The latest TRAI data shows that India is still a 4G market as 5G adoption remains far off though Reliance Jio and Bharti Airtel are in the process of migrating smartphone users to 5G plans.

At present, Vodafone Idea and the state-run BSNL do not have their own 5G networks in India.

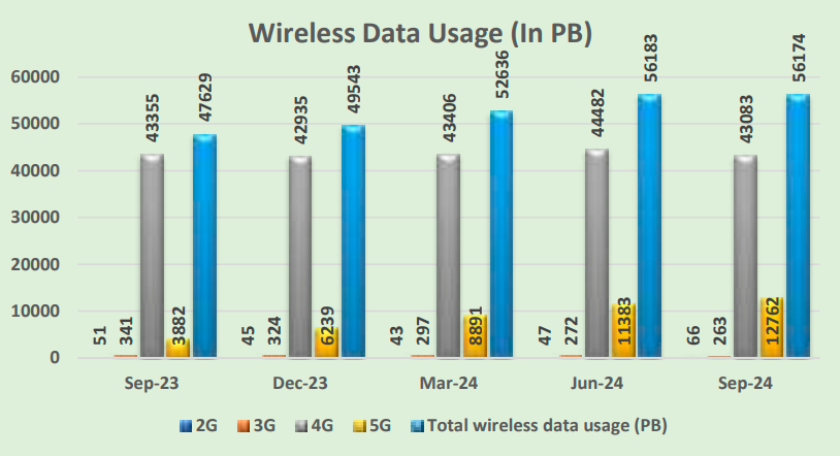

The above chart from TRAI shows that 5G data use has increased to 12,762 PB in September 2024 as compared with 11,383 PB in July 2024, 8,891 PB in March 2024, 6,239 PB in December 2023 and 3,882 PB in September 2024.

On the other hand, 4G data use was 43,083 PB in September 2024 as compared with 44,482 PB in July 2024, 43,406 PB in March 2024, 42,935 PB in December 2023 and 43,355 PB in September 2023.

The volume of wireless data usage decreased from 56,183 PB in the June quarter of 2024 to 56,174 PB in the September quarter of 2024, reflecting a minimal quarterly decline of 0.02 percent.

Out of this total, 2G data usage accounted for 66 PB, 3G for 263 PB, 4G for 43,083 PB, and 5G for 12,762 PB. In terms of data usage, 2G, 3G, 4G, and 5G contributed 0.12 percent, 0.47 percent, 76.70 percent, and 22.72 percent respectively to the overall wireless data usage during the quarter. This shows that efforts of mobile operators, smartphone suppliers and telecom equipment majors to create a strong 5G market in India are taking more time for bringing result.

The total number of wireless data subscribers increased marginally from 926.91 million in June to 927.07 million in Sept.

The average wireless data usage per subscriber was 21.10 GB per month, with an average revenue realization per GB standing at Rs 9.08.

The monthly ARPU for wireless services was Rs. 172.57, and the average minutes of usage per subscriber were 974.

India had 1,153.72 million wireless subscribers at the end of Sept, with 628.12 million in urban areas and 525.60 million in rural areas. The total wireless data usage during the quarter was 56,174 PB, with gross revenue reaching Rs 91,426 crore and adjusted gross revenue of Rs 75,310 crore.

In terms of internet usage, India had 944.39 million broadband subscribers, 43.64 million wired internet subscribers, and 927.86 million wireless internet subscribers.

The total number of internet subscribers increased from 969.60 million in June to 971.50 million in Sept, showing a growth rate of 0.20 percent. Among these, 944.39 million were broadband users, while the number of narrowband users decreased from 28.85 million in June to 27.11 million in Sept.

The monthly ARPU for wireless services increased by 9.60 percent, rising from Rs. 157.45 in June to Rs 172.57 in Sept, with a year-on-year increase of 15.31 percent. The ARPU for pre-paid subscribers was Rs 171, and for post-paid subscribers, it was Rs 190.67 in July-Sept quarter of 2024.

Despite the growth of 5G, India continues to be a 4G-dominated market, with 5G still a distant reality for the majority of users.

Baburajan Kizhakedath