IDC today said it is expecting a flat growth in Indian tablet market in 2014.

This is primarily due to certification issues posed by the Indian government.

The forecast is significant for the tablet vendors since 2013 was a good year for the industry.

IDC says tablet shipments in 2013 reached 4.14 million units with 56.4 percent increase over 2012.

The silver lining in 2014 is the demand from enterprise segments.

“The Government mandate on BIS (Bureau of Indian Standards) Certification mixed with the growing popularity of phablets is likely to obstruct the growth in the tablet category,” said Kiran Kumar, research manager with IDC.

IDC noted that commercial users primarily from industries such as financial services, healthcare, media and education are demanding enterprise tablets.

Activities such as interactive digital presentations, collecting KYC (Know your Customer) documents, and point-of-sale transactions are typical use cases.

While H1 2013 witnessed substantial growth in tablet volumes driven largely by low-end devices, the market observed contraction in the second half of 2013. Despite a strong festive season demand, spending on tablets slowed down in H2 2013 as the consumer adoption approached early stages of maturity on this category of devices.

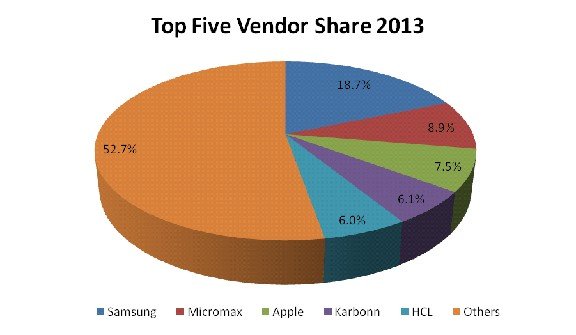

With 18.7 percent market share, Samsung outperformed its competitors with strong presence in 7-8 inch screen size. Despite a dominating presence, the vendor has scaled down its volumes owing to changing market dynamics.

With 8.9 percent market share, Micromax retained its rank, primarily due to their value for money proposition and concerted marketing efforts.

With 7.5 percent market share, Apple has shown significant growth in 7-8 inch screen size despite its niche positioning. iPad Mini was noted to be well accepted by the Indian tablet market, supported by installment payments for consumers.