Altice USA reported a total revenue of $2.2 billion for Q1 2025, down 4.4 percent year-over-year, with residential revenue declining by 5.7 percent to $1.7 billion and business services revenue slightly decreasing by 0.4 percent to $363.5 million.

Broadband ARPU increased by 2.4 percent to $75.31, while residential ARPU dropped by 1.3 percent to $133.93. The company posted a net loss of $75.7 million or $0.16 per diluted share, compared to a net loss of $21.2 million ($0.05 per share) in Q1 2024.

CEO Dennis Mathew highlighted record customer growth in fiber and mobile, successful programming negotiations, and operational transformation efforts leading to the lowest churn in three years. Adjusted EBITDA stood at $799 million, down 5.6 percent year-over-year, with a margin of 37.1 percent. Despite the decline, Altice USA anticipates achieving approximately $3.4 billion in Adjusted EBITDA for full-year 2025, driven by competitive strategies and operational efficiencies.

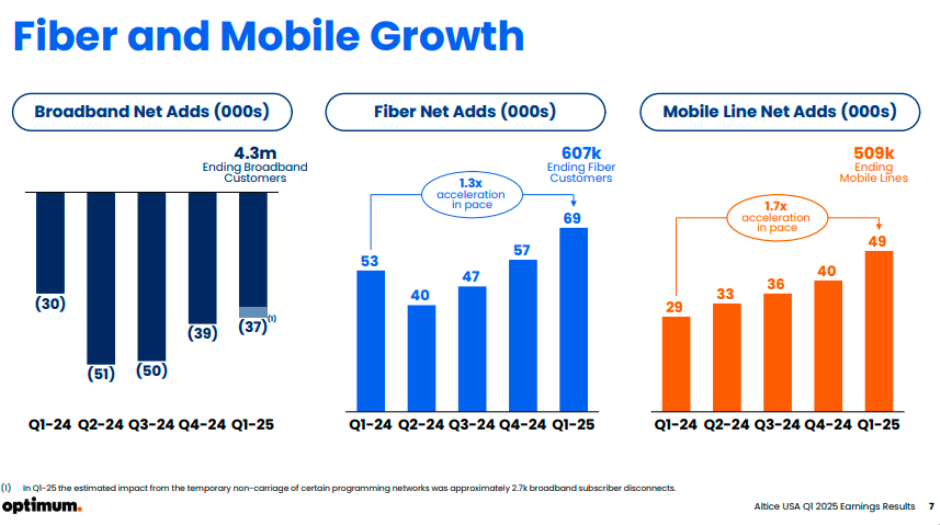

In Q1 2025, Altice USA experienced significant growth in both fiber and mobile sectors. The company achieved its highest-ever fiber net additions, adding 607k fiber customers, a 54 percent increase from Q1 2024, with a 69k net addition in the best quarter for fiber. Fiber network penetration reached 20.3 percent, up from 14.2 percent in the same period last year. Mobile growth also saw impressive results, with 509k mobile lines at a 45 percent increase compared to Q1 2024, marking the best performance in five years. The company also saw broadband and mobile convergence grow to 6.3 percent, up from 5.7 percent in Q4 2024.

Despite the positive growth in fiber and mobile, broadband primary service units (PSUs) faced a net loss of 37k, an improvement from Q4 2024’s loss of 39k, supported by better performance in the East region. The company achieved its lowest quarterly churn in three years, with residential broadband churn improving by 90bps year-over-year.

Altice continued to enhance and expand its networks, adding 25k total passings in Q1 2025, and is targeting 175k additional passings for the year. Fiber passings increased by 33k in Q1 2025. The company also focused on efficiency with mid-split upgrades to its DOCSIS 3.1 network to enable multi-gig speeds. Lightpath expanded into the Columbus, Ohio market, driven by a major hyperscaler partner.

The company is focusing on competitive strategies across local markets, deepening product penetration across broadband, mobile, video, and B2B, and driving operational transformation with digital and AI capabilities, innovative programming deals, and cost efficiency. For FY 2025, Altice is targeting approximately $1.2 billion in cash capital expenditures.

TelecomLead.com News Desk