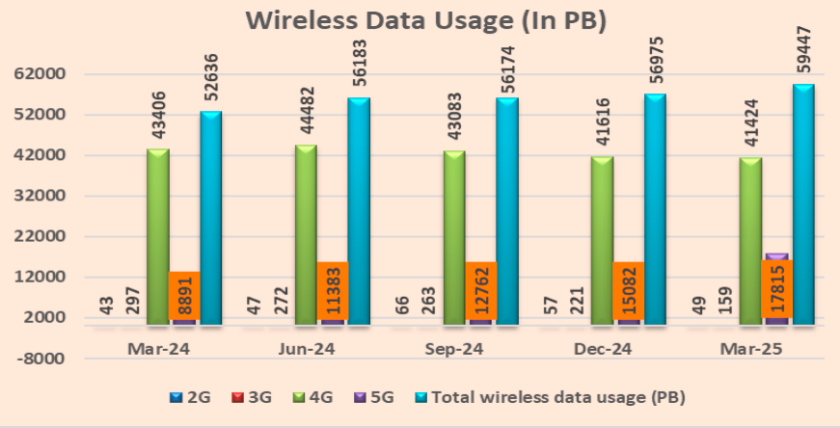

India continues to be largely a 4G-driven telecom market, as shown by the wireless data consumption patterns during the quarter ended March 2025, according to TRAI data.

Out of the total 59,447 petabytes (PB) of wireless data consumed during the January-March quarter, 4G usage accounted for a dominant 41,424 PB — nearly 70 percent (69.68 percent) of total wireless data consumption.

In comparison, 5G data usage contributed 17,815 PB, amounting to 29.97 percent of total data traffic. Meanwhile, legacy networks like 2G and 3G had a negligible share of 0.08 percent and 0.27 percent, respectively.

These figures highlight that while 5G services, including 5G FWA (Fixed Wireless Access), are expanding, the ecosystem and user base are still centered around 4G networks.

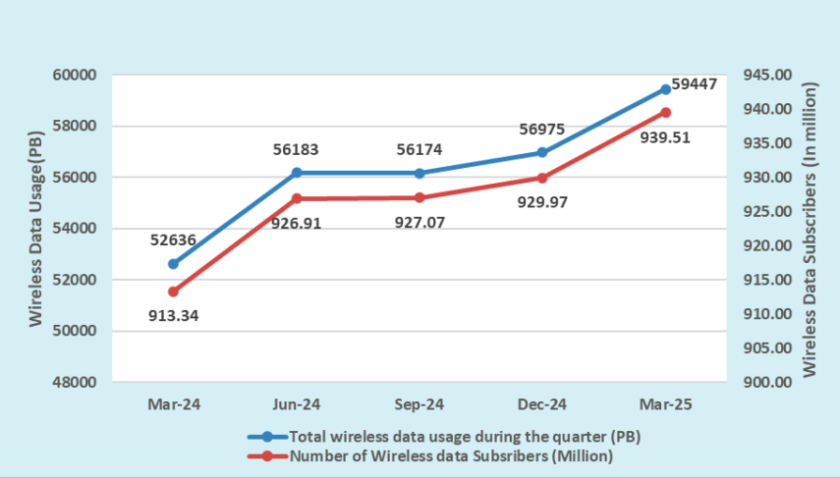

The total number of wireless data users rose from 929.97 million in December 2024 to 939.51 million by March 2025. A broader look at the overall wireless subscriber base, now inclusive of 5G FWA connections, shows a quarterly growth of 1.14 percent, increasing from 1,150.66 million to 1,163.76 million. The inclusion of 5G FWA users, which were earlier reported under wireline, has contributed to this growth. As of March 2025, 5G FWA subscribers stood at 6.77 million, with 63 percent in urban areas and 37 percent in rural India.

Reliance Jio leads with 469.76 million subscribers, followed by Bharti Airtel with 389.80 million, Vodafone Idea with 205.36 million, and BSNL with 91.06 million.

ARPU

The monthly Average Revenue per User (ARPU) for wireless services in India rose slightly by 0.64 percent from Rs. 181.80 in the quarter ending December 2024 to Rs. 182.95 in the quarter ending March 2025. Year-on-year, ARPU increased significantly by 19.16 percent.

In the March 2025 quarter, the ARPU for the prepaid segment stood at Rs. 182.53, while the postpaid segment recorded a higher ARPU of Rs. 187.48. The market share of prepaid users slightly declined from 91.53 percent to 91.32 percent over the same period.

Private telecom service providers – Jio, Airtel, and Vodafone Idea — saw 0.62 percent ARPU increase to Rs. 191.61 during January-March 2025. Public sector units (PSUs) such as BSNL / MTNL experienced a decline of 0.51 percent, with ARPU dropping to Rs. 82.34 during January-March 2025.

Revenue

The Indian telecom sector reported a Gross Revenue (GR) of ₹98,250 crore during January-March, marking a 1.93 percent rise over the previous quarter. Adjusted Gross Revenue (AGR) rose by 1.66 percent quarter-on-quarter and 12.44 percent year-on-year — reflecting steady industry growth amid ongoing investments in 5G infrastructure.

The Adjusted Gross Revenue (AGR) of Indian telecom operators showed mixed trends in the quarter ending March 2025. Reliance Jio maintained its leadership position, reporting an AGR of Rs 29,464.67 crore, up from Rs 28,542.76 crore in the previous quarter.

Bharti Group’s AGR slightly declined to Rs 26,324.20 crore from Rs 26,073.70 crore.

Vodafone Idea reported an AGR of Rs 7,653.53 crore, a drop from Rs 7,958.46 crore in the preceding quarter.

BSNL’s AGR also fell to Rs 2,239.54 crore from Rs 2,292.47 crore. Tata Teleservices & TTML showed marginal improvement, reaching Rs 677.58 crore from Rs 654.47 crore.

MTNL’s AGR continued to decline, falling to Rs 147.15 crore from Rs 150.93 crore, TRAI report indicated.

Baburajan Kizhakedath