TRAI in its consultation paper said it aims to fix entry level net worth criteria for multi-system operators (MSOs) in cable TV services in India.

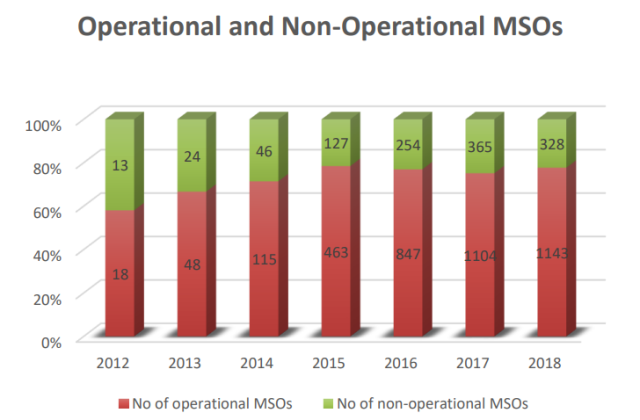

India has 1,471 registered MSOs including 1,143 operational4 MSOs and more than 60,000 local cable operators.

India has 1,471 registered MSOs including 1,143 operational4 MSOs and more than 60,000 local cable operators.

The percentage of non-operational MSO reached 22.3 percent in 2018, indicating the fact that a sizeable number of registered MSOs may not have sustained in India’s cable TV industry due to stiff competition.

MSOs face competition both from incumbent MSOs, as well as from distribution platforms such as DTH service providers etc. The competition and new technology like freely available content on OTT platforms impose pressure on small MSO firms.

Small MSOs fail to recover fixed costs and become unviable. TRAI aims that there should be a net worth criteria to encourage financially viable MSOs to enter the cable TV industry.

A new MSO incurs fixed overhead costs for starting its operations. In addition to the fixed cost, MSOs also incur variable costs which comprise of operating expenditures as well as maintenance cost.

MSO spent on for three purposes — a) Head end establishment b) CAS and SMS installation c) STB deployment d) Laying down cables. One such criterion could be that the minimum net worth be a fraction of the fixed cost.

TRAI said the number of Cable TV homes has soared to 98.5 million, as per FICCI – EY Report 2018. Total number of households in India is 286 million out of which 183 million are TV households.

Ministry of Information and Broadcasting says MSOs need to entry fee of Rs one lakh only for MSO registration.

Earlier, MSOs should have a net worth of Rs 5 lakh for district level license, Rs 10 lakh for state level registration and Rs 25 lakh for country level registration.

TRAI also said India needs regional MSOs in the cable TV sector as they can better provide the program diversity to cater to the regional/ local tastes. A minimum net-worth criterion or entry could discourage the growth of smaller MSOs in rural areas and in-turn may block the growth of local and regional channels.

TRAI said one criterion for fixing the minimum net worth requirements for an entrant MSO could be based upon some combination of a fraction of average fixed cost (as required for setting a minimum channel carrying capacity of 100/300 channels) and a fraction of expected average variable cost incurred annually during operations of a typical MSO.

The other criteria for fixing the minimum net worth could be on the basis of expected number subscribers that an entrant MSO estimates to cater to. Net worth can be fixed taking into account the cost of providing service to this minimum number of subscribers such that the business of that entrant MSO is viable.