A recent report by the Telecom Regulatory Authority of India (TRAI) has shed light on the state of 5G adoption in the country, revealing that 5G data usage accounted for 4.59 percent of the total data consumption during the April-June quarter of 2023.

During this period, the breakdown of data usage across various generations — 2G, 3G, 4G, and 5G —showed that 2G contributed 0.10 percent, 3G accounted for 0.78 percent, while the dominant force continued to be 4G with a staggering 94.53 percent share.

However, the anticipated surge in 5G demand following the network rollout by major telecom operators like Reliance Jio and Bharti Airtel did not materialize among smartphone users in India.

At the end of 2023 – fourteen months after its commercial launch – 5G penetration is expected to have topped 11 percent in India, Ericsson Mobility Report said recently. TRAI does not reveal the number of 5G customers in India. Operators reveal the number of 5G subcribers in India has crossed 100 million.

5G Americas, an industry association, recently said 5G is emerging as a source of commercial solutions for smart connectivity. 5G Americas’ white paper outlines a framework for evaluating 5G use cases, such as FWA or private 5G networks based on industry and consumer supply and demand.

“With the increasing adoption of Standalone (SA) 5G networks, we are witnessing a shift in the industry that is leading the way to a significant transformation. SA deployments can simplify networks by eliminating 4G dependency and accelerating 5G expansion in industrial applications, FWA, and private networks. As a result, we expect to experience the full potential of 5G in these domains,” Prashanth Devaraj, Director of Technology, Networks Business, Samsung Electronics America, said.

In India, Reliance Jio and Bharti Airtel have rolled out 5G services across key towns and cities to attract customers from their 4G network.

At Reliance Industries’ annual general meeting, Chairman Mukesh Ambani highlighted Jio’s customer base, boasting over 50 million 5G users and expressing readiness to seamlessly transition 4G customers to 5G without additional capital expenditure.

Bharti Airtel similarly confirmed a 5G subscriber base exceeding 50 million in India.

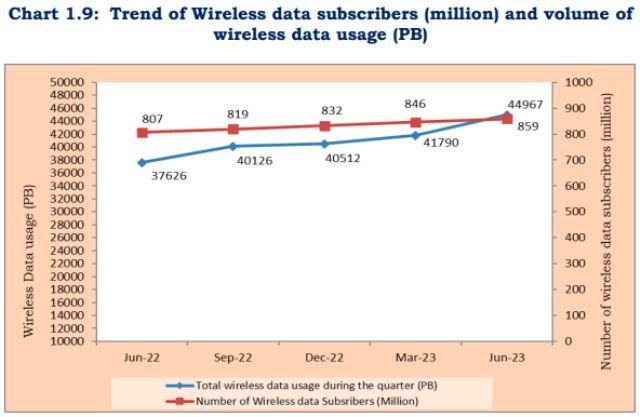

The TRAI report detailed a 7.60 percent quarterly growth in wireless data usage, surging from 41,790 PB to 44,967 PB between March and June 2023. The breakdown showcased 2G usage at 46 PB, 3G at 353 PB, 4G dominating at 42,505 PB, and 5G at 2,063 PB during the period. The total number of wireless data subscribers also saw an increase, reaching 859.33 million by June 2023.

However, amidst these figures, a slight decline in the overall wireless subscriber base from 1,143.93 million in March 2023 to 1,143.58 million in June 2023 was noted, reflecting a marginal decrease of 0.03 percent. Notably, urban wireless subscribers dipped from 627.54 million to 626.07 million, while rural wireless subscribers grew marginally from 516.38 million to 517.51 million.

Reliance Jio maintained its position as the market leader, boasting a wireless subscriber base of 438.58 million, representing a market share of 38.35 percent. Bharti Airtel followed closely with a subscriber base of 373.73 million, claiming a market share of 32.68 percent.

Furthermore, the report highlighted a 2.33 percent increase in the Monthly Average Revenue per User (ARPU) for wireless services, rising from Rs 142.32 in March 2023 to Rs 145.64 in June 2023. On a year-on-year basis, the ARPU for wireless services grew by 9.05 percent in the same quarter. However, while prepaid ARPU increased from Rs 139.63 to Rs 143.81, postpaid ARPU witnessed a decline from Rs 173.50 to Rs 166.22 in the corresponding period.

The marginal increase in mobile ARPU in India also indicates that telecom operators’ investment in 5G spectrum and network did not create enough opportunities for 5G monetization.

Baburajan Kizhakedath