The global smartphone market experienced an 11 percent year-on-year decline in the second quarter of 2023 as leading vendors, Samsung and Apple, faced the impact of weakening demand and subsequently reduced their sell-in.

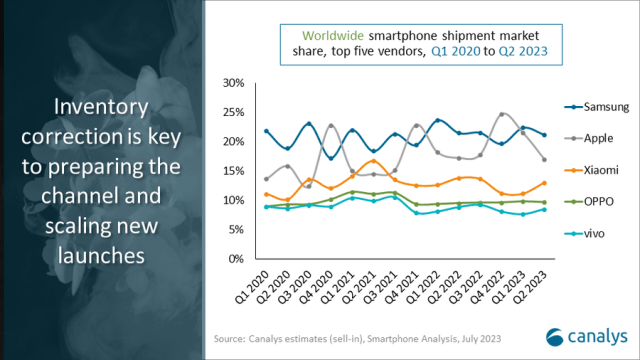

Samsung (with 21 percent share), Apple (17 percent), Xiaomi (13 percent), OPPO (10 percent) and Vivo (8 percent) are the leading smartphone vendors in Q2 2023, Canalys said in its report.

Samsung (with 21 percent share), Apple (17 percent), Xiaomi (13 percent), OPPO (10 percent) and Vivo (8 percent) are the leading smartphone vendors in Q2 2023, Canalys said in its report.

Samsung managed to maintain its position as the smartphone market leader with a 21 percent market share, closely followed by Apple at second place with a 17 percent market share. However, beyond the top two players, there are positive indications of improvement in smartphone shipments, with most vendors’ inventory returning to healthier levels and macroeconomic conditions stabilizing.

Xiaomi secured the third spot with a 13 percent smartphone market share as the supply for its newly launched Redmi series recovered. OPPO, including OnePlus, claimed the fourth position with a 10 percent market share, thanks to its strong performance in the core markets of the Asia Pacific. Vivo came in fifth with an 8 percent market share, driven by the launch of its new Y-series smartphones.

Le Xuan Chiew, analyst at Canalys, said that the smartphone market is sending early signals of recovery after experiencing six consecutive quarters of decline since 2022.

Le Xuan Chiew, analyst at Canalys, said that the smartphone market is sending early signals of recovery after experiencing six consecutive quarters of decline since 2022.

The clearing up of smartphone inventory has begun as vendors prioritize reducing the stock of older models to make room for new launches. In some key markets, Canalys has observed increased investments in the channel, including channel incentives and targeted marketing campaigns aimed at stimulating consumer demand for new releases, thereby driving channel activity.

For instance, OPPO, vivo, Transsion, and Xiaomi are gaining market share in the sub-$200 price segment through stronger sales incentives and aggressive retail strategies. There are indications that vendors are preparing for future market recovery by hedging key component prices to counter potential price hikes resulting from current inflationary conditions. This has led to an increase in component orders.

Additionally, smartphone vendors continue to invest in manufacturing and establish a direct presence in emerging markets such as Southeast Asia and India, which are expected to be strong driving forces for sustainable growth.

Toby Zhu, analyst at Canalys, emphasized the need for vendors to closely monitor significant variations in market conditions, as the speed and scale of recovery can vary significantly.

Global smartphone sendors are seeking short-term opportunities while maintaining their overall strategies. All eyes are now on upcoming Android players, including Transsion and HONOR, who are determined to act swiftly in terms of product refreshment and strategic go-to-market tactics to gain market share, particularly in open markets such as the Middle East, Latin America, and Southeast Asia.