5G subscribers in China are forecast to reach over 120 million in 2022 and 1.5 billion by 2029, according to the new IDTechEx Research report.

The report on 5G industry also said 5G investment is slowing down in China due to mobile operators’ lack of interest in making investment in 5G infrastructure. This will be a big blow on telecom network makers such as Huawei, Nokia, Ericsson, ZTE, Cisco, Samsung, NEC, CommScope, among others.

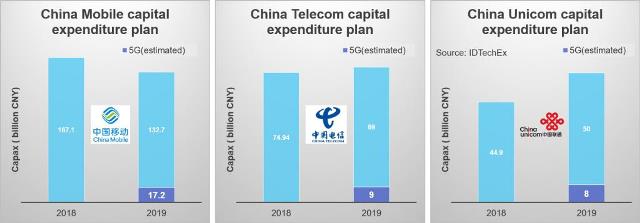

China Mobile, China Telecom and China Unicom, three main telecom carriers, announced their capital expenditure (Capex) plan for 2019.

China Telecom will spend 69 billion yuan towards Capex in 2019 vs 75 billion yuan in 2018. The 5G Capex of China Telecom will be 9 billion yuan in 2019.

China Unicom will have Capex of 50 billion yuan vs 45 billion yuan in 2018. The 5G capex of China Unicom will be 8 billion yuan in 2019.

China Mobile’s total Capex is likely to be around 133 billion yuan in 2019 vs 167 billion yuan in 2018. The 5G capex of China Mobile will be 17.2 billion in 2019.

The total 5G Capex of China Mobile, China Telecom and China Unicom is estimated to be 34 bn yuan in 2019.

The low Capex plan for 5G roll-out is due to the ongoing 4G network deployment. China Mobile and China Telecom announced increase in their 4G subscriber base.

China Mobile has built 350K 4G station in 2018 against the company’s plan of adding 140K 4G base stations.

The direct 5G revenue in China will be 6.3 trillion yuan or about $930 billion by 2030 and the Compound Annual Growth Rate (CAGR) in the coming ten years will be 29 percent. 5G will create 8 million jobs and contribute around 5.8 percent GDP growth in China by 2030.

The indirect revenue generated by 5G will be 10.6 trillion yuan or about $1,579 billion, with CAGR of 24 percent. Among them, the direct revenue for telecoms will be over $200 billion by 2029.

Telecoms in China will invest $200-350 billion from 2020-2030 for 5G development, with the key focus on automotive, industry, healthcare and energy.

Baburajan