Recent research by Canalys has unveiled a remarkable trend in the smartphone market within the Middle East (excluding Turkey), showcasing a stark contrast to the worldwide landscape.

While the global smartphone market suffered a substantial 10 percent decline, the Middle East region witnessed a noteworthy 2 percent annual growth, with vendors shipping 9.5 million smartphones in Q2 2023.

Economic improvements played a pivotal role in this positive performance. The region capitalized on the surge in global oil prices, coupled with record-low unemployment rates, expanding non-oil sectors, and a significant influx of foreign direct investment (FDI).

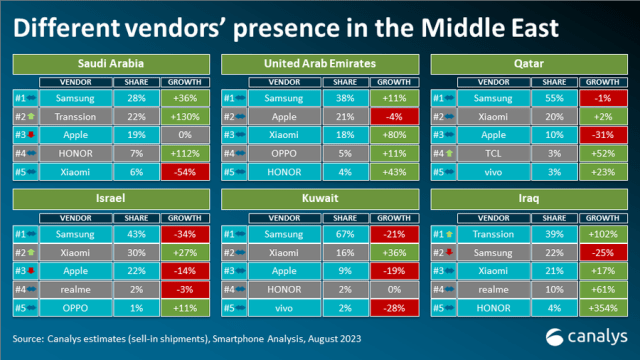

Samsung (43 percent share), Xiaomi (30 percent), Apple (22 percent), Realme (2 percent) and Oppo (1 percent) are the leading smartphone suppliers in Israel.

Transsion (39 percent share), Samsung (22 percent), Xiaomi (21 percent), Realme (10 percent) and Honor (4 percent) are the top smartphone brands in Iraq.

Samsung (67 percent share), Xiaomi (16 percent), Apple (9 percent), Honor (2 percent) and Vivo (2 percent) are the top smartphone vendors in Kuwait.

Samsung (28 percent share), Transsion (22 percent), Apple (19 percent), Honor (7 percent), Xiaomi (6 percent) are the leading smartphone vendors in Saudi Arabia.

Samsung (55 percent share), Xiaomi (20 percent), Apple (10 percent) TCL (3 percent) and Vivo (3 percent) are the leading smartphone makers in Qatar.

Samsung (38 percent share), Apple (21 percent), Xiaomi (18 percent), Oppo (5 percent) and Honor (4 percent) are the top smartphone brands in the UAE.

Saudi Arabia: Notably, Saudi Arabia emerged as a standout performer, with smartphone shipments experiencing a remarkable 19 percent year-on-year growth in Q2 2023. This growth was attributed to robust macroeconomics, expansion in non-oil sectors, and strategic vendor efforts to restock distribution channels in preparation for the Eid and Ramadan sales seasons.

United Arab Emirates (UAE): The UAE demonstrated a more modest 6 percent growth during the same period, largely fueled by an influx of tourists. Festivities led to a surge in passenger arrivals at the country’s airports, contributing to the growth in smartphone shipments.

Iraq: Surpassing economic challenges and currency fluctuations, Iraq achieved an impressive 24 percent growth in smartphone shipments. This steady emergence indicates positive prospects for the country’s market.

However, the picture wasn’t entirely rosy across the region:

Israel: Israel faced a substantial 19 percent drop in smartphone shipments, driven by rising inflation and cautious consumer spending. Families grappling with increased living costs opted to use their existing devices for longer periods.

Kuwait and Qatar: These smaller markets, each receiving fewer than half a million smartphone shipments, experienced declines of 15 percent and 23 percent year-on-year, respectively. Low consumer demand played a significant role in these setbacks.

Canalys’ Senior Consultant, Manish Pravinkumar, shed light on the performance of leading brands in the region. Both Apple and Samsung witnessed a decrease in shipments of premium segment smartphones in Q2 2023, primarily due to cautious consumer spending and a growing interest in budget-friendly alternatives.

Despite a 9 percent decline, Samsung maintained its top position, largely thanks to the success of its A series models in the more budget-conscious segment. Meanwhile, Apple continued to dominate the premium market but saw its shipments concentrated on the iPhone 12 and 13 models, catering to budget-conscious consumers.

In a surprising twist, the downturn in the high-end segment was counterbalanced by a rise in entry-level shipments. Transsion, making strides in lower ASP (average selling price) markets, secured the second spot.

Brands such as Infinix and Tecno also made gains by focusing on low-to-mid-range pricing, especially in markets like Iraq and Saudi Arabia.

Xiaomi maintained its market share due to its diverse smartphone offerings and strong online and physical store presence.

HONOR and Motorola experienced significant growth, with HONOR benefiting from targeted marketing, impactful product launches, and a versatile mid-to-high-end product range. Motorola’s growth was driven by extensive product availability, strong brand recognition, and key retail partnerships.

The Middle East’s smartphone market stands as a resilient and dynamic entity, showcasing how local economic conditions and consumer preferences can significantly impact the fortunes of global tech giants.