The number of 5G smartphones shipped to Thailand in 2022 has reached 5.7 million, increasing by 14 percent compared to 2021, according to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

The share of 5G smartphones increased to 35 percent in 2022 vs 24 percent in 2021. The volume for 4G to 5G conversion was not comparable to 3G to 4G conversion due to a lack of compelling use cases for consumers and affordability concerns.

The share of 5G smartphones increased to 35 percent in 2022 vs 24 percent in 2021. The volume for 4G to 5G conversion was not comparable to 3G to 4G conversion due to a lack of compelling use cases for consumers and affordability concerns.

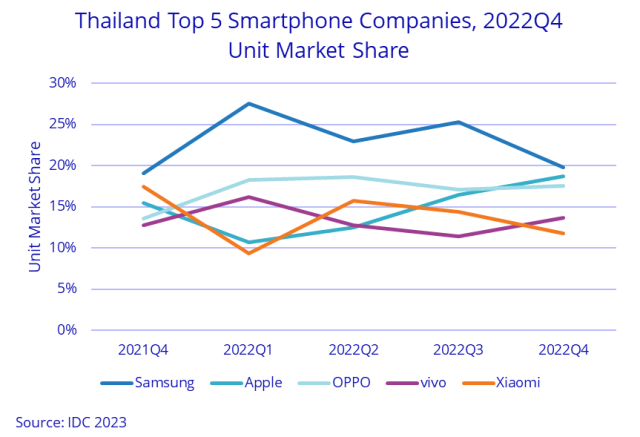

Samsung (4 million units), Oppo (3 million), Apple (2.4 million), Vivo (2.3 million) and Xiaomi (2.1 million) are the top smartphone suppliers in Thailand in 2022.

The smartphone market in Thailand in 2022 declined by 21 percent to 16.6 million shipments marking the lowest number of units sold in a year since 2014. Shipments fell 23 percent year over year (YoY) or to 4.2 million units in 4Q22.

The lack of government stimulus campaigns in 2022 which increased smartphone adoption in the previous year, coupled with the economic and inflationary pressures contributed to the decline in smartphone shipments.

The average selling price (ASP) of smartphones in Thailand increased to US$329, rising 15 percent in 2022.

Growth of smartphone market in Thailand in 2023 will be flat due to inflationary concerns, rising interest rates and a lackluster growth forecast for the economy, said Apirat Ratanavichit, Market Analyst at IDC Thailand.

Apple was the dominant player in the premium segment (>US$800) with 79 percent share, slightly down from 82 percent in 2021 as Samsung increased its share in the segment with the Galaxy S and Galaxy Fold series.

In Q4, 2022, Samsung (19.8 percent share), Apple (18.7 percent), Oppo (17.6 percent), Vivo (13.7 percent) and Xiaomi (11.8 percent) are the top smartphone suppliers in the Thailand telecom market.