The penetration of Micro LED technology in consumer electronics is gaining momentum, driven by launches across multiple industries. Following Samsung’s debut of its 140-inch Micro LED TV in 2023, the next wave of innovation is set to expand adoption into wearable and automotive applications.

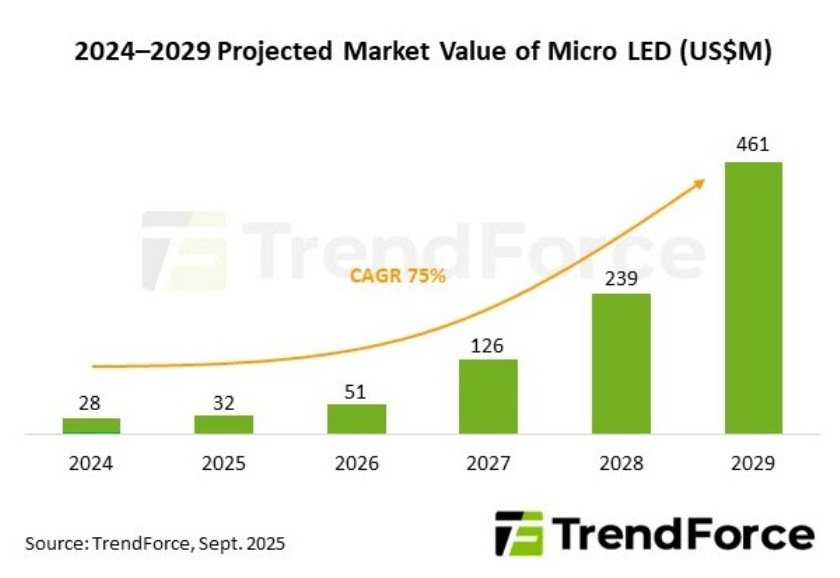

In 2025, Garmin will launch the Fenix 8 Pro smartwatch featuring a Micro LED display, while Sony Honda plans to integrate a 30-inch Micro LED automotive display into its Afeela model by the end of the year. According to TrendForce, these milestone rollouts will stimulate market demand, pushing Micro LED chip revenue to an estimated US$461 million by 2029.

Advantages and Challenges of Micro LED Technology

Despite its presence, Micro LED technology faces significant hurdles, particularly high manufacturing costs and elevated power consumption. These barriers limit its short-term competitiveness against OLED, which remains a more mature and cost-effective display solution.

However, Micro LED offers distinct advantages:

Ultra-high brightness and durability – especially beneficial for outdoor devices such as sports watches.

Superior contrast and energy efficiency at scale – positioning it for premium applications.

Potential integration of advanced sensors – paving the way for innovation in next-generation wearables and automotive electronics.

These features make Micro LED a strong candidate for markets where performance and reliability outweigh cost considerations.

Garmin Fenix 8 Pro: A Key Step for Micro LED in Wearables

The Garmin Fenix 8 Pro smartwatch will be one of the first mainstream wearables to incorporate a Micro LED display. Its 1.39-inch screen is powered by AUO’s display technology, enhanced through proprietary image calibration.

Key players in the supply chain include:

AUO – responsible for core display design and integration.

PlayNitride – providing Micro LED chips (~15 x 30 μm).

Raydium – supplying driver ICs for display performance.

This collaboration reflects how ecosystem investments are aligning to accelerate Micro LED commercialization.

Expanding Applications: From TVs to Automotive and Smart Glasses

Micro LED commercialization is progressing steadily across large-format TVs, premium smartwatches, and in-car displays. Each flagship launch represents a technological milestone that strengthens industry confidence.

Notably, next-generation smart glasses startups have already adopted Micro LED, leveraging its brightness and compact form factor for near-eye display applications. As global technology companies invest further, Micro LED is poised to become a game-changer in AR/VR and head-up displays (HUDs).

Market Outlook: Micro LED Poised for Growth

While mass adoption may still take several years, the steady rollout of consumer and automotive products signals Micro LED’s path to maturity. With major display manufacturers, semiconductor players, and consumer electronics giants investing heavily, the technology is expected to achieve greater scalability, cost reduction, and supply chain stability.

By 2029, the Micro LED market revenue is projected to reach US$461 million, underscoring its transition from niche applications to broader commercialization.

Baburajan Kizhakedath