62 percent of 455 U.S.-based companies across nine verticals do not plan to deploy 5G technology in the coming years, says ABI Research.

62 percent of 455 U.S.-based companies across nine verticals do not plan to deploy 5G technology in the coming years, says ABI Research.

The B2B technology survey uncovers a severe discord between 5G market hype and the commercial industry’s readiness to deploy the technology.

Nearly all respondents, who plan to one day incorporate 5G technology into their business models, said that they are in the early investigation phase.

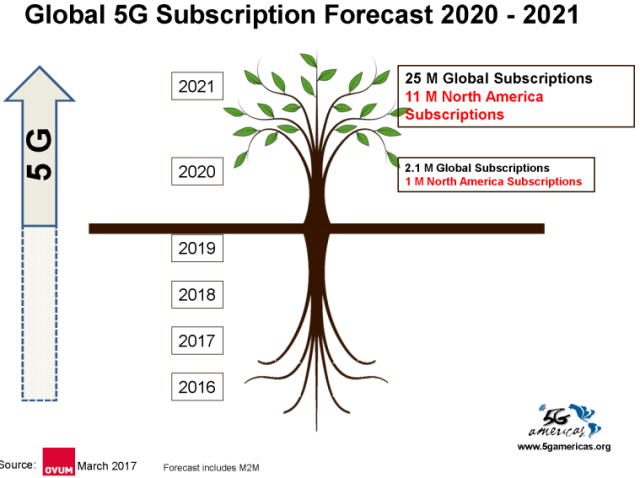

Ovum says there will be 25 million 5G subscriptions globally including 11 million in North America in 2021. Ovum also forecasts that there will be 2.1 million 5G subscribers globally including 1 million in North America.

“The hype of 5G is currently driven by the technology supply chain rather than by demand from the end-markets,” says Malik Saadi, managing director at ABI Research.

“The hype of 5G is currently driven by the technology supply chain rather than by demand from the end-markets,” says Malik Saadi, managing director at ABI Research.

ABI Research says 5G will reach the consumer market before it claims its stake in the enterprise and industrial sectors.

“As the 5G roadmap develops, it is now more imminent than ever for technology suppliers to engage with implementers—understand their requirements, educate them on the value of 5G, and help bring their specific use case needs to life,” Malik Saadi said.

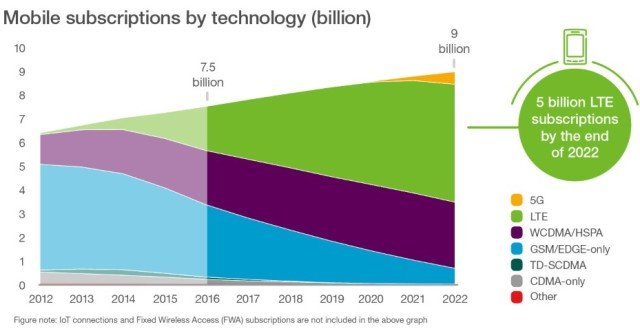

The below chart from Ericsson Mobility Report indicates a marginal increase in 5G user base in 2022 as compared with 5 billion users on LTE network.

ABI Research said retail vertical shows the most aggressive outlook in its willingness to adopt 5G technology. 51 percent of retail respondents are assessing or planning to deploy 5G in the coming years.

ABI Research says retail vertical has a specific need for 5G to support bandwidth-hungry and low latency use cases, including AR, VR, and robotic applications.

Autonomous driving ranks as the least popular 5G use case across all verticals. Autonomous driving is the most hyped use case in the 5G technology supply chain.

89 percent, who plans to deploy 5G in the coming years, is also planning to deploy VR. Robotics ranks high in use case popularity but remains largely ignored by 5G vendors due to technology complexities and several regulatory and socioeconomic challenges facing this industry.

ABI Research said 5G technology suppliers are working in a vacuum, often denigrating the rights of technology implementers to influence the 5G development roadmap. 5G technology majors are Intel, Qualcomm, Ericsson, Nokia, Huawei, among others.

The retail, healthcare, and federal government verticals show the highest willingness to deploy 5G technology in the coming years.