AMD has posted revenue of $5.6 billion (+16 percent), gross margin of 43 percent, operating loss of $149 million and net income of $21 million for the fourth quarter of 2022.

For full year 2022, AMD reported revenue of $23.6 billion (+44 percent), gross margin of 45 percent, operating income of $1.3 billion and net income of $1.3 billion.

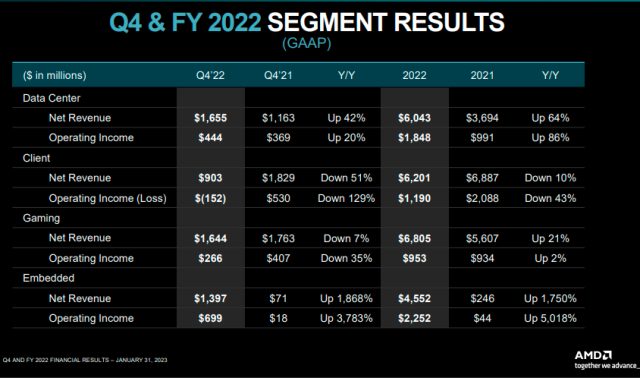

Revenue growth in 2022 was driven by revenue of $4.55 billion from Embedded, $6.043 billion (+64 percent) from Data Center, and $5.6 billion (+21 percent) from Gaming segment, offset by 10 percent drop in Client revenue at $6.2 billion.

The U.S. chip maker said Q4 revenue of $5.6 billion increased 16 percent primarily driven by growth across the Embedded and Data Center segments, partially offset by lower Client and Gaming segment revenue.

AMD’s Data Center revenue was $1.7 billion, up 42 percent primarily driven by strong sales of EPYC server processors.

AMD’s Client revenue was $903 million, down 51 percent due to reduced processor shipments resulting from a weak PC market and a significant inventory correction across the PC supply chain. PC shipments fell 16.5 percent to 292.3 million units in 2022, according to data from research firm IDC. AMD said Client processor ASP was flat.

Gaming segment revenue was $1.6 billion, down 7 percent driven by lower gaming graphics sales partially offset by higher semi-custom product revenue.

Embedded segment revenue was $1.4 billion, up 1,868 percent year-over-year primarily driven by the inclusion of Xilinx embedded revenue.

AMD forecast current-quarter revenue of $5.3 billion, plus or minus $300 million. AMD had already started under-shipping last year in response to plummeting processor demand.

AMD CEO Lisa Su said she was confident AMD will keep gaining market share this year and that the second half would be stronger than the first.

While Intel still dominates the PC and server processing chip markets with a share exceeding 70 percent, that is down from more than 90 percent in 2017, according to tech research firm IDC. A big chunk of that share was taken by AMD, Reuters news report said.

Su said that AMD was expecting the PC market this year to be down 10 percent and it would continue to ship below consumption in the first quarter to reduce downstream inventory.

The slumping PC business pummeled Intel’s first-quarter outlook and Intel CEO Pat Gelsinger said he was seeing “some of the largest inventory corrections literally that we’ve ever seen in the industry.”

“I think we will still see pain across the industry for at least another few quarters before things turn around,” said Anshel Sag, analyst at Moor Insights & Strategy.

“We believe AMD’s results continue to show softness across the PC and gaming markets,” said Angelo Zino, analyst at CFRA Research. “We also expect revenue levels in both segments to trough in the first half of this year.”