Reliance Jio has impacted the India revenue and profit growth of Indian telecom operator Bharti Airtel in Q4 fiscal 2017.

Reliance Jio has impacted the India revenue and profit growth of Indian telecom operator Bharti Airtel in Q4 fiscal 2017.

Vodafone, Reliance Communications and Idea Cellular will be announcing their revenue growth in coming days. The industry is expecting significant drop in revenue growth of these well established telecom operators in the country.

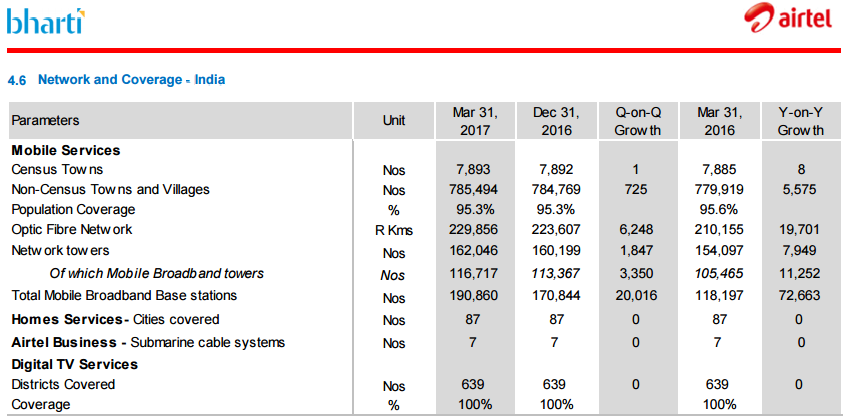

Airtel made significant investment in network to address incoming voice traffic from Reliance Jio.

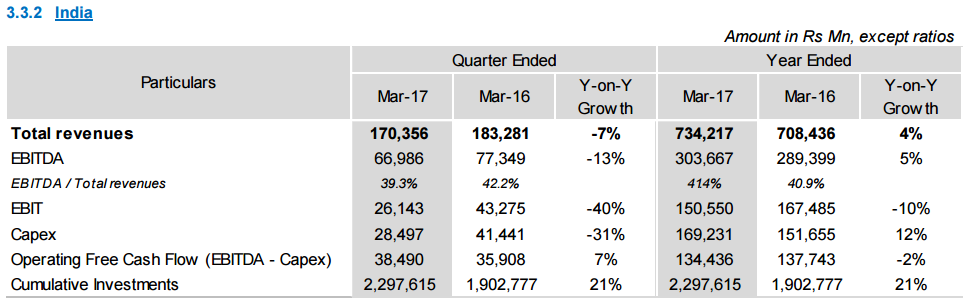

Airtel India’s Capex (capital expenditure) fell a massive 31 percent to INR 28,497 million in Q4. However, Airtel’s India Capex rose 12 percent to INR 169,231 million in fiscal 2017 — indicating that the telecom operators investment plans are going in the direct direction.

“The net result of this was a revenue decline of 7.1 percent in Q4 even as EBITDA margins eroded by2.9 percent. FY 16-17 saw a muted top line growth of 3.6 percent against the double digit growth witnessed in preceding years,” said Airtel.

“The net result of this was a revenue decline of 7.1 percent in Q4 even as EBITDA margins eroded by2.9 percent. FY 16-17 saw a muted top line growth of 3.6 percent against the double digit growth witnessed in preceding years,” said Airtel.

“The sustained predatory pricing by the new operator has led to a decline in revenue growth for the second quarter in a row,” said Gopal Vittal, MD and CEO, India & South Asia at Bharti Airtel.

The India CEO of Airtel said the Indian telecom industry also witnessed a revenue decline for the first time ever on a full year basis.

Bharti Airtel said its India business achieved revenue of Rs 17,036 crore (–7.1 percent) in Q4. Airtel added 72,000 mobile broadband base stations vs last year. The growth in mobile broadband customers was 20.5 percent to 42.7 million from 35.5 million in the same quarter last year. Mobile data revenues contribute to 21.5 percent of mobile India revenues against 23.3 percent in the same quarter last year.

How Airtel dropped revenue

Airtel India’s data ARPU fell 17.3 percent to Rs 162 in the fourth quarter. On the other hand, data usage per customer increased a whopping 55 percent to 1,331 MBs. Voice revenue dropped 17.2 percent to Rs 114 in Q4.

Airtel in Q4 fiscal 2017

# India revenues down 7.1 percent

# Africa revenues up 2.6 percent

# Mobile data traffic reaches 271 billion MBs (+56.3 percent)

# Mobile data revenues of Rs 3,686 crore (–14.6 percent)

# EBITDA of Rs 7,993 crore (–13 percent)

# EBITDA margin of 36.4 percent (–0.4 percent)

# Net income of Rs 373 crore (Rs 1,319 crore)

Airtel in fiscal 2017

# Revenues of Rs 95,468 crore (+1.1 percent)

# EBITDA of Rs 35,621 crore (+4.3 percent)

# EBITDA margin +1.9 percent

# Net income of Rs 3,799 crore (–37.5 percent)

Reliance Jio added 72 million 4G subscribers during its migration of free offers to paid services after adding 100 million during the free promotional period. During the last two quarters, some telecoms have slashed their data rates for all users, while some telecoms offered unlimited voice along with data bundles.

The data customer base of Airtel India fell 1.5 percent to 57 million.

Baburajan K

editor@telecomlead.com

Airtel idea Vodafone cheating operator with hidden tariffs agenda. Nothing transparent. Just fooling public.