The latest Ookla report has revealed that the UK is behind in 5G deployment as compared with several countries in the Nordic region.

The UK’s lag in 5G deployment can be attributed to structural and policy shortcomings, despite having favourable geographical and urbanisation conditions comparable to high-performing Nordic countries. Leading telecom operators in UK are BT/EE, Virgin Media, Vodafone, Three UK, and SKY.

With a 5G Availability of 42.2 percent in Q4 2024, the UK falls behind peers like Ireland (61.9 percent), France (65.7 percent), and Germany (63.4 percent), as well as Nordic nations, where availability exceeds 65 percent.

The Nordics’ success stems from mid-band spectrum releases, strong government policies incentivising widespread rollouts, and innovative network-sharing practices.

Denmark, for example, tied spectrum license fee reductions to coverage commitments in underserved areas, accelerating deployment of the critical 700 MHz band.

In contrast, the UK lacks similar initiatives to drive rural and indoor 5G coverage. This disparity is further emphasized by the Nordics’ high operator profitability, flat topography, and high ARPU, which support efficient and rapid rollout, placing them alongside global leaders like the US and South Korea.

Nordic is a European leader in 5G

The Nordic region has emerged as a European leader in 5G, leveraging unique advantages and strategic initiatives. Home to Ericsson and Nokia, two of the world’s leading radio vendors, the region enjoys higher operator profitability than much of Europe.

This success stems from the timely release of mid-band spectrum, innovative government policies that promote both urban and rural rollouts, and a strong culture of network sharing. Favourable geographic and economic factors, such as high urbanisation rates, flat terrain, and high ARPU, have further propelled the Nordics to the forefront of 5G development, rivaling global leaders like the US and South Korea.

Nordic operators have achieved milestones in both rural and urban 5G coverage. For example, Telia in Norway reached nearly 99 percent of the population, DNA in Finland achieved close to 100 percent population coverage, and Tele2 and Telenor in Sweden reported 90 percent coverage through their joint venture, Net4Mobility.

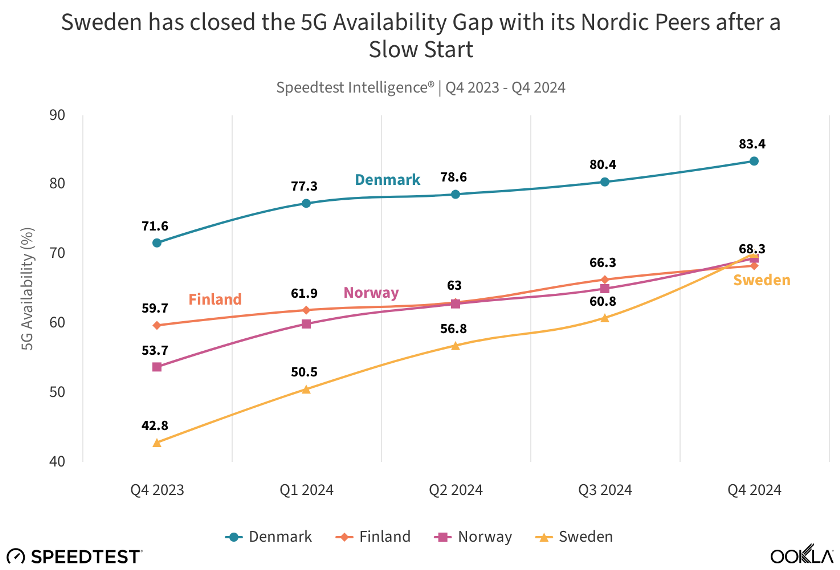

Nordic countries have consistently ranked among the top in Europe for 5G Availability, with Denmark leading at 83.4 percent in Q4 2024. Unlike other European nations relying heavily on Dynamic Spectrum Sharing (DSS), which compromises performance, the Nordics benefited from early access to dedicated low-band spectrum in the 700 MHz band at competitive prices. This has enabled extensive deployments that ensure deeper indoor and rural coverage.

National policies have played a transformative role, with governments adopting a carrot-and-stick approach to incentivise 5G rollouts. Norway, for instance, integrated 5G access into its broader digitalisation strategy, aiming to be the most digitalised country by 2030.

A Letter of Intent signed by Nordic prime ministers in 2018 further underscored a commitment to creating a unified Nordic 5G region, prioritising digital transformation and economic competitiveness. These coordinated efforts have ensured a greater shift of traffic to 5G networks.

Finland reported nearly a quarter of smartphone traffic on 5G in early 2024, a metric significantly higher than in other parts of Europe. This combination of technological, policy-driven, and economic strategies makes the Nordic model an enviable benchmark for 5G deployment worldwide.

The Nordic Governments have implemented innovative policy frameworks, using financial incentives and coverage obligations tied to spectrum auctions to ensure operators prioritize underserved areas. Denmark’s multi-band auctions in 2019 included obligations for operators to deliver specific download and upload speeds to underserved addresses. Finland and Sweden attached similar coverage commitments to their 700 MHz spectrum auctions.

Sweden’s rural 5G expansion, supported by €140 million from the European Investment Bank, and Norway’s extensive upgrades funded by €85 million from the Nordic Investment Bank, underscore the importance of targeted financing in bridging the rural-urban divide.

Network sharing has been a cornerstone of the Nordic 5G strategy, significantly reducing deployment costs and ensuring balanced coverage across operators. Joint ventures like TT Network in Denmark, the Finnish Shared Network, and Sweden’s Net4Mobility have fostered greater symmetry in 5G availability, reducing disparities between operators. Sweden exemplifies this with nearly identical 5G availability levels among major providers, whereas smaller operators outside these collaborations face lower coverage levels.

Finland and Norway have already sunset 3G networks, allowing operators to focus resources on 5G expansion. The careful management of 2G network phaseouts, such as Sweden’s delayed shutdown to support essential industries, highlights the region’s strategic approach to minimizing disruptions.

These factors — policy innovation, favorable conditions, financial support, network sharing, and efficient spectrum use — have positioned the Nordics as leaders in 5G deployment, achieving better coverage and performance in both urban and rural areas.

Baburajan Kizhakedath