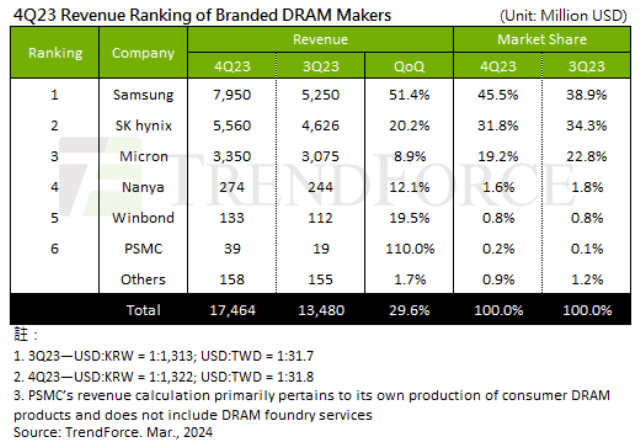

The DRAM industry witnessed a significant surge in revenue, marking a 29.6 percent quarter-on-quarter (QoQ) increase in 4Q23, reaching US$17.46 billion.

This surge was attributed to rejuvenated stockpiling and strategic production management by major DRAM manufacturers. Looking forward to 1Q24, the DRAM industry industry aims to bolster profitability further, with an anticipated nearly 20 percent surge in DRAM contract prices, albeit accompanied by a slight dip in shipment volumes, TrendForce said.

This surge was attributed to rejuvenated stockpiling and strategic production management by major DRAM manufacturers. Looking forward to 1Q24, the DRAM industry industry aims to bolster profitability further, with an anticipated nearly 20 percent surge in DRAM contract prices, albeit accompanied by a slight dip in shipment volumes, TrendForce said.

Samsung reported the most substantial increase among top manufacturers, soaring by 50 percent QoQ to reach $7.95 billion. This spike was largely fueled by heightened shipments of 1alpha nm DDR5, propelling server DRAM shipments by over 60 percent.

SK Hynix observed a modest 1–3 percent uptick in shipment volumes but benefited from the pricing advantage of HBM and DDR5, particularly in high-density server DRAM modules, resulting in a 17–19 percent increase in ASP and a 20.2 percent revenue rise to $5.56 billion.

Micron experienced growth in both volume and price, with a 4–6 percent increase in each, translating to a more moderate revenue growth of 8.9 percent, totaling $3.35 billion for the quarter, owing to its relatively lower share of DDR5 and HBM.

Samsung’s production rebounded in the first quarter of the year, achieving an 80 percent utilization rate after significant production cuts in 4Q23. Anticipated demand surges in 2H24 are expected to lead to a continuous uptick in production capacity through 4Q24.

SK Hynix is expanding its HBM capacity and incrementally increasing wafer starts, especially with the commencement of mass production for HBM3e.

Micron is ramping up its wafer starts, aiming to boost its advanced 1beta nm process share for HBM, DDR5, and LPDDR5(X) products, foreseeing a convergence in capacity due to increased deployment of advanced process equipment.

In Taiwan, Nanya observed growth in both volume and price, with a slower recovery in consumer DRAM sales dynamics driving a 12.1 percent increase in Q4 revenue to $274 million.

Winbond, leveraging new capacity from its KH fab to reduce inventory and expand its customer base without raising contract prices, witnessed proactive shipment performance, leading to a 19.5 percent revenue increase to around $133 million in the fourth quarter.

PSMC capitalized on the gradual uptick in spot and contract prices, bolstering client stocking efforts, and, with a low base shipment, witnessed DRAM revenue skyrocketing by 110 percent to $39 million for the quarter. Including foundry services, PSMC experienced an 11.6 percent increase in total revenue.