The telecom equipment market in 2024 saw shifts in revenue share among top vendors, the latest data from Dell’Oro Group showed.

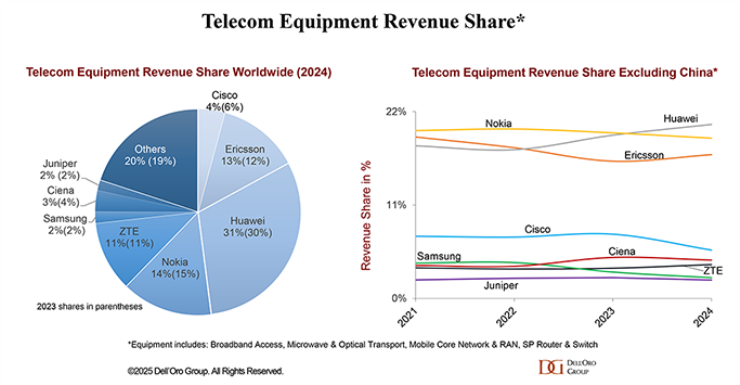

Huawei has remained the telecom equipment market leader worldwide, increasing its share to 31 percent from 30 percent in 2023.

Nokia followed, though its share declined slightly from 15 percent to 14 percent in telecom equipment market.

Ericsson strengthened its position in telecom equipment market with a marginal increase from 12 percent to 13 percent.

ZTE held its share steady at 11 percent in telecom equipment market.

Other key players included Cisco, which saw a decline from 6 percent to 4 percent, and Ciena, which maintained a stable presence at 3 percent. Samsung and Juniper each accounted for 2 percent of the market.

The “Others” category, representing various smaller suppliers, saw a notable decline from 19 percent to 20 percent, indicating a slight concentration of market share among leading players.

Outside of China, Huawei overtook Nokia as the top vendor, while Ericsson remained in a strong position. Cisco experienced a decline, whereas Ciena, Samsung, and ZTE remained relatively stable in their market positions.

The telecom equipment market faced significant challenges in 2024, with conditions improving in the second half but failing to offset an overall difficult year for telecom suppliers.

Worldwide telecom equipment revenues across six key segments — Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch — declined 11 percent, marking the steepest annual decline in over two decades. The last comparable drop exceeded 20 percent in 2002.

This downturn led to a cumulative 14 percent decline over the past two years, reflecting broad-based deceleration across telecom sectors. Multiple factors, including excess inventory, macroeconomic challenges, and difficult comparisons with previous 5G expansion periods, contributed to the decline.

Fourth-quarter stabilization was primarily driven by growth in North America and EMEA, nearly counteracting weaker demand in the Asia-Pacific region, including China. However, the annual decline varied across the six telecom segments. Optical Transport, SP Routers, and RAN experienced the sharpest contractions, collectively shrinking by 14 percent in 2024. Meanwhile, Microwave Transport and MCN registered a more moderate decline in the low single digits, and Broadband Access revenues remained relatively stable.

Regional developments also presented a mixed picture. The slowdown impacted all five major regions — North America, EMEA, Asia Pacific, China, and CALA — but was more pronounced in Asia Pacific, where difficult market conditions in both China and the broader Asia-Pacific region contributed to the downturn.

Looking ahead to 2025, telecom equipment market conditions are expected to stabilize, although challenges will persist. Analysts project that global telecom equipment revenues across the six key segments will remain flat for the year, signaling a pause in the decline but no immediate return to growth.

Baburajan Kizhakedath