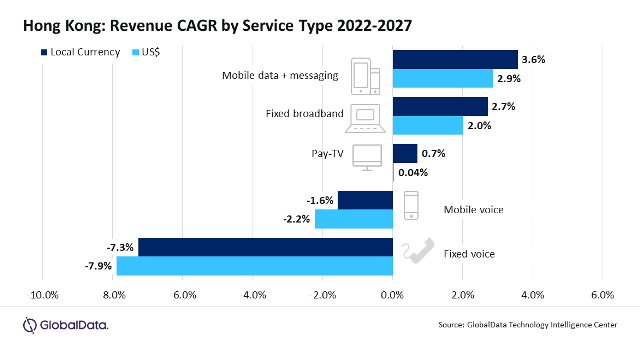

Hong Kong’s telecom and pay-TV services are on a growth trajectory, anticipated to surge to $6.1 billion by 2027 from $5.8 billion in 2022, as forecasted by GlobalData. This increase is chiefly propelled by mobile data and fixed broadband segments, revealed in the Hong Kong Telecom Operators Country Intelligence Report.

The report suggests a decline in mobile voice service revenue due to a consistent drop in mobile voice service ARPU (Average Revenue Per User), with users increasingly shifting towards Over-The-Top (OTT) communication platforms.

The report suggests a decline in mobile voice service revenue due to a consistent drop in mobile voice service ARPU (Average Revenue Per User), with users increasingly shifting towards Over-The-Top (OTT) communication platforms.

However, a different trend emerges for mobile data service revenues, expected to rise at a 4.1 percent CAGR during the forecast period. This surge is attributed to the steady increase in smartphone adoption, rising mobile internet subscriptions, elevated consumption of mobile data services, and the growing adoption of higher ARPU 5G services.

The report notes that while 4G services dominated the mobile subscriptions landscape in 2022, 5G subscriptions are set to surpass 4G subscriptions by 2025. This shift is propelled by escalating demand and wider availability of 5G services, with operators offering enticing promotional plans geared towards high-bandwidth applications like video streaming and mobile gaming.

In a significant development in June 2023, Hong Kong’s telecom regulator, the Office of the Communications Authority (OFCA), initiated a public consultation regarding the allocation of 400MHz in the 6/7GHz band for mobile services, specifically targeting 5G. This move aims to further expand 5G networks and bolster its adoption across the country.

Within fixed communication services, the report predicts a decline in fixed voice service revenue owing to reductions in circuit-switched subscriptions and declining fixed voice service ARPU. Conversely, fixed broadband service revenues are poised to grow at a 2 percent CAGR from 2022 to 2027, driven by an uptick in fixed broadband subscriptions, especially over fiber access lines.

The growing demand and increased availability of high-speed fiber broadband connectivity, bolstered by initiatives to expand fiber network infrastructure, will drive the steady rise in the adoption of fiber broadband services in the coming years. For instance, OFCA extended its subsidy schemes for fixed network operators (FNOs) to support the deployment of fiber-optic networks in remote and underserved areas.

Regarding Pay-TV service revenues, a marginal increase is anticipated due to the continual rise in IPTV subscriptions. However, traditional pay-TV services face declining demand as consumers increasingly favor OTT-based video services.

In the competitive landscape, China Mobile Hong Kong (CMHK) and PCCW are poised to maintain their leading positions in the mobile services market. Both entities are capitalizing on 5G network expansion and modernization initiatives, with CMHK and PCCW achieving nationwide 5G coverage surpassing 90 percent.

PCCW is expected to lead in both fixed voice and fixed broadband segments, while PVVW secures a leading position in the fixed broadband segment, primarily due to its expansion of fiber networks and promotional tariff plans.