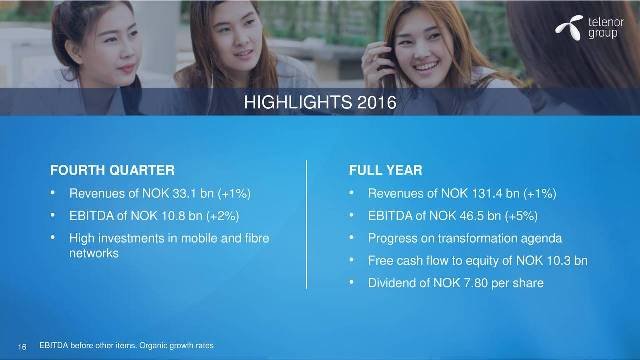

Global telecom operator Telenor Group recently announced that its Capex (capital expenditure) to sales ratio, excluding spectrum licenses, is expected to be 15 percent to 16 percent for 2017.

Global telecom operator Telenor Group recently announced that its Capex (capital expenditure) to sales ratio, excluding spectrum licenses, is expected to be 15 percent to 16 percent for 2017.

Telenor’s Capex to sales ratio of 15-16 percent will be a notch down from the two last years and reflecting that “we have been through a very significant investment period,” said Telenor during an analyst call.

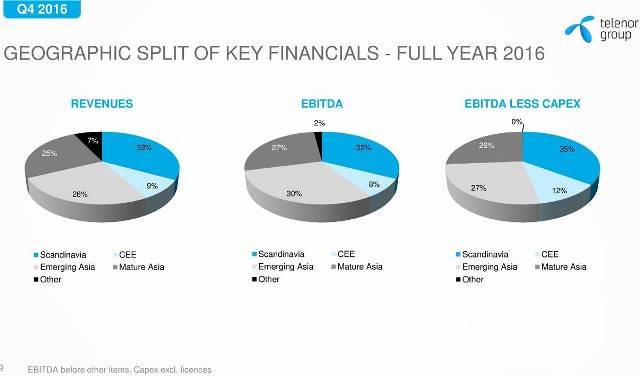

Telenor Group’s investment in fiber network in Norway and Sweden will enable the global telecom operator to achieve 1 percent to 2 percent organic revenue growth in 2017. EBITDA margin expects to be around 36 percent.

Telenor Group’s investment in fiber network in Norway and Sweden will enable the global telecom operator to achieve 1 percent to 2 percent organic revenue growth in 2017. EBITDA margin expects to be around 36 percent.

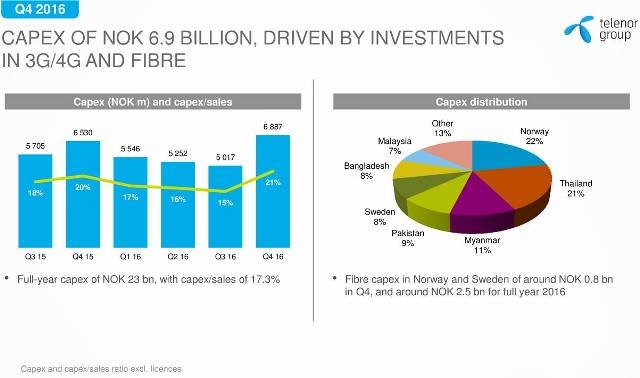

The Capex to sales ratio for the Telenor Group was 21 percent in the fourth quarter and 17 percent in the full year of 2016 – mainly due to investment in fiber and mobile networks.

Telenor Group has stepped up fiber deployment because the North Sea fiber to the home has growth opportunity in Norway and Sweden.

Telenor Group made an investment of NOK 0.8 billion in the fiber deployment during the fourth quarter in Norway and Sweden, which is 0.4 billion higher than the same quarter last year. Telenor Group’s fibre investment for the year 2016 was NOK 2.5 billion.

Telenor Group made an investment of NOK 0.8 billion in the fiber deployment during the fourth quarter in Norway and Sweden, which is 0.4 billion higher than the same quarter last year. Telenor Group’s fibre investment for the year 2016 was NOK 2.5 billion.

Telenor Group focused on its mobile networks investments on the 4G rollout in Norway and in several other markets. The telecom operator continued network densification in Thailand and expansion in Myanmar. Telenor Myanmar has more than 7,200 sites Myanmar in 2016.