GSMA Intelligence estimates a $500 billion opportunity for telecom operators from the enterprise digital transformation market. As industries worldwide adopt technologies such as AI, IoT, robotics, AR/VR, big data analytics, and cloud computing, demand for new digital solutions is accelerating.

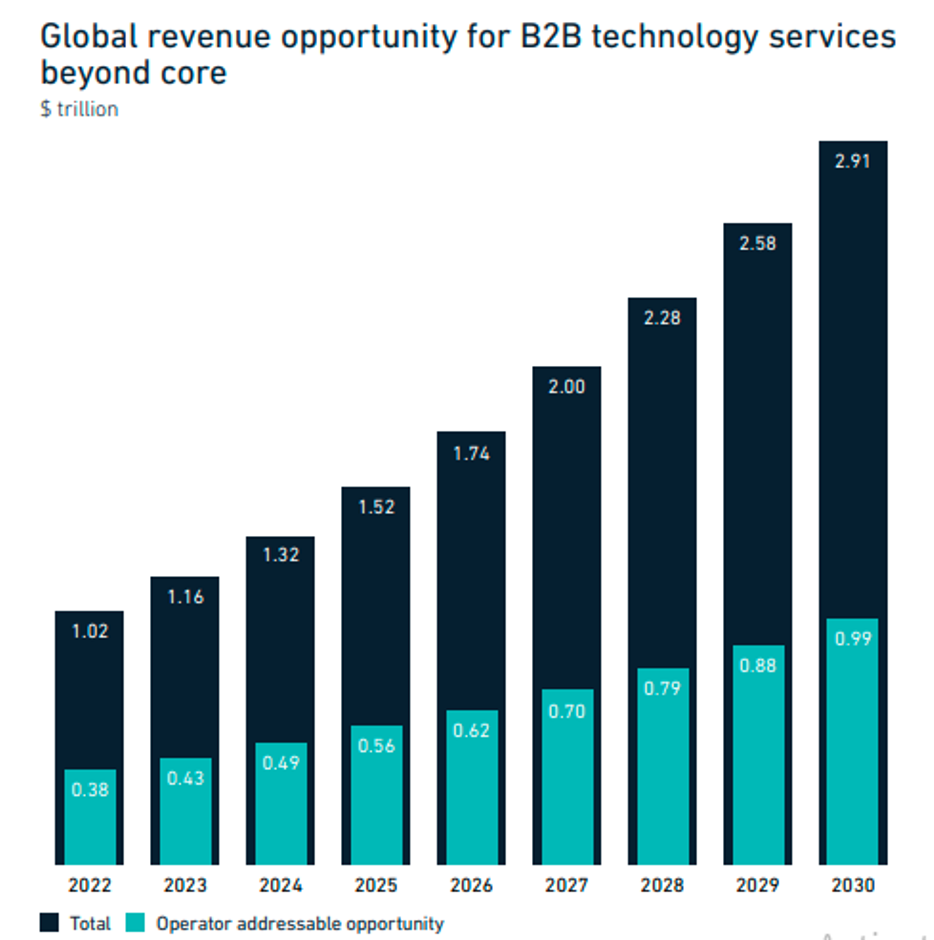

According to the GSMA Intelligence report “The Opportunity for Operators in B2B Technology Services”, the global B2B technology services market — beyond traditional telecom — is expected to reach $2.91 trillion by 2030, with operators positioned to capture nearly one-third of this value.

GSMA Intelligence says the top four industry sectors account for 40 percent of the operator-addressable B2B revenue opportunity in digital transformation.

Manufacturing and automotive together represent nearly 19 percent of this opportunity, driven by adoption of cloud, edge, IoT, robotics, AI, and extended reality (XR) to enhance automation, real-time operations, asset management, and worker safety.

The financial services sector is focusing on cybersecurity, fraud prevention, process automation, risk management, and customer experience improvements through digital solutions.

Meanwhile, the aviation industry is investing in technologies to modernize legacy systems, improve asset and operations management, and deliver better customer experiences.

These sectors highlight where operators can play a pivotal role by providing advanced connectivity, cloud integration, and secure digital infrastructure.

Cloud, data centres, and cybersecurity are emerging as major growth areas for telecom operators, accounting for over 50 percent of the addressable B2B opportunity, according to GSMA Intelligence.

Despite hyperscalers’ dominance in the public cloud market, operators can expand their role in hybrid and multi-cloud orchestration, especially for SMEs, by leveraging their data centre assets, network infrastructure, and partnerships. The move toward cloud-native and software-defined architectures enables operators to deliver industry-specific SaaS, analytics, APIs, and collaboration tools, while their national infrastructure positions them strongly for sovereign cloud and edge computing demand.

Cybersecurity remains a key strength, with operators holding a strong market position in network security, identity and access management, endpoint protection, zero-trust models, and managed security services — areas where their expertise in network monitoring provides a clear advantage.

Additionally, operators are investing in emerging technologies such as generative AI and network APIs. Examples include Chinese operators combining AI, IoT, and 5G for industrial services, and Telefónica, Telkomsel, and Vodafone exploring 5G monetization through API-based offerings.

Cybersecurity has become the top enterprise priority, cutting across all industries as organizations focus on protecting personal data, proprietary information, endpoints, and assets.

Cloud adoption continues to grow, but enterprises are shifting toward hybrid and multi-cloud architectures that combine public cloud and on-premise networks to balance flexibility, control, and security.

Meanwhile, Generative AI (GenAI) is now central to digital transformation strategies, driving new investments and applications. Edge computing is gaining importance as it enables low-latency use cases such as digital twins and industrial robotics, efficiently managing data and compute distribution closer to end users.

New business model

GSMA Intelligence highlights that telecom operators must adopt a new approach to capture the growing B2B digital transformation opportunity. Traditional product-centric models — where standardized services are pushed to broad customer bases — will not deliver the step change needed in enterprise sales.

Operators must transition from sellers to strategic partners, offering customized, solution-oriented services that involve consulting, customer engagement, and flexible commercial models.

Many leading operators are evolving into “tech-co” models, creating specialized B2B units with greater autonomy, dedicated R&D, and the ability to tailor solutions for enterprise clients.

Artificial intelligence (AI) is becoming central to both internal transformation and customer offerings, yet fewer than 30 percent of operator employees have advanced AI training.

To compete effectively, operators need to build a solutions mindset by developing talent beyond traditional network deployment roles — focusing instead on IT consulting, long-term transformation projects, and close enterprise collaboration to strengthen their role as digital transformation partners.

Orange

Orange and Capgemini have launched Bleu, a sovereign cloud services joint venture established in January 2024, built on Microsoft technology and operated through data centres located in France. These facilities are independent of Microsoft’s global Azure infrastructure and fully managed by Orange and Capgemini.

Bleu’s mission is to support Europe’s data sovereignty and localisation goals, ensuring compliance with GDPR and France’s Cloud de Confiance (trusted cloud) standards. It targets sectors with high data sensitivity, including defence, healthcare, public administration, and critical infrastructure, offering security, privacy, and sovereignty combined with the flexibility and scalability of Microsoft’s technology — all under French control.

The initiative reflects a broader European trend of telecom operators partnering with IT firms to deliver localised, compliant cloud solutions. However, Bleu’s long-term success will depend on its ability to match the performance, scalability, and innovation of global cloud providers such as AWS, Google, and Microsoft, while maintaining its strong focus on trust and data sovereignty.

SK Telecom

SK Telecom has launched GPU-as-a-Service (GPUaaS) as part of its expanding AI data centre business, offering enterprises on-demand access to AI infrastructure for faster development and deployment of AI applications. The service currently uses Nvidia H100 Tensor Core GPUs and will integrate the latest H200 GPUs in early 2025. The launch aligns with SK Telecom’s AI Pyramid Strategy, announced in September 2023, which focuses on three pillars. As part of this strategy, SK Telecom has partnered with Lambda, a GPU cloud company, to enhance its AI infrastructure capabilities.

The move reflects rising global demand for generative AI, machine learning, and high-performance computing, with several operators — such as Telekom Malaysia, Indosat Ooredoo Hutchison, Singtel, Maxis, Ooredoo, Swisscom, and Orange Business — also entering the GPUaaS market. However, SK Telecom and its peers face strong competition from AI compute startups, hyperscalers, and data centre providers as the market continues to expand.

Telstra

Telstra Purple and Cisco have partnered to transform Victoria University into a connected campus by deploying a software-defined access network (SDAN) that integrates Telstra Purple’s enablement and installation expertise with Cisco’s advanced networking technology.

The project supports Victoria University’s goals of delivering next-generation digital services, enhancing student engagement and retention, and enabling seamless digital experiences for students, staff, and industry partners.

To succeed, operators must evolve beyond connectivity, leveraging their strengths in ICT infrastructure, enterprise data management, security, and partnerships while investing in new capabilities. The report emphasizes that the $500 billion represents an addressable market, not guaranteed revenue, and that competition from hyperscalers, IT service firms, and software startups will require operators to adopt new business models and organizational cultures, Tim Hatt, Head of Research and Consulting at GSMA Intelligence, said.

Baburajan Kizhakedath