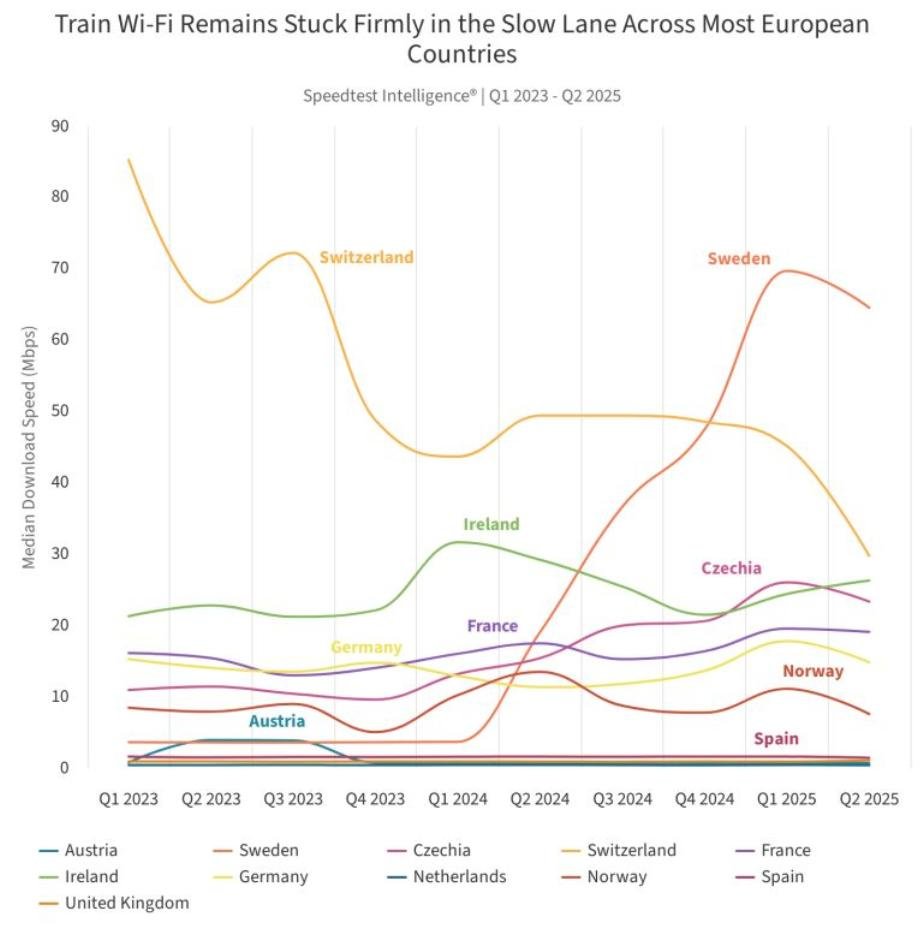

Analysis of Speedtest Intelligence data shows a divide in European train Wi-Fi performance. Sweden leads by a wide margin in Q2 2025, with a Internet download speed of 64.58 Mbps and upload speeds of 54.95 Mbps — far surpassing 7.59 Mbps across Europe.

This represents a dramatic improvement from 2022–2024, when Swedish train Wi-Fi was below average at ~2 Mbps down and ~1 Mbps up. The turnaround is attributed to targeted state aid, infrastructure investments, spectrum auction obligations, and policies ensuring rail operators provide mobile access and tunnel coverage.

Switzerland remains notable, delivering download speed of 29.79 Mbps through a FreeSurf system that subsidizes mobile usage onboard, though access is limited to Swiss SIM users.

Other countries exceeding the European average include Ireland (26.33 Mbps), Czechia (23.36 Mbps), and France (19.12 Mbps), with Ireland also achieving the lowest latency at 40 ms. Sweden’s success demonstrates how strategic investment and policy can overcome geographic and climatic challenges to deliver high-speed rail connectivity.

European Train Wi-Fi Lags Behind Despite Asian Progress

In Q2 2025, the performance gap in European train Wi-Fi remained stark, with countries like Spain, the Netherlands, and the UK delivering Internet speeds up to 158 times slower than Sweden. Weak performance stems from legacy Wi-Fi standards (Wi-Fi 4), capacity-limited 2.4 GHz bands, fragmented responsibility across rail and mobile operators, and reliance on incidental mobile coverage for backhaul.

The Netherlands’ poor onboard Wi-Fi contrasts with its strong mobile networks, while the UK faces systemic infrastructure and coordination challenges. In Asia, Japan, South Korea, and Taiwan prioritize trackside cellular coverage over public Wi-Fi, with Taiwan leading in low latency (13 ms). Delivering consistent, high-speed Wi-Fi remains an engineering challenge due to metal carriages, tunnels, and frequent cellular handovers, highlighting the need for coordinated upgrades across train-to-ground backhaul and onboard Wi-Fi systems.

Improving Train Wi-Fi Through Investment and Policy Support

Several countries have boosted train Wi-Fi performance through targeted government support, regulatory frameworks, and infrastructure investment. Sweden transformed its rail connectivity by providing €2 million in state aid to Telia and Net4Mobility for operator-neutral tunnel infrastructure, integrating rail-specific coverage obligations into spectrum auctions, and mandating mobile access along tracks. Switzerland leveraged the SBB FreeSurf program, subsidizing mobile usage onboard to bypass Wi-Fi bottlenecks.

Telia has announced a partnership with Sweden’s national train operator, SJ, to enhance nationwide train communications. This collaboration includes providing onboard Wi-Fi for all trains operating within the Nordic region and to Germany, along with mobile connectivity and IoT solutions to support efficient and sustainable train operations.

France and Austria invested in dedicated trackside networks with carefully spaced antennas and tunnel solutions, co-funded by rail operators and government programs.

Japan and Taiwan deployed modern Wi-Fi standards (Wi-Fi 5/6) and extended trackside cellular into tunnels through government-subsidized programs.

Germany and Belgium upgraded rolling stock with RF-permeable glass and advanced rooftop antennas, while LEO satellite trials in countries like Scotland, France, Italy, and Poland are supplementing cellular backhaul.

Baburajan Kizhakedath