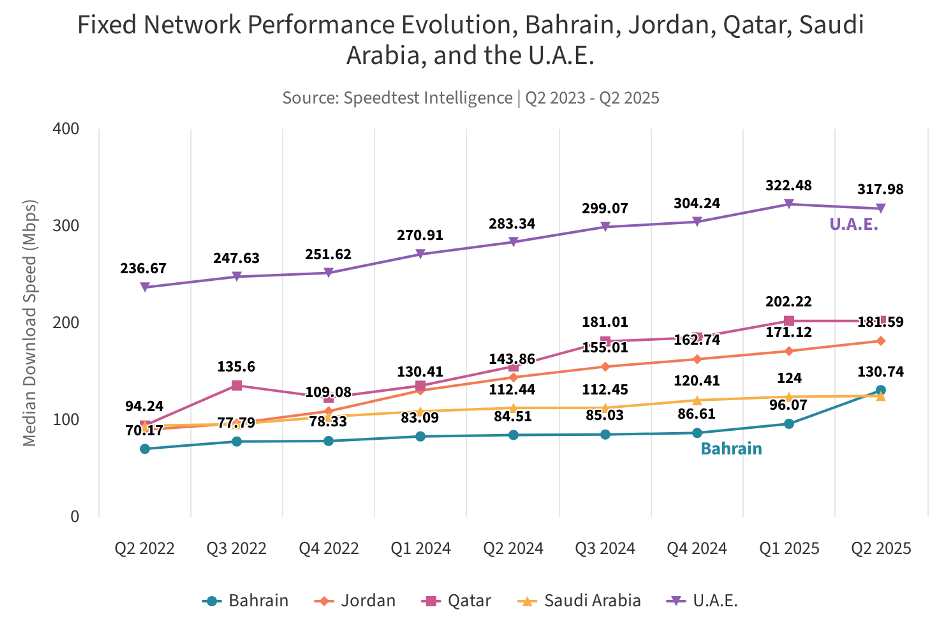

The Middle East is setting benchmarks in fixed broadband speed performance, with Bahrain, Jordan, Qatar, Saudi Arabia and the UAE emerging as regional leaders in fiber deployment and gigabit adoption, Ookla said in its report.

According to the latest Speedtest Global Index, these countries have achieved record-breaking speeds thanks to aggressive fiber expansion, regulatory mandates and widespread gigabit packages.

Record-Breaking Broadband Speeds

UAE: Download speed of broadband surged to 317.98 Mbps in Q2 2025 after ISPs increased minimum package speeds from 250 Mbps to 500 Mbps. Upload speeds of broadband reached 147.28 Mbps, with e& UAE and du offering 5 Gbps and 10 Gbps plans.

Jordan: Fiber covers 1.65 million premises, boosting download speeds of broadband to 181.59 Mbps and upload to 143.47 Mbps. Orange Jordan now offers 2 Gbps and 10 Gbps packages.

Bahrain: Regulatory mandates doubled minimum fiber broadband speeds to 300 Mbps, pushing downloads to 130.74 Mbps and uploads to 58.9 Mbps.

Saudi Arabia: stc and Mobily led upgrades to 300 Mbps entry-level plans, lifting downloads to 124.89 Mbps and uploads to 56.96 Mbps.

Qatar: The first Gulf country with 10 Gbps packages, Qatar now treats 1 Gbps as the entry level, more than doubling national broadband download speeds in two years.

Drivers of Growth

Regulators and ISPs have accelerated fiber-to-the-home (FTTH) deployment, doubled or tripled minimum package speeds and slashed gigabit pricing. Broadband operators are bundling Wi-Fi 6/7 routers, mesh systems and fiber-to-the-room (FTTR) to ensure whole-home gigabit coverage.

In-Home Wi-Fi: The Next Challenge

Despite lightning-fast fiber, legacy Wi-Fi 4/5 routers remain a bottleneck. Speedtest data shows Wi-Fi 6 can deliver 10x the speed of Wi-Fi 4, highlighting the need for customer-premises equipment (CPE) upgrades to fully realize multi-gigabit potential.

The Middle East’s rapid fiber rollout is driving record-breaking fixed broadband speeds — but many households are missing out. While gigabit fiber packages promise lightning-fast internet, indoor Wi-Fi networks often bottleneck performance, especially in large homes and apartments.

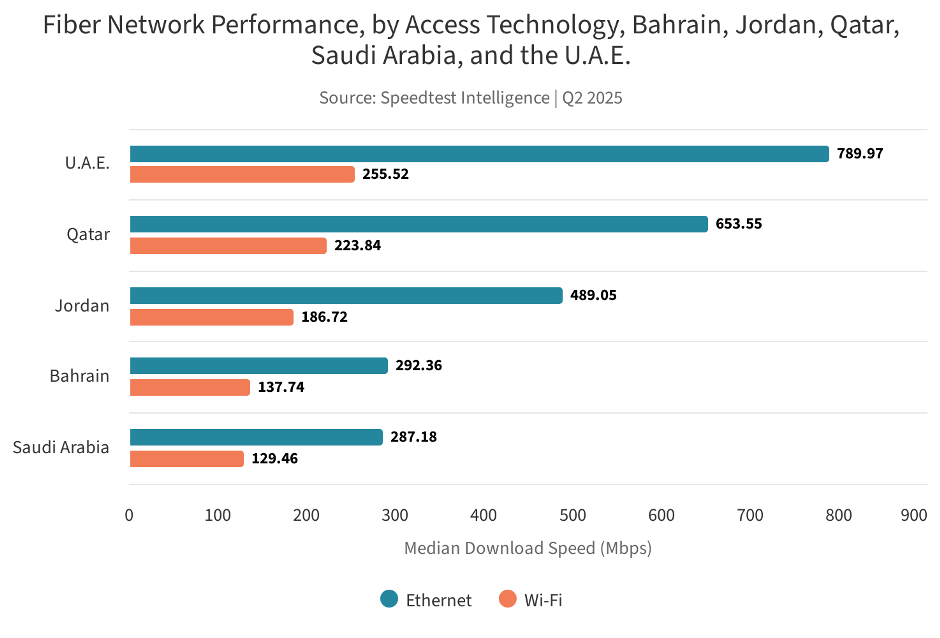

Ethernet Delivers 2–3x Faster Speeds Than Wi-Fi

Speedtest Intelligence data for Q2 2025 reveals that users connecting via Ethernet to the optical network terminal (ONT) enjoy:

2–3x higher download speeds

1.6–2.1x faster upload speeds

For example, median Ethernet downloads reached 790 Mbps in the UAE, 653.6 Mbps in Qatar, and 489.1 Mbps in Jordan—far exceeding Wi-Fi results. Uploads more than doubled to 348.6 Mbps in top markets.

Legacy Wi-Fi Standards Hold Back Gigabit Fiber

Despite most ISPs offering Wi-Fi 6 routers, over 75 percent of Middle Eastern speed tests still rely on Wi-Fi 4 or Wi-Fi 5 as of H1 2025. Country breakdown:

Jordan: 89 percent on Wi-Fi 4/5

Bahrain: 70 percent

Qatar: 60.7 percent (lowest)

Adoption of Wi-Fi 6 climbed from 18.6 percent to 24.2 percent between H2 2023 and H1 2025, while Wi-Fi 7 remains nascent at just 0.19 percent—led by the UAE (0.41 percent) and Qatar (0.25 percent).

Speed Gains by Wi-Fi Generation

Consumer tests confirm the impact:

Wi-Fi 4: Median download speeds around 35–45 Mbps

Wi-Fi 5: 5–6x faster (up to 226–209 Mbps)

Wi-Fi 6: 10–12x faster, hitting 448 Mbps in Qatar and 400+ Mbps in the UAE

Top 10 percent Wi-Fi 6 samples in Qatar and UAE exceeded 800 Mbps, rivaling wired Ethernet.

Upgrade Path for ISPs and Consumers

ISPs are bundling Wi-Fi 6/6E and Wi-Fi 7 routers, mesh systems, and fiber-to-the-room (FTTR) to unlock full gigabit performance. Consumers upgrading their customer premises equipment (CPE) will experience lower latency, wider channels, and multi-band aggregation—key benefits of Wi-Fi 7.

Despite fiber rollouts and gigabit broadband plans, many Middle East households remain stuck on legacy Wi-Fi 4 routers, limiting their true internet potential. Speedtest Intelligence Q2 2025 data reveals that Huawei and TP-Link are the top CPE (customer premises equipment) brands behind these outdated connections, highlighting the need for targeted upgrades to Wi-Fi 5 and Wi-Fi 6.

Huawei and TP-Link Lead Wi-Fi 4 Router Share

Bahrain: Highest Huawei presence, with 58.5 percent of Wi-Fi 4 samples.

Jordan & Saudi Arabia: Around 33 percent Huawei usage.

Qatar & UAE: TP-Link dominates with 39.28 percent and 33.23 percent, respectively; Saudi Arabia follows closely at 33.22 percent.

Saudi Arabia and the UAE show the greatest CPE diversity, with 66 additional router/mesh brands detected, making it harder for ISPs to address performance issues or convince users to upgrade.

Why Users Remain on Wi-Fi 4

Most routers sold since 2020 can support Wi-Fi 5 or Wi-Fi 6, yet many subscribers still operate on Wi-Fi 4 due to:

Misconfigured routers that default to older standards

Legacy devices incapable of modern Wi-Fi

ISP restrictions preventing third-party router use

ISPs can help by pushing firmware updates, ensuring automatic band steering, and offering incentives to replace aging routers.

2.4 GHz vs 5 GHz: The Band Bottleneck

Speedtest results show that 5 GHz delivers far higher speeds thanks to wider channels and less congestion. However, users moving around their home often drop back to 2.4 GHz, which offers better range but slower performance. Some routers fail to automatically reconnect to the faster 5 GHz band even when users return to range—another fixable issue via firmware.

Path to Better Broadband

Upgrade Campaigns: Focus on Huawei and TP-Link routers for Wi-Fi 5/6 migration.

Automatic Band Steering: Ensure devices switch to 5 GHz when possible.

Customer Education: Encourage use of dual-band or tri-band routers for improved throughput.

Gulf nations and Jordan are rapidly transforming the home internet landscape, pairing gigabit fiber broadband with cutting-edge Wi-Fi technologies to deliver seamless, whole-home connectivity. Internet service providers (ISPs) across the region are leveraging Wi-Fi 6, Wi-Fi 7, mesh systems, and fiber-to-the-room (FTTR) to ensure customers experience the full potential of gigabit speeds.

Wi-Fi 6 and Wi-Fi 7 CPE Upgrades

Most ISPs now ship Wi-Fi 6-compatible routers (customer premises equipment or CPE) with new broadband connections and offer free upgrades to renewing customers. Leading the pack, Ooredoo Qatar bundles Wi-Fi 7 routers with its premium gigabit packages, providing faster data rates and lower latency for smart homes and high-bandwidth applications.

Mesh Wi-Fi for Whole-Home Coverage

To eliminate dead zones and improve indoor speed, ISPs frequently bundle mesh Wi-Fi nodes supporting Wi-Fi 6—often at discounted rates or free of charge. These mesh solutions enhance multi-room coverage, enabling smooth streaming, gaming, and video conferencing across larger properties.

FTTR: Fiber to Every Room

A new trend is fiber-to-the-room (FTTR), which extends fiber-optic connectivity to each room via discreet cables for consistent gigabit performance:

Jordan: Umniah and Zain now include or offer FTTR packages.

Qatar: Ooredoo provides FTTR free with its top two plans, connecting up to five rooms.

Saudi Arabia & UAE: Salam, stc, and e& UAE offer FTTR add-ons or dedicated packages.

Competitive Pricing Drives Adoption

Affordable pricing is fueling gigabit adoption across the Middle East:

Jordan: 1 Gbps plans start at $38/month.

UAE: Gigabit packages now begin at $100/month, a 33 percent price cut from 2023.

Bahrain: Entry price dropped from $345 to $117.

Saudi Arabia: Mobily offers 1 Gbps for about $196/month.

These reductions mirror global leaders like Hong Kong and Singapore, where gigabit fiber costs around $30/month, making gigabit internet more accessible to a wider audience.

Meeting the Gigabit Challenge

With fiber deployment accelerating, high-speed Wi-Fi is essential to unlock full broadband potential. By upgrading to Wi-Fi 6/7 routers, integrating mesh networks, and deploying FTTR, ISPs in the Gulf and Jordan are ensuring consistent gigabit performance, reducing latency, and supporting next-generation smart homes.

Baburajan Kizhakedath