Charter Communications reported mixed operating performance for the fourth quarter of 2025, as competitive pressure in the U.S. broadband market continued to weigh on Internet subscriber growth, while mobile and video showed improvement. The company is doubling down on network upgrades, rural expansion and bundled offerings under its Spectrum brand to position itself for a longer-term recovery.

Subscriber Performance: Internet Pressure, Mobile and Video Gains

Charter lost 119,000 Internet customers in the fourth quarter of 2025, an improvement compared with the decline of 177,000 Internet customers in the same quarter of 2024. As of December 31, 2025, Charter served 29.7 million Internet customers. Analysts expect broadband subscriber recovery across the U.S. cable industry only from 2027, as operators face aggressive competition from fixed wireless access and mobile broadband offerings.

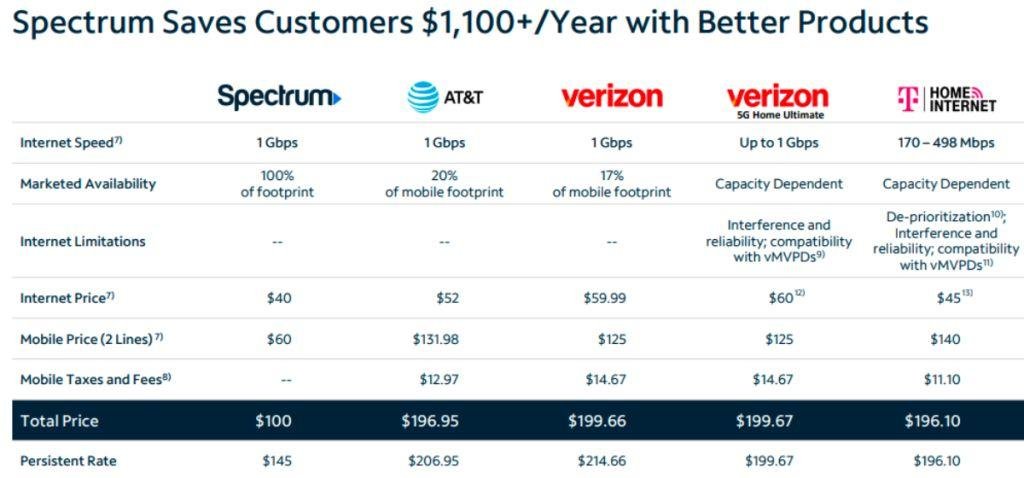

Mobile continued to be a relative bright spot, although growth slowed. Charter added 428,000 mobile lines during the quarter. This compared with growth of 522,000 mobile lines in the fourth quarter of 2024. By the end of 2025, Charter served 11.8 million mobile lines. Spectrum Mobile remains central to Charter’s converged connectivity strategy, offering contract-free plans with taxes and fees included and nationwide 5G access.

Video subscribers returned to growth, with Charter adding 44,000 video customers in Q4-2025, compared with a loss of 123,000 video subscribers a year earlier. The improvement was driven by simpler pricing options, bundled packages and the inclusion of popular streaming services in Spectrum TV plans. As of December 31, 2025, Charter had 12.6 million total video customers.

Total customer relationships stood at 31.8 million, while total connectivity customers reached 30.6 million at the end of the quarter. Wireline voice continued to decline, with a loss of 140,000 customers during the quarter, leaving Charter with 6.0 million wireline voice customers.

Revenue: Modest Decline Amid Competitive Market

Charter’s Q4 revenue fell about two percent to $13.60 billion. The revenue decline reflects broadband subscriber losses and pricing pressure, partially offset by growth in mobile, video stabilization and bundled offerings under the Spectrum brand.

Capital Expenditure: Heavy Investment in Network and Rural Expansion

For the year ended December 31, 2025, Charter reported capital expenditures of $11.7 billion. This included $3.9 billion dedicated to line extensions, highlighting the company’s focus on expanding its network footprint.

Charter Communications reported capital expenditures of $3.3 billion in the fourth quarter of 2025, up by $273 million from the same period a year earlier, driven mainly by higher support capital and increased spending on network upgrades and rebuilds as part of its network evolution initiative.

Charter is actively investing in subsidized rural build-outs in partnership with federal, state and local governments. During the fourth quarter of 2025, the company activated 147,000 subsidized rural passings, bringing total activations for the year to 483,000. Within its subsidized rural footprint, total customer relationships increased by 46,000 during the quarter.

Looking ahead, Charter expects full-year 2026 capital expenditures to be approximately $11.4 billion.

CEO Chris Winfrey said Charter expects to nearly complete its rural build-out in 2026, which will provide more than 1.7 million new subsidized rural passings. This expansion targets communities that previously lacked reliable high-speed Internet access and is expected to support long-term subscriber growth.

Strategy: Network Evolution, Bundles and Converged Connectivity

Charter is evolving its Spectrum connectivity network to deliver symmetrical and multigigabit Internet speeds across its entire footprint. Symmetrical Internet service has already launched in several markets, and the company expects to complete its network evolution initiative in 2027. Unlike some competitors, Spectrum upgrades its network to serve all of its passings, doing so at a lower cost per location.

In early 2026, Charter plans to launch Invincible WiFi, a tri-band WiFi 7 router that integrates 5G cellular and battery backup to maintain connectivity during power outages or service disruptions.

In video, Charter is pursuing a broader video evolution strategy that blends traditional pay TV with streaming. Spectrum TV Select customers receive up to approximately $117 per month, rising to about $129 per month, of included streaming app value at no extra cost. These include ad-supported versions of Disney+, Hulu, ESPN Unlimited, HBO Max, Paramount+, Peacock and others. The launch of the Spectrum App Store in October 2025 further enables customers to manage and purchase streaming apps flexibly, even without a traditional TV package.

BABURAJAN KIZHAKEDATH