The advancements in the telecom sector have been the primary drivers of growth, innovation, and disruption in a number of industries across the world over the past few years.

This is also true in India, where smartphones and internet-based services are getting embedded in the fabric of our society. Thanks to a strong and consistent growth in the past one and a half decades, India has now emerged as the second largest telecommunications market in the world.

As per a recent report published by the GSM Association (GSMA) in collaboration with the Boston Consulting Group (BCG), India’s mobile economy is growing rapidly and will contribute substantially to the country’s Gross Domestic Product (GDP) in the days to come. In 2016, the telecommunication operators (telecoms) were focused on providing a basic high-speed network experience to its customers by expanding 4G coverage.

More bandwidth, faster internet speed, less latency and better network reliability became the demands of the end customers, be it individuals or enterprises. A strong year-on-year growth in data consumption and the popularity of mobile applications serve as an indication of the transformation powered by the country’s telecom infrastructure. In the coming year, we foresee several trends unravelling in India’s telecom sector.

More bandwidth, faster internet speed, less latency and better network reliability became the demands of the end customers, be it individuals or enterprises. A strong year-on-year growth in data consumption and the popularity of mobile applications serve as an indication of the transformation powered by the country’s telecom infrastructure. In the coming year, we foresee several trends unravelling in India’s telecom sector.

Here are our top 5 predictions for 2017.

4G Expansion and Rural Broadband

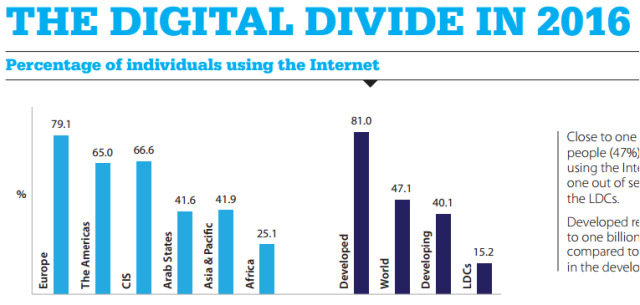

In 2016, we saw many new service providers rolling out 4G services and there was a large-scale migration of users from 3G to 4G services. However, most of the 4G users are still limited to metros and tier-1 cities. In 2017, we expect telcos to invest more on expanding 4G coverage to provide high-speed mobile connectivity to unserved subscribers in tier-2 cities and towns. This will significantly increase the number of users of mobile internet-based applications in India. Government of India’s BharatNet project will start ramping up and we expect that large parts of rural India will join the Internet revolution. Many of the new subscribers might be first time users of internet/data, and their entry into the internet segment will give a big push for the Digital India initiative.

Ecommerce and Digital Payments

The recent demonetization drive by the Government of India has given a massive push to the move towards a cashless and digital economy. With the shortage of cash, everybody from customers to retailers, from merchants to street hawkers are looking at digital payment options. This will be fuelled, in part, by the 4G expansion. Doing e-transactions over a smartphone/4G connection is way faster and more convenient than through outdated counterparts like interactive voice response transactions (IVR). We foresee a decline in the usage of these older options and they will be limited to areas consumers where 4G penetration has not yet happened.

Rise of Over-the-Top Messaging Apps

While packetized voice applications (Voice over IP) in the form of Skype, Google Hangouts, etc. have been around for a few years, the absence of a reliable, low-latency connection has always put a dampener on the usage experience. With 2G/3G networks, VOIP calls were not very reliable or of good quality and hence people continued to use mobile voice services. However, with the advent of 4G, this is going to change. 4G allows a satisfactory quality of a voice call over the data network. Besides, 4G data tariffs have come down significantly, making voice calls over the internet much cheaper than traditional voice calls. This is causing the subscribers to increasingly use VOIP in the form of WhatsApp or Skype calls to make phone calls to each other. The number of VOIP users for the first time is expected to be significant enough to potentially impact voice-based revenues of telecom service providers.

High-bandwidth 100G and OTN technologies

With the roll out of 4G services and customers using data-hungry applications like video calling, YouTube, multimedia messages (for example through WhatsApp), the pressure on the backhaul networks will increase. In order to cater to the growing traffic requirements, service providers will upgrade their networks and links to 100G. We expect a huge uptake of 100G interfaces in service provider networks. Also, as the individual links in the network are upgraded to 100G, there will be a concomitant need to multiplex/demultiplex traffic from multiple sources and to effectively utilize the 100G links through grooming and switching traffic in a cost effective manner. OTN (Optical Transport Networking) technology addresses these needs and we expect a huge uptake of OTN grooming/cross-connect fabrics of upwards of 1 Tbps capacity.

Technology Convergence in the Backhaul

With the challenge of telecom service providers to support everything from 2G to 3G to 4G, enterprise services, and triple play, a converged packet optical (CPO) network, would make the most sense to reduce both capital and operational expenditure. CPO products combine multiple technologies and layers of the network like DWDM, OTN, PTN and SDH in the same equipment. This gives several benefits like having reprogrammable interfaces/modules which, through software configuration, can support multiple types of interfaces and line rates. A circuit board which was earlier being used for SDH can now be reprogrammed for OTN. Similarly, a bank of interfaces on a card can be programmed either as Ethernet, OTN or SDH technology as needed. This provides more flexibility to the service provider and helps him adapt to changing business requirements in a better way. Converging multiple technologies on the same platform and under a common management system also helps streamline services and manage multiple network layers from a single Graphical User Interface (GUI).

By Sanjay Nayak, CEO and MD of Tejas Networks