Apple has told its smartphone manufacturing contractors Foxconn and Pegatron to halt plans for additional production lines dedicated to the iPhone XR, the Nikkei reported on Monday.

Apple had also asked smaller iPhone assembler Wistron to stand by for rush orders, but the company will receive no orders for the iPhone XR this season.

Apple had also asked smaller iPhone assembler Wistron to stand by for rush orders, but the company will receive no orders for the iPhone XR this season.

Foxconn first prepared nearly 60 assembly lines for Apple’s XR model, but recently used only around 45 production lines as its top customer said it does not need to manufacture that many by now.

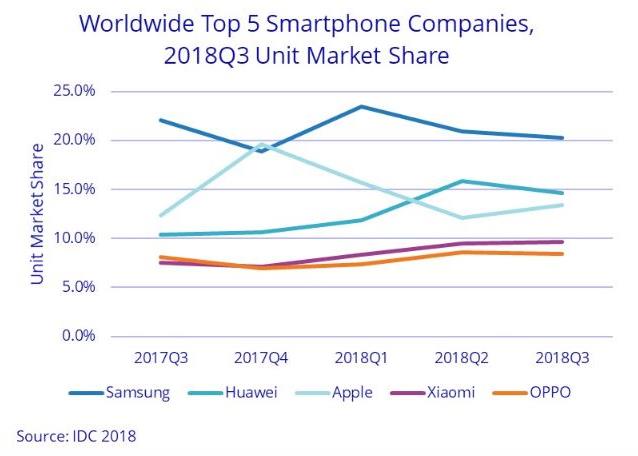

Apple is the third largest smartphone maker in the world after Huawei moved to the second spot — behind Samsung.

Apple — at its iPhone launch event in September — introduced the lower-cost iPhone XR, made of aluminum, along with two other models, the XS and XS Max.

The strategy of Apple was to increase the ASP of iPhones with the launch of the new 6.5-inch iPhone XS Max and 5.8-inch iPhone XS that were joined by the more affordable iPhone XR in the Apple line-up.

An IDC report said Apple’s newest iPhones helped push shipments to 46.9 million units, up 0.5 percent from the 46.7 million units last year.

Apple five years ago cut production orders for its plastic-backed iPhone 5C a month after its launch, fueling speculation of weak demand for the model.

The Cupertino, California-based company warned last week that sales for the holiday quarter would likely miss Wall Street expectations.

Meanwhile, industry research firm Counterpoint said on Saturday that Apple’s iPhone sales are set to dip by around a quarter in India’s holiday season fourth quarter, putting them on course for the first full-year fall in four years.

Apple CEO Tim Cook earlier said after publishing third quarter results that sales were flat in India in the fourth quarter, which includes a month-long festive season culminating this week in Diwali – a bumper period for electronics sales.

Channel checks pointed to numbers for the quarter in the range of 700,000 to 800,000 units, down from about a million a year ago, Neil Shah, research director at HongKong-based Counterpoint Research, said.

For the whole of 2018, Apple was set to sell about 2 million phones – a drop of about a million from last year, he said, as Indians balk at high prices for the devices, driven by trade tariffs and a weak rupee.

While more than half the phones sold this year were older iPhone models, high selling prices meant Apple’s Indian revenue should still be flat or slightly higher than a year ago.