Verizon Verizon is expanding its fixed wireless access (FWA) footprint with the planned acquisition of Starry, a U.S.-based fixed wireless internet provider. The deal, expected to close in the first quarter of 2026, will add 100,000 FWA subscribers and bring Starry’s high-capacity mmWave technology into Verizon’s broadband ecosystem.

Verizon Bolsters Its FWA Capabilities

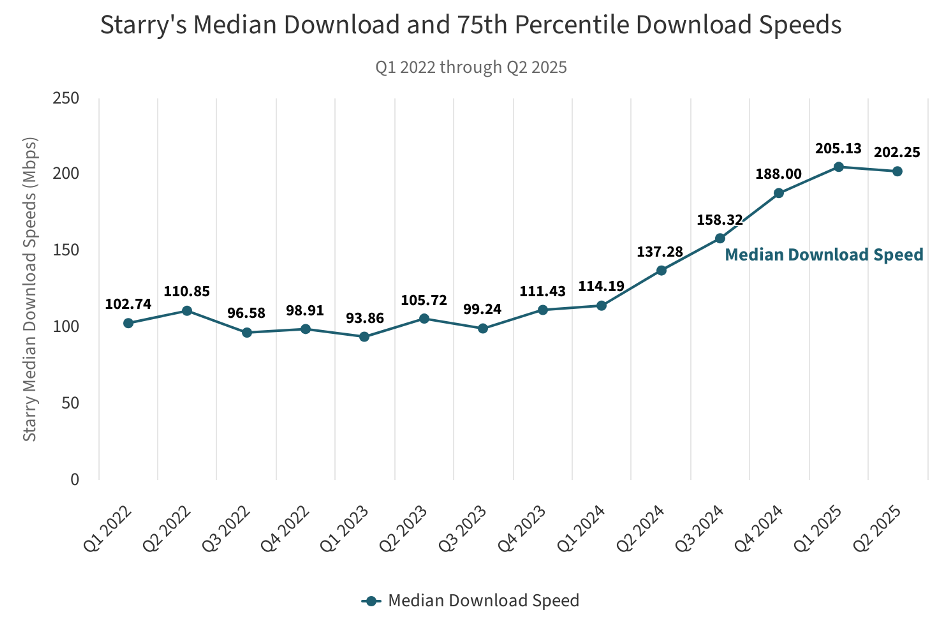

Starry currently operates in Boston, Denver, Los Angeles, New York/New Jersey, and Washington, D.C./Virginia, serving multi-dwelling units (MDUs) with broadband speeds that have steadily improved. According to Ookla Speedtest data, Starry nearly doubled its median download speed from 102.74 Mbps in Q1 2022 to 202.25 Mbps in Q2 2025—outpacing Verizon’s FWA median download speed of 149.21 Mbps in the same period.

Verizon plans to integrate Starry’s mmWave assets with its existing mmWave spectrum and fiber backhaul, enabling faster and more efficient broadband delivery to MDUs. This move aligns with Verizon’s ongoing strategy to expand FWA coverage while leveraging its existing 5G infrastructure.

Starry’s Technology Edge

Starry’s network operates on shared mmWave spectrum in the 37.1–37.5 GHz bands, along with 104 licenses in the 24 GHz band covering 51 partial economic areas. Its proprietary near-line-of-sight system uses rooftop base stations that transmit signals to building-mounted receivers, allowing a single base station to serve multiple buildings—an approach praised by industry analyst Roger Entner of Recon Analytics as both technologically sophisticated and cost-efficient.

Starry’s technology, based on modified 802.11ac/ax standards, leverages the Wi-Fi chipset ecosystem, reducing costs while delivering competitive broadband speeds.

From Bankruptcy to a Strategic Asset

Starry’s journey has been turbulent. After going public via SPAC in March 2022, it filed for bankruptcy in early 2023, later re-emerging as a private company in August 2023. Despite limited resources, Starry maintained around 90,000–100,000 customers across its five core markets.

Its broadband offerings include:

200 Mbps for $30/month

500 Mbps for $55/month

1 Gbps for $75/month

These plans closely mirror Verizon’s FWA tiers, suggesting an easy integration path post-acquisition.

Boosting Verizon’s MDU Ambitions

Verizon had already outlined plans to target MDUs with gigabit-speed FWA solutions using mmWave spectrum. The Starry acquisition accelerates those ambitions by adding proven technology and an existing urban customer base.

“Starry’s architecture is less expensive to build and quicker to deploy,” said Joe Russo, EVP and president of global networks and technology at Verizon. “This deal allows us to accelerate our FWA capabilities while leveraging our fiber and mmWave assets.”

Market Performance and Speed Insights

Starry’s top-performing market is New Jersey, where median download speeds reached 251.08 Mbps, followed by Massachusetts at 184.96 Mbps. Ookla data highlights consistent speed growth across all markets, especially among users on higher-tier plans.

Strategic Outlook

The acquisition will boost Verizon’s FWA subscriber base but will not alter its long-term goal of reaching 8–9 million subscribers by 2028. Instead, Verizon says the deal will “accelerate” progress toward that milestone.

With Starry’s advanced mmWave technology, urban market presence, and efficient deployment model, Verizon is poised to strengthen its position in the competitive FWA market, particularly in dense MDU environments where fiber expansion remains challenging.

For 2025, Verizon’s Capex is projected to be around $17 billion to $18 billion, consistent with its guidance from 2024. The spending is primarily directed toward 5G Ultra Wideband deployment, C-band spectrum integration, and core network upgrades to support FWA and enterprise solutions. The company has largely completed its major C-band build, allowing for reduced Capex compared to the peak investment years (2021–2023) when spending exceeded $23 billion annually.

Baburajan Kizhakedath