KPN said it reiterates its 2022 outlook for adjusted EBITDA AL of more than € 2.4 billion, Capex of €1.2 billion, and Free Cash Flow of approximately €850 million.

KPN has confirmed its 2022 outlook as its third-quarter earnings beat expectations, and said it expected slight growth in core earnings next year as it works to offset inflation, especially in energy.

The largest telecom provider in the Netherlands had previously said it targeted adjusted earnings before interest, taxes, depreciation and amortisation and after leases (EBITDAAL) of more than 2.40 billion euros ($2.39 billion) this year, and of more than 2.45 billion in 2023.

European power costs have surged in the past year, driven by record gas prices as Russia curbed supply to Europe.

“Despite the macro backdrop, we aim to deliver growth next year and remain fully committed to our Accelerate to Grow strategy,” Chief Executive Joost Farwerck said, referring to KPN’s plan launched in November 2020.

He added the group had given its employees a one-off payment to help them cope with the rising cost of living.

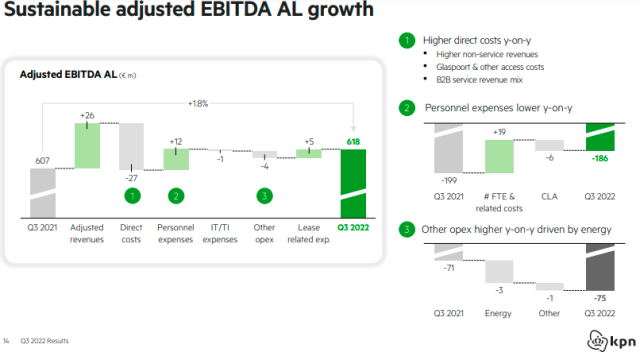

KPN reported adjusted EBITDAAL of 618 million euros ($616 million) for the three months ended Sept. 30. It will specify the 2023 outlook when it publishes fourth-quarter results in January.

Strategies

In Q3 2022, KPN added 76,000 households to its own fiber footprint. During the quarter, KPN activated 69,000 households on its own infrastructure. Together with Glaspoort, KPN added 123,000 households to its fiber footprint in Q3 2022, with KPN and Glaspoort now jointly covering 46 percent of Dutch households.

KPN has the best mobile network and fastest 5G in the Netherlands and focuses on completing its mobile network modernization. The 3.5GHz spectrum auction which was scheduled for Q2 2023 is likely to be postponed by the Dutch government for several months.

KPN’s 5G strategy is focused on differentiated services for B2B customers in specific industries. Supply chain scarcities and labor shortages are impacting the timing of investments throughout KPN’s network. KPN has mitigated the financial impact using substitution products, optimizing inventory levels and budget prioritization.