Arm Holdings, a UK-based technology company specializing in semiconductor intellectual property, announced its financial results for the third quarter of fiscal year ending 2024, showcasing remarkable growth across various segments.

Total Revenue Hits All-Time High

The revenue for Q3 FYE24 surged to $824 million, marking the highest ever recorded by the SoftBank group company. This represents 14 percent increase compared to the corresponding period in the prior year. The surge was attributed to record royalty revenue and better-than-expected performance in license and other revenue categories.

Robust Growth in Royalty Revenue

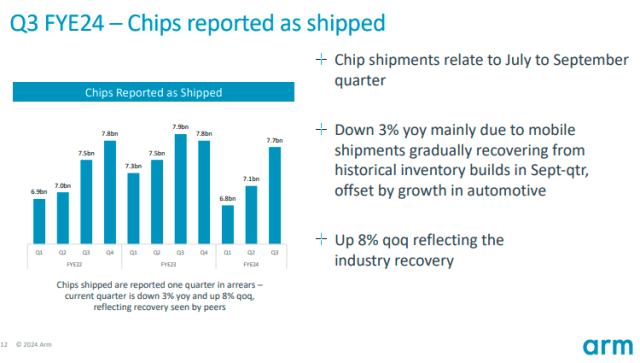

Royalty revenue stood at $470 million, reflecting an 11 percent increase year-over-year and a 12 percent sequential growth. This growth was propelled by the resurgence in the smartphone market and the escalating adoption of Armv9 architecture. Notably, cloud server growth and higher royalty rates associated with the Armv9 transition contributed significantly to this surge.

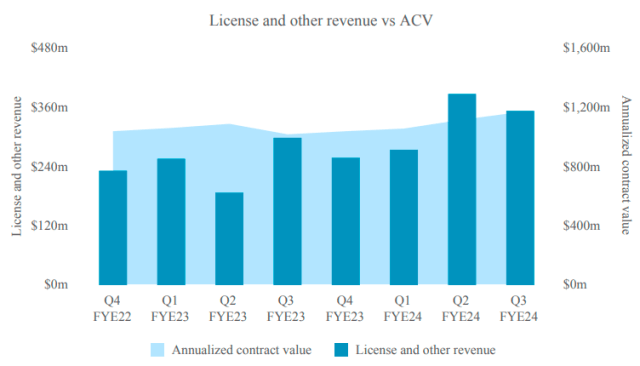

Licensing and Other Revenue Exceed Expectations

Licensing and other revenue for the quarter reached $354 million, marking an 18 percent year-over-year increase. This exceptional performance was fueled by the signing of multiple high-value, long-term license agreements with prominent technology firms. Furthermore, the preference for Arm’s advanced CPUs for AI applications, which command higher license fees, played a pivotal role in this revenue surge.

Expanding Customer Base and Market Penetration

Rene Haas, CEO of Arm, attributed the growth to an increasing number of customers transitioning to higher-value Armv9 technology. He emphasized the company’s market share gains in the cloud server and automotive sectors, driven by the demand for power-efficient compute platforms.

Strategic Expansion Pays Off

Strategic Expansion Pays Off

Arm’s expansion strategy is yielding positive results, with customers increasingly adopting Arm-based central processors to complement Nvidia’s chips for AI work in data centers. This trend extends to the development of new AI-enabled devices such as laptops and smartphones, driving further growth opportunities for the company, Reuters news report said.

Positive Outlook and Raised Guidance

ARM executives expressed optimism about the company’s future prospects, particularly in markets such as automotive and AI. The finance chief, Jason Child, raised the guidance by approximately $100 million for the fiscal fourth quarter, citing anticipated strength in these segments. The company expects significant revenue from licensing chips powering AI in various devices, including data centers, smartphones, and PCs.

Evolution of Business Model

Arm’s evolved business model, characterized by increased adoption of its ninth-generation chip architecture, is proving to be lucrative. Notably, about 15 percent of Arm’s royalty revenue now stems from its ninth-generation technology, signaling a shift towards more advanced chip designs across diverse markets.

Outlook for Full Fiscal Year

For the full fiscal year, Arm anticipates revenue of $3.18 billion and adjusted earnings of $1.22 per share.

Robust Growth in Remaining Performance Obligations

As of the end of Q3 FYE24, remaining performance obligations (RPO) surged to $2,433 million, marking 38 percent increase. This growth was driven by the signing of high-value license agreements and the renewal of a long-term customer agreement. ARM anticipates recognizing approximately 28 percent of RPO as revenue over the next 12 months, with 26 percent recognized over the subsequent 13-to-24-month period, and the remainder thereafter.

Expansion of License Agreements

During the quarter, ARM inked five additional Arm Total Access agreements, bringing the total number of extant licenses to 27, which includes more than half of the company’s top 20 customers. These new agreements span various end markets, including embedded computing, wireless connectivity, AI-enabled camera technology, and smartphones. Notably, three of the new Arm Total Access agreements were with companies that previously held Arm Flexible Access licenses, indicating a significant upgrade in partnership.

The Arm Flexible Access program serves as a gateway for early-stage companies to leverage the advantages of the extensive Arm ecosystem as they venture into new markets. In Q3 FYE24, ARM witnessed over 50 renewals and 14 new agreements under this program, resulting in six net additions and bringing the total number of extant licensees to 218. The companies involved in renewing existing agreements or signing new ones are actively developing products for diverse applications, including multiple AI accelerators, edge servers, automotive applications, and sensors.

Baburajan Kizhakedath