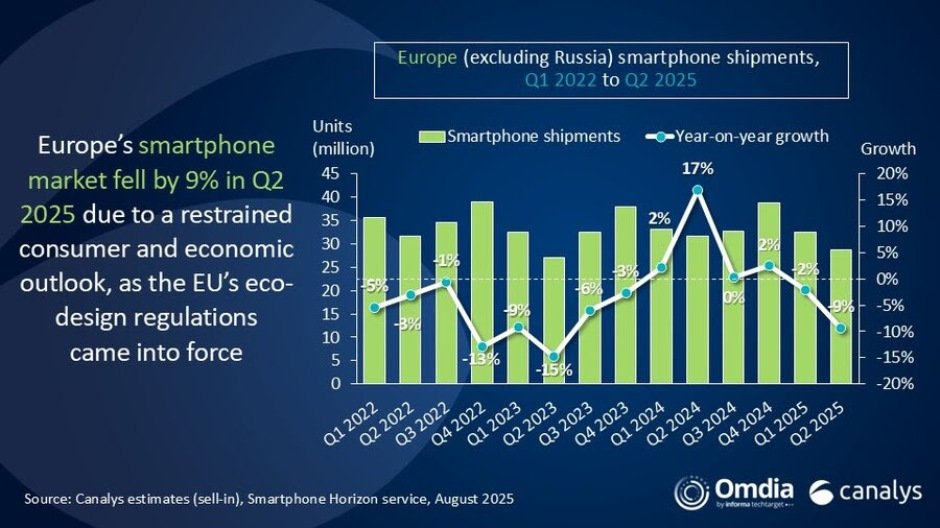

Smartphone shipments across Europe (excluding Russia) declined 9 percent year-on-year to 28.7 million units in the second quarter of 2025, according to new data from Canalys, now part of Omdia. The region remains the weakest-performing smartphone market worldwide, as consumer demand continues to be constrained by economic uncertainty.

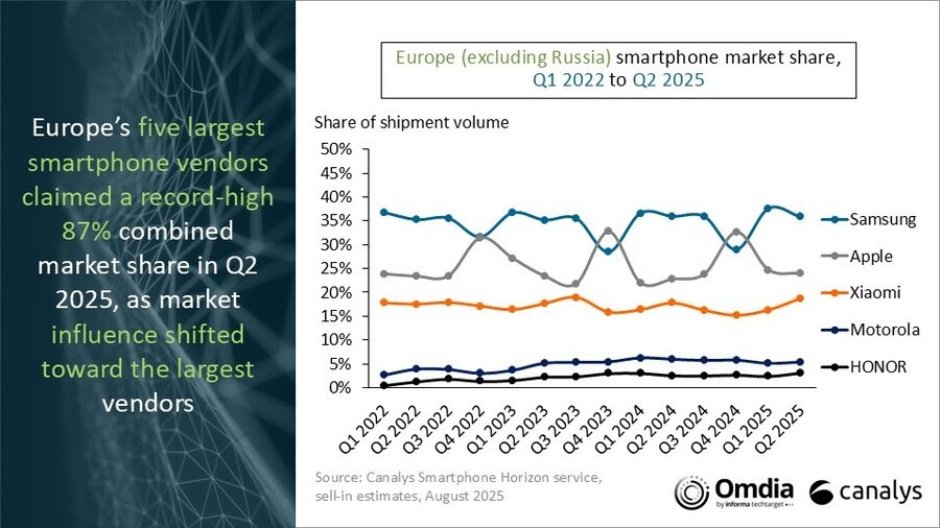

Samsung retained its leading position with 10.3 million shipments and a 36 percent market share, slightly down from 11.3 million units but maintaining the same share as Q2 2024. Samsung’s performance was partly impacted by EU eco-design regulations, which restricted the Galaxy A06 from entering EU-regulated markets.

Apple followed with 6.9 million shipments and 24 percent share, a marginal decline from 7.2 million units and 23 percent share last year. Apple’s shipment of iPhones was supported by steady iPhone 16 series sales despite its narrower product portfolio compared with 2024.

Xiaomi shipped 5.4 million units, capturing 19 percent share, compared to 5.6 million and 18 percent share in Q2 2024. Xiaomi posted strong growth in Italy, where shipments rose more than 50 percent year-on-year.

Motorola’s shipment dropped to 1.5 million with 5 percent share from 1.9 million units for 6 percent share.

HONOR increased slightly to 0.9 million units, holding steady at 3 percent. HONOR was the only brand in the top five to grow.

Other brands fell to 3.7 million shipments, down from 4.8 million, with market share slipping from 15 percent to 13 percent.

Runar Bjorhovde, Senior Analyst at Canalys (now part of Omdia), noted that Europe’s smartphone sector faced a challenging first half of 2025, shaped by weak consumer demand, cautious inventory management, and the enforcement of EU eco-design and energy efficiency rules in June.

Despite vendors’ efforts, mobile operators and retailers resisted stockpiling ahead of the new regulations, while some network operators required early compliance. Runar Bjorhovde believes the market is positioned for a healthier second half as vendors look to capitalize on major product launches.

The top five vendors held a record 87 percent share of the European smartphone market in Q2 2025, underscoring the dominance of large-scale brands. While this scale is key for profitability, competition remains intense across channels, with telcos, retailers, e-commerce platforms, and direct-to-consumer (D2C) models vying for customers.

Consumer research highlights that direct purchases are often motivated by brand engagement and customer service, while open-market sales are driven largely by price. Operators, however, remain a crucial channel, playing a central role in driving the adoption of 5G and eSIM-capable devices.

Looking ahead, Omdia analysts expect the European smartphone market to recover modestly, with growth returning by 2026. Replacement demand for low-end devices and the rise of AI-enabled smartphones are expected to drive momentum, though long-term growth will be limited.

The market is forecast to expand at a compound annual growth rate (CAGR) of just 1.7 percent through 2029. Runar Bjorhovde stresses that smartphone vendors must better understand shifting consumer purchase motivations and buying journeys to secure resilience in an increasingly competitive and saturated market.

Baburajan Kizhakedath