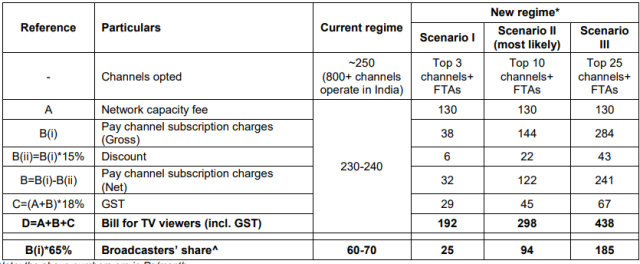

Subscription revenues of broadcasters will rise by around 40 percent to Rs 94 per subscriber per month compared with Rs 60-70 now in the wake of the new tariff imposed by TRAI from February 1, according to a report from rating agency Crisil.

The network capacity fee and channel prices announced by broadcasters and distributors as per TRAI’s new guidelines could increase the monthly bill of most subscribers of television channels, Crisil said.

The TRAI framework allows consumers to select and pay only for the channels they wish to view, and requires TV broadcasters to disclose the maximum retail price of each channel and that of bouquets.

The monthly TV bill can go up by 25 percent from Rs 230-240 to around Rs 300 per month for viewers who opt for the top 10 channels, but will come down for those who opt up to top 5 channels.

The rating agency said the new regime could drive consolidation in the broadcasting industry as content will be the main influencing factor.

“With viewers likely to opt for popular channels, large broadcasters will have greater pricing power,” Crisil senior director Sachin Gupta said.

Broadcasters with less-popular channels will not be able to depend on packages, and the least popular ones will not have a strong business case and could go off air from the Indian broadcasting industry.

The new TRAI regulations are a mixed bag for distributors like DTH and cable operators in India.

“OTT platforms could emerge as the big beneficiary because viewers could shift because of rising subscription bills. And low data tariffs also encourages viewership on OTT platforms,” Crisil director Nitesh Jain said.

While content cost will become a pass-through, protecting them from fluctuations, they may lose out on the benefits of value-added services such as bundling content across broadcasters, customisation, and placement revenue.

Currently, most distributors are charging network capacity fee at the cap rate of Rs 130 per month. Similarly, broadcasters have priced subscription for the most popular pay channels at the cap rate of Rs 19 per month.

Airtel DTH

Airtel said its Digital TV operations are available in 639 districts connecting 15 million (+7.6 percent) DTH customers in the December quarter. Airtel DTH ARPU was Rs 231 vs Rs 233 in Q3 fiscal 2017-18.

Airtel revenue from Digital TV services rose by Rs 68.7 crore to Rs 1,033 crore. EBITDA of Airtel Digital TV business increased to Rs 382.6 crore from Rs 370.8 crore with EBITDA margin of 37 percent and EBIT of Rs 156.8 crore.