Infineon Technologies AG has revised its revenue target for the fiscal year 2024, now aiming for approximately €16 billion, down from the previous guidance of €17 billion.

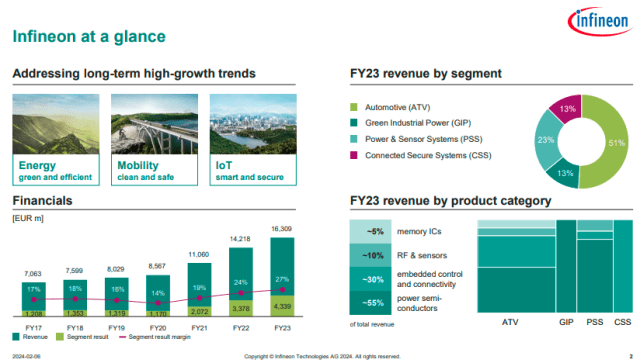

The company anticipates growth in the Automotive (ATV) segment to be in the low double-digit percentage range. However, it expects declines in revenue for the Green Industrial Power (GIP) segment to fall within the mid to high-single-digit percentage range compared to the prior year. Furthermore, revenue decreases in both the Power & Sensors Systems (PSS) and Connected Secure Systems (CSS) segments are forecasted to be in the mid to high-teens percentage range.

The company anticipates growth in the Automotive (ATV) segment to be in the low double-digit percentage range. However, it expects declines in revenue for the Green Industrial Power (GIP) segment to fall within the mid to high-single-digit percentage range compared to the prior year. Furthermore, revenue decreases in both the Power & Sensors Systems (PSS) and Connected Secure Systems (CSS) segments are forecasted to be in the mid to high-teens percentage range.

Additionally, Infineon has scaled back its capital expenditure (Capex) outlook for the 2024 fiscal year to around €2.9 billion, down from the previous projection of €3.3 billion. The focus of Capex will primarily be on completing Phase 1 of the third manufacturing module at the Kulim site in Malaysia, designed for compound semiconductors production, as well as initiating Phase 2.

Furthermore, substantial investments will be directed towards constructing the fourth manufacturing module in Dresden, Germany, catering to analog/mixed-signal components and power semiconductors. Significant funds are also allocated to machinery for manufacturing silicon carbide and gallium nitride-based products.

REVENUE

During the first quarter of the 2024 fiscal year, which ended on December 31, 2023, Infineon reported revenue of €3,702 million, marking a 6 percent decrease compared to €3,951 million in the previous quarter.

Capex for the first quarter of the fiscal year amounted to €653 million, down from €1,057 million in the prior quarter.

Jochen Hanebeck, CEO of Infineon, acknowledged the challenging market conditions, stating, “In consumer, communication, computing, and IoT applications, we are not anticipating a noticeable recovery in demand until the second half of the calendar year.” He also mentioned that despite a slowdown in demand for electromobility outside China, expectations for the automotive sector remain largely unchanged.

Segment-wise, revenue in the ATV segment totaled €2,085 million in the first quarter of the 2024 fiscal year, reflecting a 4 percent decrease compared to the fourth quarter of the previous fiscal year. This decline was attributed to expected inventory adjustments by customers towards the end of the calendar year.

In the GIP segment, revenue decreased by 16 percent from an all-time high of €582 million in the final quarter of the 2023 fiscal year to €487 million in the first quarter of the 2024 fiscal year. This decline was attributed to partly seasonally declining demand across all areas, as well as increasing inventory adjustments by industrial customers.

Similarly, revenue in the PSS segment declined by 16 percent to €765 million in the first quarter of the 2024 fiscal year compared to €912 million in the prior quarter. While there was an uptick in demand for components for smartphones, other applications such as PCs, laptops, consumer electronics, battery-powered devices, USB controllers, and microinverters for rooftop solar systems experienced continued decline.

The CSS segment also saw a significant revenue decrease of 26 percent, dropping to €364 million in the first quarter of the 2024 fiscal year from €490 million in the prior quarter. This decline was attributed to lower demand and ongoing inventory adjustments in distribution channels.