The NAND Flash market finds itself in a complex scenario as it battles lackluster demand while grappling with a surplus of supply, according to the latest report from TrendForce.

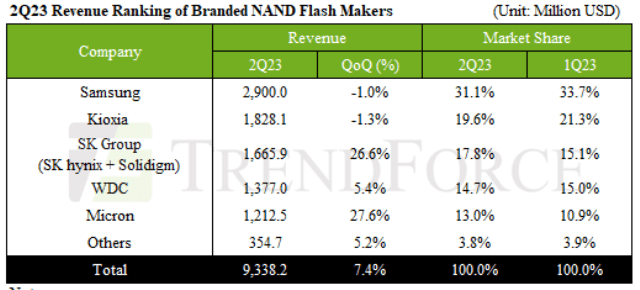

The Average Selling Price (ASP) of NAND Flash has taken a notable hit, plummeting by 10–15 percent. Despite this challenging landscape, there is a glimmer of hope as bit shipments saw a significant 19.9 percent quarter-over-quarter (QoQ) increase, albeit from a low baseline in the first quarter of 2023. In summary, the second quarter of 2023 witnessed a 7.4 percent QoQ growth in revenue for the NAND Flash sector, reaching a total of US$9.338 billion.

The Average Selling Price (ASP) of NAND Flash has taken a notable hit, plummeting by 10–15 percent. Despite this challenging landscape, there is a glimmer of hope as bit shipments saw a significant 19.9 percent quarter-over-quarter (QoQ) increase, albeit from a low baseline in the first quarter of 2023. In summary, the second quarter of 2023 witnessed a 7.4 percent QoQ growth in revenue for the NAND Flash sector, reaching a total of US$9.338 billion.

Samsung, one of the key players in the NAND Flash market, began curbing production from the second quarter, with further reduction expected in the third quarter. As inventories are poised to thin out, there is a possibility of price hikes on the horizon, potentially alleviating the chronic supply-demand imbalance.

However, the NAND Flash sector remains crowded with suppliers, and many players burdened with substantial inventories may continue aggressive sales into the third quarter. Forecasts suggest a deceleration in the decline of ASP for NAND Flash products in Q3, with a range of 5–10 percent. Riding the wave of stockpiling momentum for the high season, bit shipments are expected to rise, pushing Q3 revenue growth past the 3 percent threshold.

The second quarter proved to be a remarkable one for Micron, which outperformed its peers with an impressive 27.6 percent spike in revenue, totaling US$1.21 billion. This resurgence in revenue was primarily driven by decreasing inventories in the PC and mobile markets. Client SSDs, in particular, benefited from expanding average storage capacities, setting a new record for bit shipments in a single quarter.

While the industry as a whole adopts a production cut strategy, Micron aims for a more balanced supply-demand scenario in the second half of 2023. Nevertheless, the overarching outlook for the year suggests that high inventory levels will continue to hinder the recovery of the NAND Flash industry, with expectations of a low bit output supply until 2024.

Both SK Group (comprising SK hynix and Solidigm) and Western Digital enjoyed positive growth in the second quarter due to a continuous decline in SSD inventories and an increase in the storage capacities of consumer electronics devices. This combination fueled growth in bit shipments, bolstering their second-quarter revenues. SK Group’s performance was particularly impressive, recording a quarterly increase of approximately 26.6 percent, while Western Digital experienced a 5.4 percent bump in revenue.

Conversely, Samsung and Kioxia faced challenges in Q2, as they were the only players in the market to register revenue shrinkage. The decline in ASP overshadowed their bit shipment growth. Samsung’s revenue dipped by 1 percent, settling at around US$29 billion.

While the tech industry buzzes with excitement about AI servers, it is the general-purpose server segment that has the most significant impact on NAND demand, leaving NAND Flash revenues unaffected by the AI boom. Kioxia also encountered its own set of obstacles, with Q2 revenues contracting by approximately 1.3 percent, totaling US$18.3 billion.

The NAND Flash market continues to be a dynamic and highly competitive sector, with players navigating a delicate balance between supply and demand dynamics.