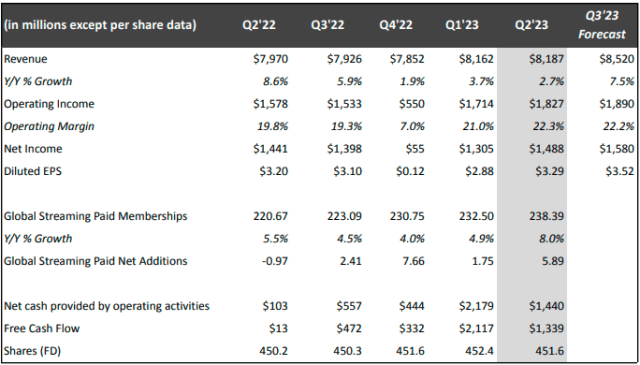

Streaming giant Netflix said second-quarter revenue rose 2.7 percent to $8.2 billion despite adding 5.9 million new streaming customers between April and June.

This growth in revenue was attributed to a significant 6 percent rise in paid memberships to 5.9 million. This marks a significant improvement compared to Q2’22 when the company experienced a decline of 1.0 million paid memberships. The rollout of paid sharing to more than 100 countries, representing over 80 percent of Netflix’s revenue, contributed to this positive trend, with each region contributing over 1 million paid net additions.

This growth in revenue was attributed to a significant 6 percent rise in paid memberships to 5.9 million. This marks a significant improvement compared to Q2’22 when the company experienced a decline of 1.0 million paid memberships. The rollout of paid sharing to more than 100 countries, representing over 80 percent of Netflix’s revenue, contributed to this positive trend, with each region contributing over 1 million paid net additions.

ARM (Average Revenue per Member) of Netflix declined by 3 percent during the same period. Several factors contributed to this decline, including limited price increases over the past year, the timing of paid net additions primarily occurring late in the quarter due to the rollout of paid sharing in Q2, and a higher proportion of membership growth from lower ARM countries.

For the third quarter, Netflix estimated revenue to reach $8.5 billion.

As streaming competition intensifies, and the company nears market saturation in the United States, Netflix has been exploring new ways to generate revenue. To address these challenges, the company introduced a more affordable tier with advertising options in November of the previous year. Additionally, they began cracking down on password sharing in May to protect their content.

Netflix expressed its expectations for revenue growth to accelerate during the second half of the year. The company plans to achieve this by continuing to produce compelling shows and movies, improving monetization efforts, boosting its video game business, and enhancing user experiences.

Despite the positive subscriber additions, average revenue per member dropped by 3 percent compared to the previous year. This dip was partially attributed to the influx of new subscribers from countries where Netflix offers lower subscription prices.

The nearly 6 million subscriber additions, brought Netflix’s global subscriber count to 238.4 million by the end of June.

Some analysts believe that investors may have become overly optimistic about the potential of Netflix’s advertising tier and the impact of the password crackdown.

Regarding Netflix’s advertising tier, the company clarified that it remains a small part of its membership base, and current ad revenue does not significantly impact its overall earnings.

Netflix Chief Financial Officer Spencer Neumann emphasized that Netflix has room to grow in the advertising space, but the company still has a long way to go, stating, “even getting to 10 percent (of revenue).”

Furthermore, like other streaming platforms, Netflix is grappling with strikes by Hollywood actors and writers, which have disrupted several film and television productions. However, analysts believe that Netflix’s global production capabilities give it an advantage in navigating these challenges.

Netflix raised its 2023 free cash flow estimate to $5 billion, up from $3.5 billion, primarily due to reduced content expenses as certain productions were shut down during the labor strikes.

Netflix said its operating income for Q2’23 reached $1.8 billion, showing a healthy 16 percent increase compared to the same quarter in the previous year, which stood at $1.6 billion. The operating margin also saw improvement, rising to 22 percent from 20 percent in Q2’22.

Looking ahead, Netflix anticipates that revenue growth will accelerate in the second half of 2023, driven by increased monetization resulting from the recent launch of paid sharing and the expansion of this initiative to nearly all remaining countries. Additionally, the steady growth in the company’s ad-supported plan is expected to contribute positively to revenue generation.

For the upcoming third quarter, Netflix forecasts a revenue of $8.5 billion, reflecting a 7 percent increase compared to the same period last year. The revenue growth in Q3 is expected to be fueled by an expansion in average paid memberships, with Q3’23 paid net additions projected to be similar to those in Q2’23.

In a bid to enhance monetization further, Netflix is employing a more sophisticated pricing and plans strategy. In Q1, the company lowered prices in several less-penetrated markets to attract new customers. Additionally, in Q2, Netflix phased out its Basic ads-free plan for new and rejoining members in Canada. However, existing members on the Basic ads-free plan in Canada remain unaffected. The company is implementing the same change in the US and the UK. Netflix asserts that the entry prices in these regions – $6.99 in the US, £4.99 in the UK, and $5.99 in Canada – offer great value to consumers, given the breadth and quality of the content catalog.

While Netflix continues to experience growth in its ad-supported plan membership, the ad revenue remains relatively small for the streaming giant. Brands can now target media buys on Netflix’s Top 10, a daily-updated list that allows them to connect with audiences during peak viewing moments.

Despite being in the early stages of monetization, Netflix’s expansion of paid sharing to more than 100 countries has received a positive response, with a low cancellation rate. Many borrower households have converted into full paying Netflix memberships, and the uptake of the extra member feature has been encouraging.

Netflix remains optimistic about the future and is strategically positioning itself for continued growth and success in the streaming market.