India’s 5G market is expanding rapidly, driven by soaring data consumption and a steady rise in wireless subscribers, according to the Telecom Regulatory Authority of India (TRAI) Quarterly Performance Indicator Report for June 2025.

Strong Growth in 5G Data Usage

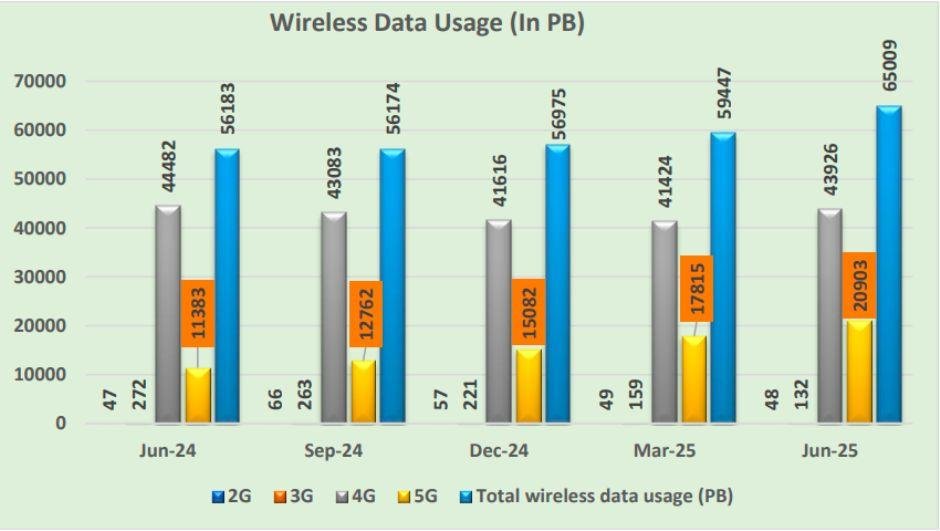

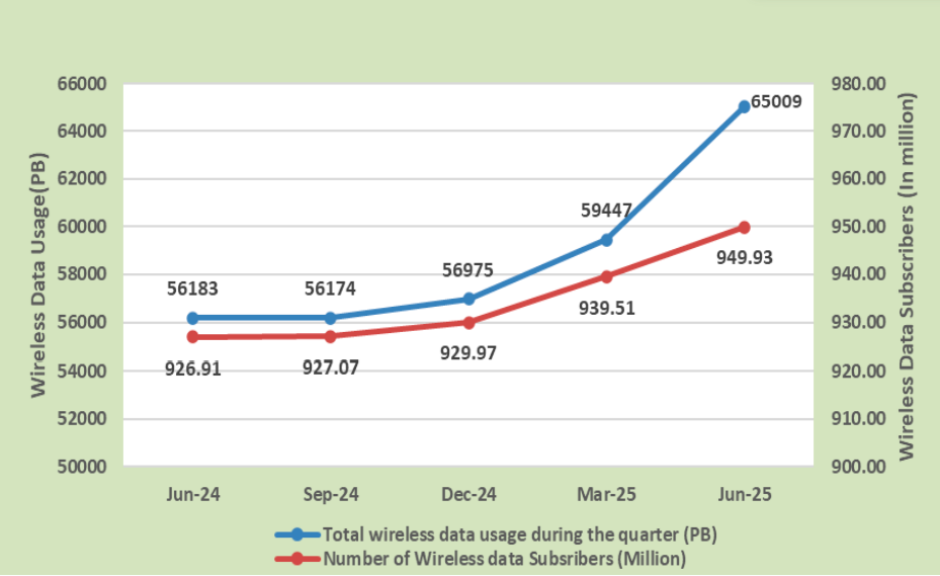

Total wireless data usage in India climbed to 65,009 petabytes (PB) in Q2 2025, up 9.36 percent from 59,447 PB in Q1. Notably, 5G data accounted for 20,903 PB, representing 32.15 percent of total wireless data traffic, while 4G led with 43,926 PB (67.57 percent). Legacy networks contributed marginally, with 2G at 48 PB (0.07 percent) and 3G at 132 PB (0.20 percent). This underscores the rapid consumer shift to high-speed 5G services.

Expanding Wireless Subscriber Base

The total wireless (mobile + 5G Fixed Wireless Access) subscriber base grew from 1,163.76 million in March 2025 to 1,170.88 million in June 2025, adding 7.12 million subscribers for a quarterly growth of 0.61 percent. Mobile-only subscribers reached 1,163.03 million, reflecting a 0.52 percent quarterly increase despite a slight year-on-year decline of 0.64 percent. Wireless teledensity improved to 82.74 percent, up from 82.42 percent in the previous quarter.

Revenue and ARPU Trends

India’s telecom revenue indicators also show resilience. The blended average revenue per user (ARPU) rose 2 percent to ₹186.62 in Q2 2025. Private operators outperformed, with ARPU increasing 2.40 percent to ₹196.21, while PSU operators saw a decline to ₹73.57. Pre-paid users remain dominant at 91.11 percent, though slightly lower than the previous quarter’s 91.32 percent.

For the quarter ending June 2025, Reliance Jio Infocomm posted an adjusted gross revenue (AGR) of ₹30,291.36 crore, up 2.81 percent sequentially and 16.99 percent year-on-year. Bharti Airtel reported AGR of ₹27,047.61 crore, marking a 2.75 percent quarterly and 21.79 percent annual increase. Vodafone Idea recorded AGR of ₹30,291.36 crore, reflecting 1.95 percent growth quarter-on-quarter and 7.32 percent year-on-year. State-run BSNL reported AGR of ₹2,059.70 crore, a decline of 8.03 percent from the previous quarter but an 8.07 percent rise compared to last year.

5G Market Outlook

The data highlights India’s strong 5G adoption curve, with nearly one-third of total wireless data now carried on 5G networks less than two years after launch. Rising ARPU and expanding subscriber numbers point to a healthy monetization path for telecom providers. As operators continue to invest in 5G infrastructure and innovative services, India’s 5G market is set for sustained growth through 2026 and beyond, reinforcing the nation’s position as one of the world’s fastest-growing digital economies.

Baburajan Kizhakedath