The Latin American smartphone market is witnessing a strong shift toward 5G adoption, driven by increasing competition and a maturing consumer base.

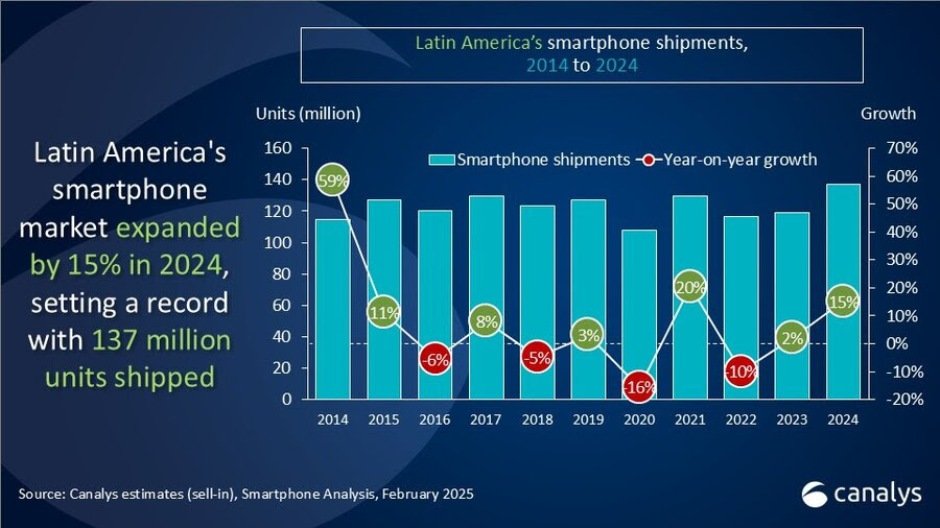

According to the latest research from Canalys, now part of Omdia, the Latin American smartphone market saw a 15 percent growth in 2024, reaching a record 137 million shipments. While affordability remains a key factor, brands are increasingly looking to 5G as a means to differentiate themselves in a highly competitive space.

As competition intensifies, smartphone vendors are focusing on higher-value segments to ensure long-term profitability. The sub-$300 price segment accounted for 72 percent of total sales, reflecting the dominance of budget-friendly smartphones.

5G smartphones are gaining traction as manufacturers seek to push mid-range and premium offerings. The challenge remains in balancing aggressive pricing strategies with the need to upgrade consumers to more advanced technologies. While the market has expanded, the increasing reliance on low-margin segments poses risks, particularly with potential inventory build-up and shifts in consumer demand.

Samsung retained its position as the leading vendor, shipping 42.9 million units, a 12 percent increase from 2023. Despite this growth, its market share slightly declined from 32 percent to 31 percent.

Motorola faced a 4 percent drop in shipments, falling to 22.8 million units and losing market share from 20 percent to 17 percent, allowing Xiaomi to close the gap.

Xiaomi saw a strong 20 percent growth, shipping 22.7 million units, increasing its market share from 16 percent to 17 percent.

TRANSSION continued its upward trajectory, achieving a 40 percent growth rate, with shipments reaching 12.8 million units and its market share rising to 9 percent.

HONOR recorded the highest growth among major vendors at 79 percent, increasing its shipments from 4.5 million to 8 million units and expanding its market share from 4 percent to 6 percent. The combined market share of other brands remained stable at 20 percent, with shipments growing 14 percent to 27.7 million units.

Looking ahead, the Latin American smartphone market is expected to face a slight decline of 1 percent in 2025. The winners in this evolving landscape will likely be those brands that successfully elevate their portfolios to include more 5G-capable devices while maintaining their competitive edge in affordability.

Baburajan Kizhakedath