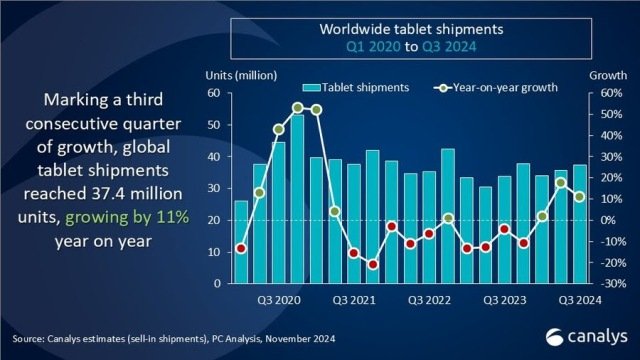

Worldwide tablet shipments rose by 11 percent in Q3 2024, totaling 37.4 million units, Canalys said in its report. This growth in the global tablet market – reflecting the third consecutive quarter of increases – is supported by strong consumer and commercial demand.

Seasonal and Commercial Demand Drivers:

Back-to-school purchases, early holiday season promotions, and inventory buildup boosted shipments.

Bundling offers and aggressive discounts across different markets encouraged purchases, even amid tighter consumer budgets.

Increased business spending on tablets in sectors like education, healthcare, and retail further drove demand as organizations invested in digital transformation.

“Bundling offers and aggressive promotions across various markets have helped drive tablet shipments in a challenging spending environment,” said Canalys Research Manager Himani Mukka. “The third quarter of this year witnessed a buildup of inventory in the retail channel in anticipation of the holiday season, in which discounting began early.”

Top Vendors:

Apple has maintained the top position with a 36 percent market share and 13.6 million units shipped. Its recent iPad mini launch, featuring Apple Intelligence, aims to improve user experience across the lineup. Apple remains the market leader in tablet shipments, although its growth was modest compared to competitors.

Samsung is ranked second, with 6.9 million units shipped and a 12 percent year-on-year growth. Samsung has achieved tablet market share of 18.4 percent. Samsung holds the second position, achieving a strong 12.4 percent year-on-year growth, helped by its diverse tablet lineup.

Chinese Companies such as Lenovo, Xiaomi, and Huawei rounded out the top five. Lenovo saw a 14 percent growth, while Xiaomi led with a remarkable 58 percent year-on-year increase. Huawei followed with 29 percent growth and 2.9 million units shipped.

Lenovo shipped 3 million units. Lenovo has a tablet market share of 7.9 percent. Lenovo has recorded solid growth, increasing its shipments by 14.4 percent year-on-year, reflecting demand in consumer and business sectors.

Huawei has shipped 2.9 million tablets in Q3. Huawei has 7.7 percent share in the global tablet market. Huawei experienced notable growth at 28.8 percent, likely due to strong performance in the Chinese market and targeted commercial deployments.

Xiaomi shipped 2.6 million tablets. Xiaomi has tablet market share of 6.8 percent. Xiaomi was the fastest-growing vendor with an impressive 58.4 percent increase in shipments, driven by aggressive pricing and new product releases.

Outlook

The current market performance suggests a stable outlook for tablets, with continued adoption expected across consumer and commercial sectors. This trend may continue with further investment in digital solutions across various industries.

Baburajan Kizhakedath