Analysts at IDC and Canalys have indicated how Apple has retained its second rank in the global smartphone market in Q2-2025.

Apple

Apple shipped 46.4 million iPhones in the second quarter of 2025, achieving a year-on-year growth of 1.5 percent, according to IDC report.

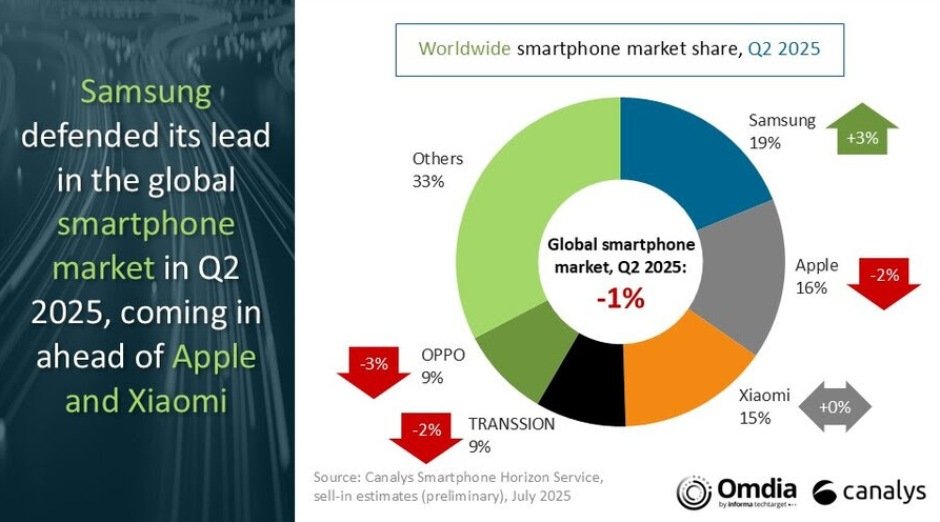

This performance allowed Apple to retain its second position with 15.7 percent share in the global smartphone market, behind Samsung, which shipped 58 million units for 19.7 percent share during the same period. IDC reported a 1 percent year-on-year increase in overall smartphone shipments, totaling 295.2 million units in Q2 2025.

In contrast, Canalys report indicated a 1 percent year-on-year decline in global smartphone shipments, marking the first decline in six quarters. Despite this difference in overall market estimates, Canalys also placed Apple in second position with a consistent market share of 16 percent, unchanged from a year ago.

Apple’s global performance was supported by strong double-digit growth in emerging markets, which helped offset a shipment decline of about 1 percent in China.

IDC noted that Apple’s performance in China was affected by macroeconomic headwinds and intensifying local competition, although the brand topped sales during the 618 online shopping festival. Both IDC and Canalys highlighted that vendors, including Apple, maintained elevated inventory levels in the U.S. market to mitigate risks from potential tariffs.

While Apple maintained steady shipments and market share, it trailed Samsung in growth, as the Korean brand posted a 7.9 percent year-on-year increase, driven by the popularity of its Galaxy A-series. Apple’s overall resilience, despite regional headwinds, was attributed to its continued appeal in the premium segment and successful traction in newer markets.

Amber Liu, Practice Lead for Smartphone Research at Canalys (now part of Omdia), said: “After a slow start to 2025, vendors are now well placed and ready to navigate what is expected to be a flat year for the smartphone market.”

Nabila Popal, senior research director for Worldwide Client Devices, IDC, said: “While Apple was the top brand during the promotion period at the 618 e-commerce festival, it saw a 1 percent drop in China in Q2, offset by strong double-digit growth in emerging markets leading to a 1.5 percent growth globally in the quarter.”

The overall smartphone industry was affected by inflation, unemployment, currency volatility, and trade policy concerns, impacting particularly the low-end device demand. According to both IDC and Canalys, the outlook for the second half of the year will likely depend on the adoption of AI features in smartphones and the effectiveness of promotional campaigns in major markets.

Apple investment

In 2025 Apple has made headline-grabbing investments while steadily refreshing its product lineup and maintaining its premium pricing strategy.

Apple kicked off the year by unveiling a $500 billion investment plan in U.S. operations over four years, including a new server factory in Texas, doubling its Advanced Manufacturing Fund to $10 billion, creating around 20,000 jobs in AI, silicon engineering and R&D, and expanding facilities from Houston to Oregon.

Apple has debuted the low‑cost iPhone 16e in February with A18 chip and a $599 starting price —higher than the discontinued SE, marking a shift in Apple’s budget approach.

Looking toward September 2025, the iPhone 17 series is expected to include four models — 17, 17 Air, 17 Pro, and Pro Max — featuring A18/A19 chips, faster ProMotion screens, improved cameras (up to 48 MP / 24 MP front cameras), a sleeker Air variant, and new color options like Teal, Ultramarine, Sky Blue, Copper‑Orange, Green and Purple.

Apple continues its classic “price skimming” strategy — introducing flagship devices at premium prices to maximize early-margin revenue, then gradually lowering prices on older models as demand wanes. This is visible in the launch of the 16e at $599, a clear move to capture budget buyers while phasing out older SE/iPhone 14 models.

Baburajan Kizhakedath