The size of the global smartphone market has reached 304.9 million units in the first quarter of 2025, marking a 1.5 percent increase, according to data from IDC.

The smartphone market’s performance aligned with forecasts as phone vendors accelerated production to mitigate the impact of potential U.S. tariffs on imports from China. This preemptive move led to inflated shipment volumes, especially to the U.S., as companies attempted to get ahead of expected cost increases and supply chain disruptions.

The U.S. smartphone market grew by more than 5 percent despite trade tensions driven by heightened consumer interest in the latest models from major brands and a sense of urgency to make purchases before possible price hikes. A 90-day exemption from U.S. smartphone tariffs provided temporary relief and is expected to support additional growth in the second quarter, as consumers and vendors alike take advantage of the current tariff pause.

In China, the extension of government subsidies to smartphones in January 2025 significantly boosted domestic consumption. These subsidies targeted devices priced below CNY6,000 (approximately $820), which covers most of the offerings from Chinese vendors, leading to notable sales increases.

Smartphone vendors

Samsung has regained its position as the global market leader, powered by strong performance from its flagship Galaxy S25 and mid-range Galaxy A36 and A56 models, both of which feature AI capabilities at more affordable price points.

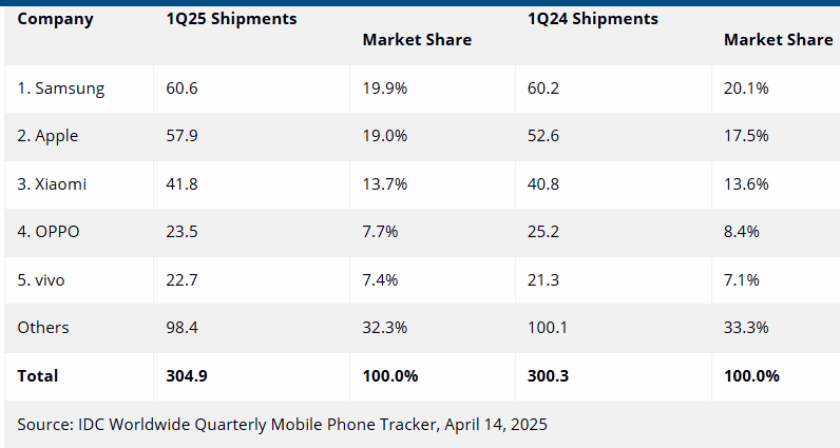

Samsung led global smartphone shipments with 60.6 million units, a slight increase from 60.2 million units in Q1 2024. Despite this growth in volume, its market share declined marginally from 20.1 percent to 19.9 percent.

Apple recorded its best-ever Q1 in terms of units shipped, largely due to strategic stockpiling to avoid tariff impacts and to prepare for potential supply shortages. However, Apple saw a decline in China where its Pro models were excluded from the government subsidy program.

Apple followed closely with 57.9 million units shipped, up from 52.6 million in the same quarter last year. This growth helped Apple boost its market share from 17.5 percent to 19.0 percent, marking a strong quarter for the company.

Xiaomi’s growth was fueled primarily by the domestic Chinese market, where the subsidies significantly boosted its mid-range product sales.

Xiaomi shipped 41.8 million smartphones in Q1 2025, a minor increase from 40.8 million units in Q1 2024. Its market share rose slightly from 13.6 percent to 13.7 percent.

OPPO, despite an overall decline in shipments, reclaimed the fourth position globally due to growth in China, although it continued to face challenges in international markets. OPPO saw a decline in shipments from 25.2 million to 23.5 million units, leading to a drop in market share from 8.4 percent to 7.7 percent.

Vivo reported strong growth of 6.3 percent year-over-year, supported by both the Chinese subsidy program and rising demand for its lower-end devices and V series in global markets.

Vivo increased shipments from 21.3 million to 22.7 million units, with its market share rising from 7.1 percent to 7.4 percent.

Shipments from all other vendors combined totaled 98.4 million units in Q1 2025, down from 100.1 million units in the same quarter last year. Their collective market share decreased from 33.3 percent to 32.3 percent. Overall, total smartphone shipments rose from 300.3 million units in Q1 2024 to 304.9 million in Q1 2025, reflecting a year-over-year growth of 1.5 percent.

Overall, the first quarter of 2025 was characterized by aggressive supply-side maneuvers, government intervention in key markets like China, and consumer behaviors shaped by economic uncertainty and shifting trade policies.

Baburajan Kizhakedath