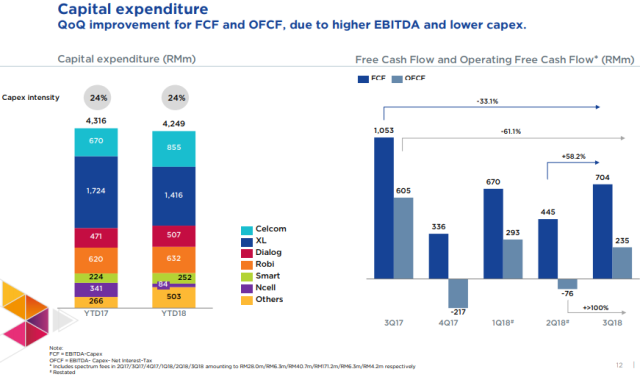

The capital spending of Axiata at RM 4.249 billion for the nine months of 2018 shows that the Asian telecom operator has 24 percent capital intensity.

Axiata

The Capex of Axiata includes investment by telecom operating companies such as Celcom Indonesia, XL Malaysia, Dialog Sri Lanka, Robi Bangladesh, Smart Cambodia Ncell Nepal, among others.

The capital investment of Axiata during the first nine months of 2017 was RM 4.316 billion, slightly above the 2018 level. The main focus of Axiata group CIO Anthony Rodrigo was in the expansion of mobile data networks of group operating companies. Axiata is yet to reveal its 5G strategy.

Celcom

Capex of Celcom has reached RM 855 million in December 2018 vs RM 670 million. The population coverage of Celcom’s LTE reached 90 percent, while LTE-Advanced reached 78 percent of the population in Indonesia.

Celcom said its post-paid ARPU grew by RM5 from RM83 to RM88. Celcom revenue rose 3 percent supported by 2.1 percent increase in service revenue, driven by growth in pre-paid and post-paid business.

XL

Capex of XL reached RM 1,416 million vs RM 1,724 million. XL’s 4G network reached 387 cities in Malaysia. XL added over 28,000 4G BTS in top cities across Malaysia. XL achieved revenue growth of 5.6 percent in Q318 compared to Q218 due to gains from its transformation efforts and data monetization. XL’s data revenue accounts for 74 percent of its service revenue.

Dialog

Capex of Dialog reached RM 507 million vs RM 471 million. The focus of Dialog was in the network coverage expansion of home broadband in Sri Lanka.

Capex of Robi reached RM 632 million vs RM 620 million. Robi added over 7,000 4G BTS in Bangladesh.

Capex of Smart reached RM 252 million vs RM 224 million. Capex of Ncell reached RM 84 million vs RM 341 million. Capex of Others reached RM 503 million vs RM 266 million.

Axiata group CEO Tan Sri Jamaludin Ibrahim will be looking forward for the continued support of operating companies in achieving revenue growth.

The strategy of Axiata group CEO Vivek Sood assisted the Asian telecom giant to achieve 6.3 percent rise in EBITDA to RM 2.171 billion in Q3 2018 as compared with RM 2.043 billion in Q2 2018. But its EBITDA fell 9.5 percent to RM 6.251 billion in the first nine months of 2018.

The latest CIMB Research said Axiata’s 2Q18 core EPS jumped 48.1 percent on-quarter and fell 16.8 percent on-year) as Idea Cellular turned profitable from a one-off tower sale and narrower share of Robi’s losses, which were partly offset by weaker earnings from Celcom, XL and Dialog.

Baburajan K