Mukesh Ambani, the promoter of Reliance Jio Infocomm, may not be happy with the growth in 4G subscriber base of the latest telecom operator in India.

Mukesh Ambani, the promoter of Reliance Jio Infocomm, may not be happy with the growth in 4G subscriber base of the latest telecom operator in India.

The main strategy of Mukesh Ambani, the richest Indian, was to offer free services to 1 billion mobile phone users on Jio’s all-India 4G network. Though the company increased the quality of network and introduced cost effective packages, Jio did not bring enough active user base to beat the rivals.

Mukesh Ambani and his team could not attract mobile Internet users because rivals such as Airtel, Idea and Vodafone introduced matching offers.

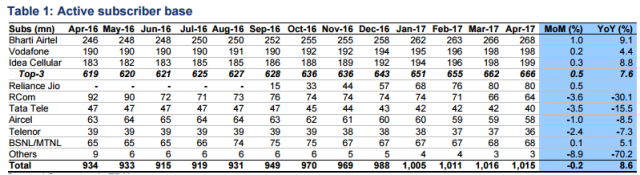

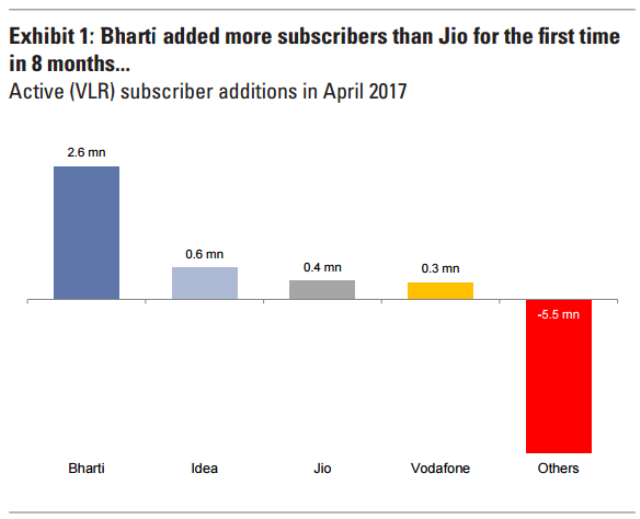

Following the release of April 2017 report from TRAI on Wednesday, investment firms Goldman Sachs and ICICI Securities revealed the active subscriber base of Jio and its main rivals. These two reports are eye openers for Mukesh Ambani and his team because of five important reasons.

First, Bharti Airtel added more active subscribers than Jio in April 2017 for the first time since Jio Infocomm’s launch in September 2016. Despite competition from Jio, 3G and 4G data subscriber additions continue to see an uptick for Bharti. April 2017 was the first month when Jio started charging for its subscribers.

First, Bharti Airtel added more active subscribers than Jio in April 2017 for the first time since Jio Infocomm’s launch in September 2016. Despite competition from Jio, 3G and 4G data subscriber additions continue to see an uptick for Bharti. April 2017 was the first month when Jio started charging for its subscribers.

Second, investment firm Goldman Sachs says since Jio has now started to charge its wireless Internet customers, this number is likely to stay strong for Bharti in the coming months, as customers shift usage back to incumbents.

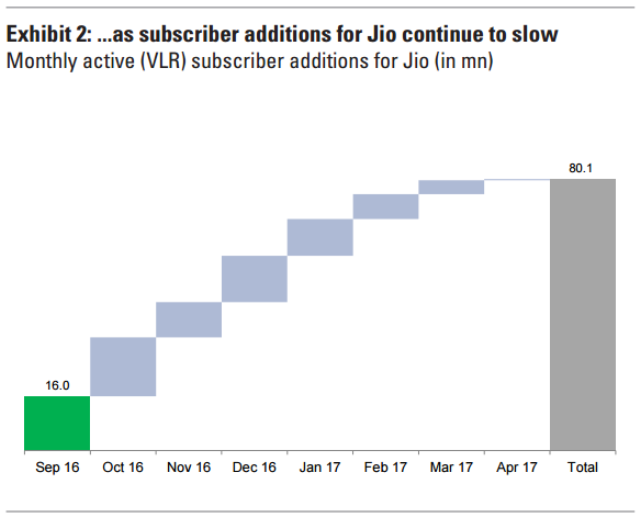

Third, despite marginal data pricing, Jio’s active subscribers as percentage of total subscribers are constantly falling with only 71 percent in April 2017. ICICI Securities says the trend is disappointing. Jio’s active subscribers as percentage of total subscribers in Mumbai and Kolkata circles are just 63.1 percent and 62.8 percent.

Third, despite marginal data pricing, Jio’s active subscribers as percentage of total subscribers are constantly falling with only 71 percent in April 2017. ICICI Securities says the trend is disappointing. Jio’s active subscribers as percentage of total subscribers in Mumbai and Kolkata circles are just 63.1 percent and 62.8 percent.

Fourth, Bharti Airtel, Idea Cellular and Vodafone India’s active subs as percentage of total subs stood at 97.6 percent.

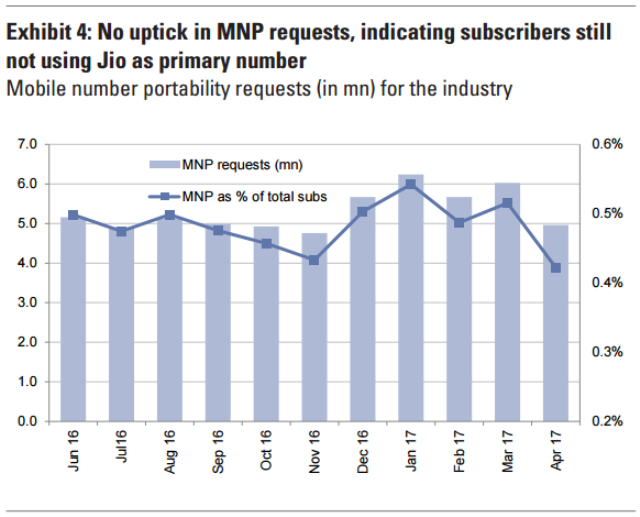

Fifth, Requests for mobile number portability (MNP) for the Indian telecom industry in April was 5 million, in line with prior months, indicating most subscribers have not yet switched to Jio as their primary mobile number.

Fifth, Requests for mobile number portability (MNP) for the Indian telecom industry in April was 5 million, in line with prior months, indicating most subscribers have not yet switched to Jio as their primary mobile number.

“This is a worrying trend for Jio and if similar trends continue, it could prompt a need for more aggressive tariff / promotions from Jio,” ICICI Securities said.

The good news for Jio is the fact that smaller telecoms lost another 5 million subscribers in April. These operators have lost 35 million subscribers since Jio’s launch, but still accounted for 23 percent of industry revenue Q4 FY17, according to TRAI data.

The good news for Jio is the fact that smaller telecoms lost another 5 million subscribers in April. These operators have lost 35 million subscribers since Jio’s launch, but still accounted for 23 percent of industry revenue Q4 FY17, according to TRAI data.

ICICI Securities expects these telecoms to lose another 350bps of revenue market share in FY 2018 as they struggle to invest in network rollout due to their levered balance sheets.

Reliance Jio is yet to officially reveal its revenue and profit / loss in the first two quarters of the launch of the 4G services. The slow growth will have a negative impact on financials of Reliance Jio that invested more than $20 billion on its 4G network.

Baburajan K

editor@telecomlead.com

Rich men fail they lose money only.but poor loses Life that’s the challenge.Mukesh also failed in Food retail/Reliance Jewels is also not separately reported.

He also controls CNBC so nobody can write much against him.The investigative Journalism & meaningful research is a relic.

Government also supports him in Oil as he along with MURLI DEORA( DIED OF ATTACK) imposing illogical Global Oil pricing of $5.42 /barrel & not cost plus based prices hence we are top 5 countries where petrol is very costly BJP+ Congress have also taxed Oil extracted Rs 110000 cr taxes last year

So its legal Corporate Government Fraud which British Petroleum & ONGC is fighting against on International Arbitration and no Judge wants to Arbitrate CORRUPT Lot. Amen

There are serious challenges as Industry Expert on LTE but not many Telecom Journalist puts in perscpective

Finally Market decides.There is long story so some other time why Jio has limitations.

Mahesh Bhatt view Kirticorp web site