Most of rural India is yet to experience high-speed data services on 4G network from major telecom operators going by the latest telecom statistics released by TRAI.

This is despite the availability of cost-effective 4G smartphones — pushed by chipset majors such as Qualcomm, MediaTek, among others — and Reliance Jio’s 4G feature phones across India.

This is despite the availability of cost-effective 4G smartphones — pushed by chipset majors such as Qualcomm, MediaTek, among others — and Reliance Jio’s 4G feature phones across India.

Wireless subscribers can buy cost effective data plans on 4G network. The 4G data price is around INR 200 or less than $3 per month for a voice and data plan in India.

Rural coverage of 4G data networks is not adequate for many operators. Telecom operators are in the process of expanding their 4G network to meet growing demand in both rural and urban locations.

The low Capex has negatively impacted telecom equipment makers such as Nokia, ZTE, Samsung, Ericsson and Huawei.

Customers who move to rural areas will experience data services on 2G or 3G networks as an automatic alternative in the case of Bharti Airtel and Vodafone Idea – if there is inadequate 4G network.

India has 333.31 million mobile Internet subscribers on 4G network, 95.48 million subscribers on 3G network and 61.87 million subscribers on 2G subscribers during the June quarter of 2018, according to the financial performance report — for June 2018 — prepared by TRAI.

India has 333.31 million mobile Internet subscribers on 4G network, 95.48 million subscribers on 3G network and 61.87 million subscribers on 2G subscribers during the June quarter of 2018, according to the financial performance report — for June 2018 — prepared by TRAI.

Reliance Jio is the largest 4G operator with a subscriber base of 215.26 million subscribers. Bharti Airtel and Vodafone Idea have the balance 118.05 4G subscribers, the TRAI data shows.

Reliance Jio is the largest 4G operator with a subscriber base of 215.26 million subscribers. Bharti Airtel and Vodafone Idea have the balance 118.05 4G subscribers, the TRAI data shows.

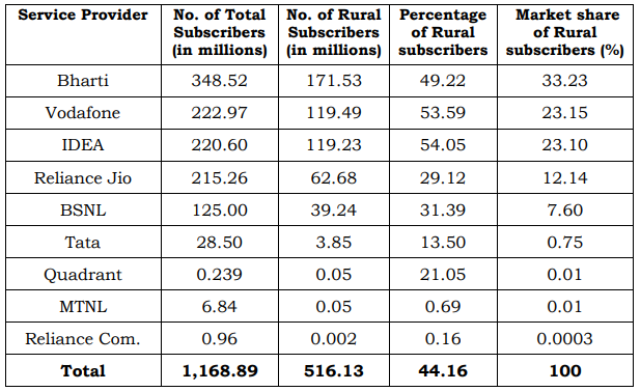

Jio has just 62.68 million subscribers in rural India. This indicates that rural India is yet to add the first 100 million subscribers on the 4G network.

Rural push

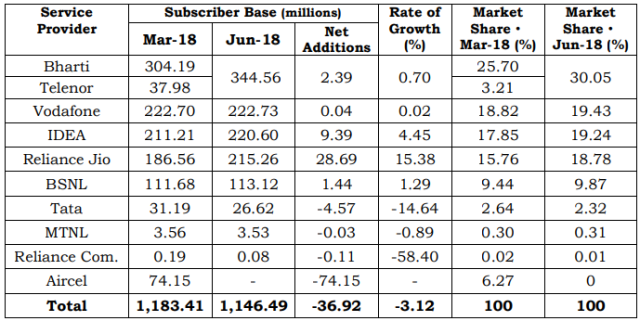

Airtel is the leading service provider in terms of number of subscribers with 348.52 million subscribers followed by Vodafone with 222.97 million in June. Reliance Jio added 28.69 million subscribers followed by Idea Cellular with 9.39 million – mainly benefitting from the closure of Aircel network.

Idea Cellular’s 54.05 percent phone customers are in rural India, followed by Vodafone with 53.59 percent.

Wireless subscriber base declined 3.12 percent or 36.92 million to 1,146.49 million in the June quarter. Rural wireless subscribers declined from 521.23 million in March quarter to 512.89 million in June quarter.

India’s 512.26 million internet subscribers – out of 1,146.49 million total subscriber-base — used 10,418,076 terabytes of data during June quarter. Indian mobile Internet customers used

108,944 terabytes of 2G data, 1,440,180 terabyte of 3G data and 8,868,397 terabytes of 4G data. 85 percent of mobile data is consumed on 4G network, while 14 percent is used on 3G network.

India has broadband Internet subscriber base of 447.12 million and narrowband Internet subscriber base of 65.14 million. The broadband Internet subscriber base increased by 8.37 percent to 447.12 million.

The data growth did not support revenue. Indian telecom service providers’ Gross Revenue (GR) during the quarter dropped 10 percent to INR 58,401 crore with monthly ARPU dipping by 8.92 percent to INR 69 or less than $1.

Baburajan K