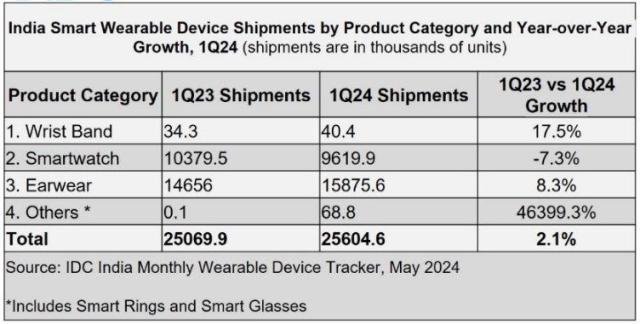

India’s wearable device market grew by 2.1 percent to 25.6 million units in the first quarter of 2024, according to IDC report.

This marks a significant slowdown for a market that had seen double-digit growth every quarter since Q4 2017, International Data Corporation’s (IDC) India Monthly Wearable Device Tracker said. The growth in India’s wearable device market was constrained by high inventory carried over from the festive quarters in the second half of 2023.

This marks a significant slowdown for a market that had seen double-digit growth every quarter since Q4 2017, International Data Corporation’s (IDC) India Monthly Wearable Device Tracker said. The growth in India’s wearable device market was constrained by high inventory carried over from the festive quarters in the second half of 2023.

The average selling price (ASP) for wearables declined by 17.8 percent to a record low of $18.59, down from $22.62 in Q1 2023.

Key Highlights of Q1 2024:

Smartwatch Shipments: For the first time since Q4 2018, smartwatch shipments declined by 7.3 percent to 9.6 million units. The share of smartwatches within the wearable market dropped to 37.6 percent from 41.4 percent in Q1 2023. Factors contributing to this decline include excess inventory in online channels and fewer new product launches. The ASP for smartwatches fell to $20.65 from $29.24 a year ago due to e-tailer sales events and discounts. However, the share of advanced smartwatches increased from 2.0 percent to 3.2 percent.

Earwear Category: The earwear category grew by 8.3 percent, shipping 15.9 million units. The Truly Wireless Stereo (TWS) segment, which comprises 70.1 percent of the earwear market, grew by 19 percent. In contrast, other types of earwear (including tethered and over-ear models) saw a decline of 10.6 percent. The ASP for earwear declined by 7.3 percent to $16.62.

Top Five Vendors: The leading vendors — BoAt, Noise, Fire-Boltt, Boult, and Oppo — remained unchanged from a year ago. However, their collective market share decreased from 63.9 percent to 59.9 percent as smaller vendors gained ground.

In the smartwatch category, the top three vendors experienced shipment declines due to high channel inventory, while Titan and BeatXP saw their shipments grow by two and three times, respectively. In the earwear category, all top five vendors except Boult increased their shipments.

“Vendors have started focusing on retail expansion through partnerships with large-format national and regional retail chains and bundling wearables with other product categories like smartphones and laptops,” said Anand Priya Singh, Market Analyst, Smart Wearable Devices, IDC India.

Channel Performance: The offline channel’s share increased to 37.9 percent from 26.1 percent in Q1 2023, while online channel shipments declined by 14.1 percent, marking the second consecutive quarter of decline.

Emerging Trends: The smart ring category continued to gain traction, with 64,000 units shipped in Q1 2024 at an ASP of $173.06. Ultrahuman leads this market with a 43.9 percent share, followed by Pi Ring at 40.1 percent, and Aabo at 8.4 percent.

Market Outlook:

“The smartwatch market is showing early signs of a slowdown in India,” said Vikas Sharma, Senior Market Analyst, Smart Wearable Devices, IDC India. “Vendors are finding it challenging to entice customers to upgrade due to limited innovation and freshness in newer models.”

IDC expects a low double-digit annual shipment decline for smartwatches in 2024. Meanwhile, earwear shipments are projected to grow by mid-single digits, driven by AI capabilities and affordable advanced features like active noise cancellation.