Saudi Arabia’s fixed communication services are poised for a substantial uptick. Projections suggest fixed communication services market in Saudi Arabia will achieve a compounded annual growth rate (CAGR) of 3.1 percent, propelling revenues from $2.4 billion in 2023 to an estimated $2.8 billion by 2028. This surge is primarily attributed to the burgeoning fixed broadband sector within the region, GlobalData said.

GlobalData’s Q3 2023 Saudi Arabia Fixed Communications Forecast divulges a contrasting narrative: while fixed voice service revenue in Saudi Arabia is expected to dwindle at a CAGR of 10.9 percent from 2023 to 2028, this downturn is ascribed to diminishing circuit switched subscriptions.

GlobalData’s Q3 2023 Saudi Arabia Fixed Communications Forecast divulges a contrasting narrative: while fixed voice service revenue in Saudi Arabia is expected to dwindle at a CAGR of 10.9 percent from 2023 to 2028, this downturn is ascribed to diminishing circuit switched subscriptions.

Concurrently, the decline in average revenue per subscriber (ARPS) for fixed voice services in Saudi Arabia is influenced by the populace’s preference for mobile and internet-based communication channels. Free voice minutes integrated into operators’ bundled plans further contribute to this downward trajectory.

Telecom Analyst Srikanth Vaidya from GlobalData explicates, “Fixed broadband services in Saudi Arabia are poised for a robust CAGR of 8.6 percent during 2023-2028, primarily fueled by the sustained surge in broadband subscriptions. This is especially pronounced in higher-ARPS yielding fiber-broadband subscriptions.”

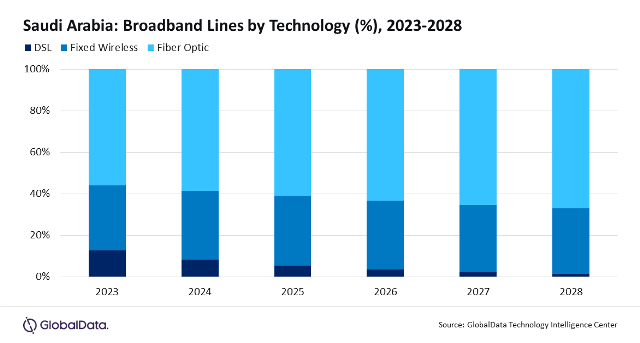

Fiber-optic lines, constituting a noteworthy 56 percent share of Saudi Arabia’s total fixed broadband lines in 2023, are anticipated to amplify to approximately 67 percent by 2028. This expansion will be bolstered by substantial investments from both the government and operators in fiber network infrastructure, coupled with the expansive rollout of FTTH services in Saudi Arabia.

The escalating demand for high-speed internet services and competitively priced fiber-broadband plans, featuring benefits such as cost-effective multi-play options, is expected to be a key driver for fiber broadband services within the country.

For example, STC, a prominent player in the market, is offering a 500 Mbps FTTH plan inclusive of unlimited data, fixed voice telephony, subscription to the SVoD platform Shahid VIP, and free installation of a fixed broadband modem for SAR 402.5 ($107.3) per month.

Anticipations indicate that STC will maintain its dominance in the fixed voice services segment until 2028, bolstered by its robust position in the burgeoning VoIP service realm. Additionally, the operator is expected to lead the fixed broadband services market by subscriptions, propelled by its strong foothold in FTTH and FWA service segments.