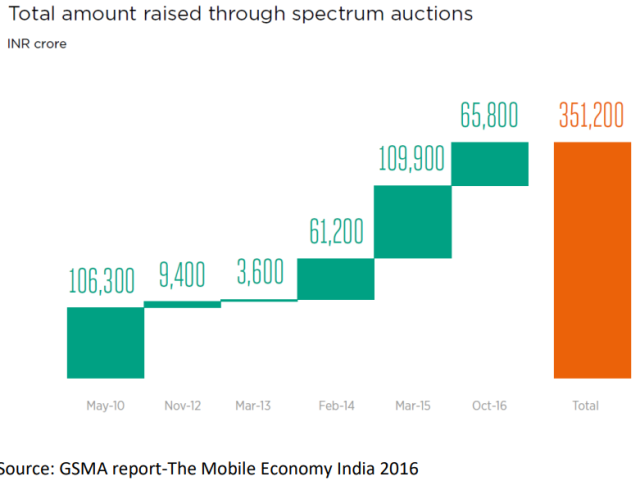

Recommendations on 5G spectrum pricing indicated that TRAI should recommend low cost for 5G bandwidth because telecom operators need to spend heavily in telecom equipment to expand 5G coverage.

Some comments

The 3400-3600 MHz band has been identified for IMT at WRC world. Many countries will release the 3300-3400 and other portions of frequency band in the 3600 deployment. For example: China’s MIIT is considering 3300; 3400-3600 MHz is already released for mobile usage in Japan; Korea will release 3400 mobile usage in 2018 or 2019; the European Union identified 3400, said GSA.

COAI said TDD arrangement may be adopted as the preferred option for spectrum in 3300- 3400 MHz & 3400-3600 MHz. Channel bandwidth for future technologies is being planned in increment of 10MHz upto 60MHz & 20MHz beyond 60MHz. 10MHz of block size is recommended for the auction. 20MHz spectrum should be defined as minimum amount of spectrum for bidding considering the quantum of spectrum available in these bands and the requirement of contiguous large blocks for delivering better performance on wireless broadband networks.

COAI said TDD arrangement may be adopted as the preferred option for spectrum in 3300- 3400 MHz & 3400-3600 MHz. Channel bandwidth for future technologies is being planned in increment of 10MHz upto 60MHz & 20MHz beyond 60MHz. 10MHz of block size is recommended for the auction. 20MHz spectrum should be defined as minimum amount of spectrum for bidding considering the quantum of spectrum available in these bands and the requirement of contiguous large blocks for delivering better performance on wireless broadband networks.

COAI said the reduced coverage of 3300-3400 MHz and 3400-3600 MHz bands as compared to 2300, 2500MHz bands would mean higher Capex in the network. The device ecosystem 3300-3400 MHz and 3400-3600 MHz is yet to develop. TRAI should consider international benchmarks for valuation of 3300-3400 MHz and 3400-3600 MHz spectrum bands. “We do not expect the valuation of 3300-3400 MHz and 3400-3600 MHz spectrum bands to be more than 25 percent of the price of 2300 MHz/ 2500 MHz band,” COAI said.

GSMA said spectrum in the bands between 1-6 GHz offers a good mixture of coverage and capacity characteristics for 5G services. The 3.5 GHz IMT range between 3.3 GHz and 3.8 GHz offers an ideal opportunity to meet this demand. The band is already championed by the US and Europe and is likely to be one of the first to carry 5G traffic.

Ericsson said that there is enormous potential for LTE to reach deeper penetration for mobile broadband which is expected to touch 200 million subscriptions by the end of 2017. This amounts to merely 20 percent penetration and hold scope for expansion. Operators should focus on deployments of Gigabit LTE on wide scale, to serve as a base for 5G/NR deployments when it is launched.

Ericsson said that there is enormous potential for LTE to reach deeper penetration for mobile broadband which is expected to touch 200 million subscriptions by the end of 2017. This amounts to merely 20 percent penetration and hold scope for expansion. Operators should focus on deployments of Gigabit LTE on wide scale, to serve as a base for 5G/NR deployments when it is launched.

In addition, there are also other bands being specified in 3GPP for NR that are today used in India like the 1800 MHz, 2100 MHz, and the 2600 MHz bands that can in future can be integrated as 5G bands.

Bharti Airtel said reduced coverage of the spectrum band compared to other TDD bands such as 2.3 GHz or 2.5 GHz band would mean higher Capex for network rollout. These bands requires extensive fiber network to have comparable coverage of bands such as in 2.3 GHz or 2.5 GHz.

Since the availability of commercial products/ solutions is expected to be in market from 2020 onwards, any commercial use of the spectrum would only happen post 3 years of spectrum auction.

Airtel indicated that the cost of solution would be on a higher side during initial phase till the economies of scale are achieved in the band, which is expected only after 3-4 years of availability of the spectrum.

Device penetration in this band is only expected to scale up from 2022 onwards. The price of spectrum bands should be 25 percent of the reserve price of 2300 MHz/ 2500 MHz band due to the propagation characteristics of 3300- 3400 MHz and 3400-3600 MHz.

Vodafone said TRAI should look at international benchmarks in 3300-3400 MHz and 3400-3600 MHz bands and adjust these for the Indian scenario, by applying purchasing power parity and also keeping in mind the significant financial deterioration of the sector since the last auctions as also the exits/consolidations that are taking place in the sector.

The reserve price for 3400-3600 spectrum may be set at 5 percent of the historical market determined 1800 prices in India. 3300-3400 MHz spectrum is likely to have a poorer ecosystem than 3400-3600MHz.

3300-3400 MHz and 3400-3600 MHz should not be treated as one band and further that the valuation of 3300-3400 MHz should be at 30 percent discount to the value of the 3400-3600 MHz band.

Baburajan K