Millicom International Cellular has confirmed on Monday that it received an acquisition offer from rival Liberty Latin America without divulging financial details.

Luxembourg-headquartered Millicom provides mobile services to 51 million customers and its cable coverage reached more than 9 million homes. Liberty Latin America is a wireless and cable operator in South America and the Caribbean.

The deal would create one of the largest telecom carriers in Latin America to compete with some of the region’s biggest players, such as America Movil, Telefonica and AT&T, Reuters reported.

Millicom said it received a preliminary highly conditional non-binding proposal for all of its shares from Liberty Latin America, which is backed by U.S. media and telecommunications mogul John Malone.

“There is no certainty that a transaction will materialize, nor as to the terms, timing or form of any possible transaction,” Millicom said.

Millicom has a market capitalization of $7.2 billion. Liberty Latin America is valued at about $3.1 billion.

The potential deal reflects the importance of scale in the Latin American telecommunications market. Inflation, currency fluctuations, corruption and political instability are just some of the challenges facing regional operators.

Millicom offers mobile services under the brand Tigo, in nine Latin American countries and the African countries of Chad and Tanzania. Swedish investment company Kinnevik had 37.2 percent voting control over Millicom as of the end of December. Kinnevik has been trimming its wireless tower portfolio around the world.

Liberty Latin America operates in more than 20 countries across Latin America and the Caribbean.

John Malone is the largest shareholder of Charter Communications, the second largest U.S. cable company. John Malone controls about a quarter of the voting power in Liberty Latin America.

Millicom financials

Millicom earlier said its Latin America segment ended 2018 with 32.4 million B2C Mobile customers, including more than 10 million on 4G network. It added 3.2 million 4G customers during the year.

Its Cable business added 1.3 million homes passed to hybrid fiber-cable network, taking the total homes passed to 10.2 million. It connected more than 400,000 additional homes to HFC network, taking the total number of HFC customer relationships to 2.7 million.

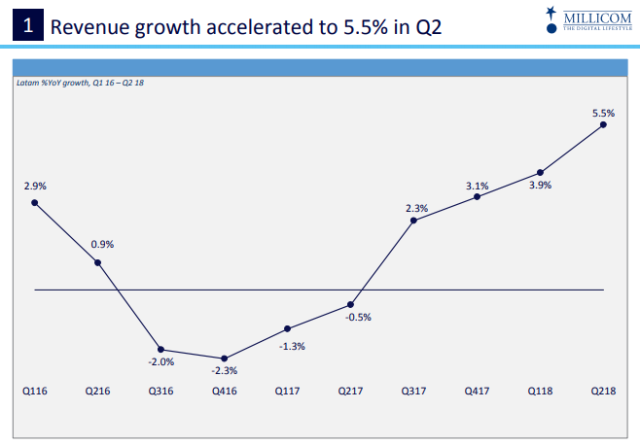

Latin America business is expected to achieve revenue growth slightly above the top end of its guidance range of 2 percent to 4 percent, while EBITDA growth will be within the guidance range.

Capex of Millicom’s Latin America business was $950 million, or $50 million below the $1 billion target for 2018.

Millicom’s Latin America business’s service revenue will be 3-5 percent with EBITDA growth of 4-6 percent and Capex of above $1 billion in 2019.