TIM Brazil has revealed its financial result – revenue, Capex, 5G coverage, subscriber growth, etc – during the first quarter of 2024.

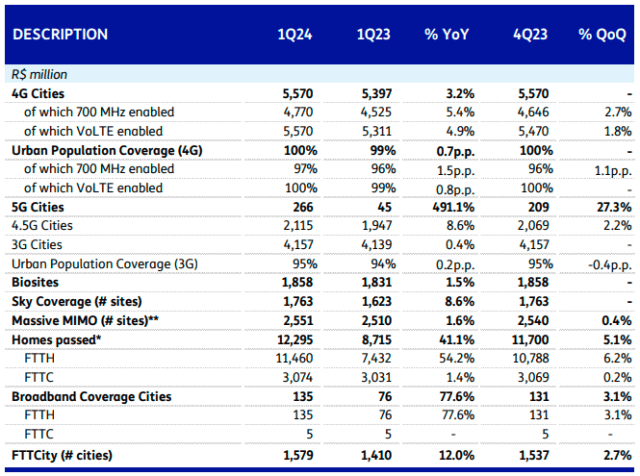

TIM Brazil says 5G is now available in 266 cities, including all capitals.

TIM Brazil says 5G is now available in 266 cities, including all capitals.

Capex totaled R$1,355 million in 1Q24, a growth of 5.1 percent, due to higher investments allocation in network infrastructure with the consolidation of 5G in new regions. Network capex was R$984 million. Capex in IT and others was R$371 million.

TIM Brazil’s 5G coverage has reached 100 percent of the neighborhoods of Belo Horizonte and Goiania. The guidance for Capex released by TIM for the year 2024 remains unchanged. As a result, the Total Capex over Normalized Net Revenue ratio was 22.2 percent compared to 22.7 percent in 1Q23, down by 50 bps YoY.

TIM Brazil has a 5G subscriber base of 6.167 million at the end of March 2024. Total subscriber base reached 61.42 million.

At the end of 1Q24, TIM recorded 61.4 million mobile lines, declining by 0.5 percent. This reduction reflects a combination of growth in the Postpaid base, reaching 28.1 million lines (+7.8 percent), and a decline in the Prepaid base, reaching 33.3 million lines (-6.6 percent). Human Postpaid (ex-M2M) reached 23.0 million lines (+6.6 percent), reaching an M2M base of 5.1 million lines (+13.5 percent. In net additions, TIM had 493k new lines in the Postpaid segment in 1Q24, of which 415k in Human Postpaid.

TIM UltraFibra’s customer base came to 806k connections in 1Q24, a growth of 10.1 percent. The transition of customers to the fiber continues its consistent growth pace: in the period, the FTTH base expanded by 23.8 percent.

Revenue grew by 7.3 percent totaling R$6,096 million due to contribution of all main fronts, of which (i) Mobile Service Revenue grew by 7.4 percent, leveraged by Postpaid services; (ii) Broadband Service Revenue from TIM UltraFibra grew by 9.1 percent; and (iii) Product Revenue grew by 7.3 percent.

Normalized Mobile Service Revenue (MSR) totaled R$5,577 million in 1Q24, growing 7.4 percent, mainly reflecting the positive organic performance in Postpaid.

In 1Q24, Fixed Service Revenue totaled R$332 million, up by 5.5 percent. TIM UltraFibra, the main line for the fixed segment, grew by 9.1 percent in 1Q24, sustaining its growth pace and reaching the highest broadband ARPU in the company’s history, R$95.8 (+3.1 percent). The result reflects the company’s strategy to focus on the evolution of FTTH (Fiber-to-the-Home), which already accounts for over 90 percent of our total broadband customer base.