Ericsson’s latest Mobility Report predicts an unprecedented surge in global mobile data traffic, with projections anticipating substantial growth from 2023 to 2029.

By the end of 2023, excluding Fixed Wireless Access (FWA) traffic, the report estimates that global mobile data traffic will reach an impressive 130 EB per month. However, when FWA traffic is incorporated, this figure is expected to climb to around 160 EB per month.

Looking ahead, the report forecasts an exponential expansion in mobile network traffic, reaching an astonishing 403 EB per month by 2029, considering a factor of approximately three-fold growth. This upward trajectory accounts for the anticipated uptake of extended reality (XR) services — such as augmented reality (AR), virtual reality (VR), and mixed reality (MR) — later in the forecast period. It is noted that if the adoption of these services exceeds expectations, data traffic could surge even more significantly toward the latter part of the forecast period.

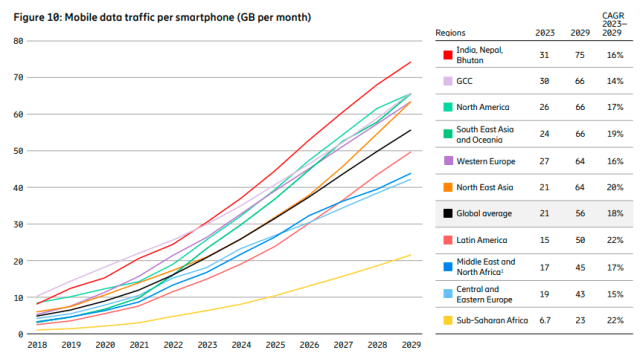

Several factors contribute to this projected surge in data traffic, including enhanced device capabilities, the proliferation of data-intensive content, and the continuous enhancement of network performance. Notably, Ericsson’s report highlights substantial differences in data usage across regions. For instance, while Sub-Saharan Africa is expected to see an average monthly mobile data usage per smartphone of 6.7 GB by the end of 2023, the Gulf Cooperation Council (GCC) countries are projected to hit an average of 30 GB per smartphone for the same period.

Globally, the average monthly mobile data usage per smartphone is anticipated to escalate from 21 GB in 2023 to an impressive 56 GB by the close of 2029. North America is expected to witness a remarkable surge in data usage, reaching an average of 66 GB per smartphone in 2029, fueled by unlimited data plans and the expansion of robust 5G network coverage and capacity.

In Western Europe, traffic usage per smartphone is projected to reach 64 GB per month in 2029 – close to the expected usage in North America at that time.

The North East Asia region’s share of total global mobile data traffic is expected to be close to 30 percent in 2029. In the region, 5G subscribers currently use, on average, 2–3 times more data than 4G subscribers. Mobile data traffic per smartphone in North East Asia is expected to reach 64 GB per month in 2029.

In Sub-Saharan Africa, data usage per smartphone will be reaching 23 GB by 2029.

In the Middle East and North Africa region, monthly data usage per smartphone is expected to reach 45 GB by 2029, rising 17 percent annually.

This growth will be fueled by the transition of more subscribers to 4G, the increasing uptake of 5G, and attractive variable data service offerings.

In the GCC countries, data usage per smartphone is projected to reach 66 GB monthly by 2029, primarily driven by 5G data volumes.

Smartphone subscriptions in India as a percentage of total mobile subscriptions are expected to grow from 82 percent in 2023 to 93 percent in 2029. Smartphone subscriptions in India have grown by 70 million in 2023.

In Latin America, data traffic per smartphone is expected to reach 50 GB per month in 2029.

In Central and Eastern Europe, monthly average data traffic per smartphone is expected to increase from 19 GB to around 43 GB per month.

The report underscores that this exponential growth in data traffic is closely tied to the expected rise in the adoption of gaming, XR, and video-based applications. These experiences demand higher video resolutions, increased uplink traffic, and heightened reliance on cloud computing resources to meet users’ demands.

Furthermore, the report highlights the increasing impact of Fixed Wireless Access on overall traffic patterns, accounting for a significant share of total network data traffic. This trend signifies a shifting landscape in how data is consumed and utilized across networks, underscoring the evolving nature of mobile connectivity and user preferences.