Two leading mobile operators – PLDT and Globe Telecom – are enhancing their investment in the Philippines to improve customer experience, according to TelecomLead.com research.

PLDT

PLDT is focusing on reducing mobile churn as part of its investment strategy to boost customer experience.

PLDT said its investment in property and equipment rose by Php9,588 million, or 3 percent, mainly due to capital expenditures. Investment for right-of-use assets grew by Php2,036 million, or 6 percent, due to the leaseback of telecom assets sold to tower companies.

PLDT’s mobile revenues from data services (mobile internet, mobile broadband and other data services) rose by Php1,606 million, or 9 percent, to Php19,802 million during January-March 2024.

PLDT says the monthly churn rates for smart prepaid subscribers were 1.7 percent in January-March 2024 vs 4.6 percent in January-March 2023.

The monthly churn rates for TNT subscribers were 1.6 percent in January-March 2024 vs 4.8 percent for January-March 2023.

The monthly churn rates for postpaid subscribers were 1.1 percent in January-March 2024 vs 1.5 percent for January-March 2023.

Recently, PLDT secured a 5-year Php1.0 billion Green Loan Facility from HSBC Philippines to fund the modernization and expansion of its fiber network.

PLDT’s mobile internet service revenues increased by Php1,726 million, or 10 percent, to Php18,899 million in January-March 2024, primarily due to new product offerings, such as Free Tiktok for All, Power All, Affordaloads, and the promotion of Smart Postpaid’s Unli 5G plans.

Smart is the leader in 5G coverage in the first quarter of 2024 according to Opensignal. Smart has rolled out 5G offers and device financing through partnerships with credit card companies. Mobile internet services accounted for 77 percent of mobile service revenues for January-March 2024.

Mobile broadband revenues generated from the use of Pocket WiFi, amounted to Php683 million for January-March 2024, a decrease of 15 percent, due to lower mobile broadband subscriber base. Mobile broadband services accounted for 3 percent of mobile service revenues in each of the first-quater of 2024 and 2023.

Mobile revenues from voice services fell by Php591 million, or 19 percent, to Php2,455 million in January-March 2024, due to subscribers’ shift to alternative calling options, digital teleconferencing solutions, and other OTT services.

Mobile voice services accounted for 10 percent of mobile service revenues in January-March 2024 vs 13 percent.

Mobile revenues from SMS services increased by Php385 million, or 31 percent, to Php1,637 million in January-March 2024, mainly due to the increase in A2P service revenues. Mobile SMS services accounted for 7 percent of mobile service revenues.

Globe Telecom

Globe Telecom says its Net Promoter Score reached 43, which is above the Asia-Pacific telco benchmark, due to its investment in IT modernization to deliver frictionless customer experience.

Rebecca V. Eclipse is the Chief Transformation and Operations Officer (CTOO) and Chief Customer Experience Officer (CCEO) of Globe Telecom.

Globe Telecom’s 5G outdoor coverage has reached 97.90 percent in the National Capital Region and 92.36 percent in key cities of Visayas and Mindanao, alongside connecting over 5.8 million devices to 5G network in December 2023 alone.

Globe Telecom has upgraded close to 7,000 mobile sites with 894 new 5G sites nationwide.

For 2024, Globe Telecom says capex budget will be approximately ₱56 billion for the network expansion and enhancement. This will include new cell site builds, upgrading of more existing sites to 4G/LTE, rollout of 5G connectivity and the fiberization of homes nationwide, and boosting the internet quality and coverage in the country.

2023’s fiber-to-the-home (FTTH) rollout showed an 85.79 percent decrease from 2022’s fiber lines. This is primarily due to Globe’s shifted focus to maximize its existing fiber inventory, in line with the company’s emphasis on capital efficiency and optimization. In 2023, Globe prioritized the underserved prepaid fiber market by providing affordable and flexible fiber-speed internet through products such as GFiber Prepaid.

In late 2022, Globe Telecom has partnered with MatSing to introduce multi-beam, multi-band lens antenna technology to meet the capacity needs of data intensive smartphone applications used for outdoor events, remote areas, densely populated areas in cities, stadiums, and rally events. In 2023, Globe deployed 176 antennas in more than 60 locations for improving customer experience.

GlobalData report

The latest GlobalData report said total mobile services revenue in the Philippines will grow at a CAGR of 2.2 percent from $3.9 billion in 2023 to $4.4 billion in 2028.

Mobile voice service revenue will decline at a 10.7 percent CAGR due to the consumer shift towards over-the-top (OTT) communication platforms.

Mobile data service revenue will increase at a CAGR of 4.2 percent between 2023 and 2028, driven by the steady rise in smartphone subscriptions.

The monthly data usage over mobile networks is forecast to increase from 7.1GB in 2023 to 58.7GB in 2028, driven by the consumption of online video and social media content over smartphones, adoption of 5G services and the data-centric packages.

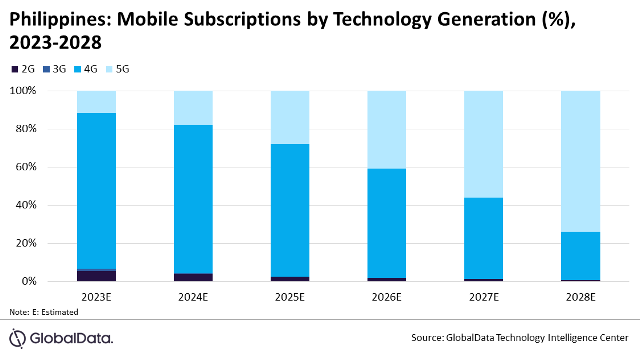

4G will remain the leading mobile technology in terms of subscriptions until 2026. 5G subscriptions will surpass 4G subscriptions and go on to account for 74 percent share of the total mobile subscriptions in 2028, Hrushikesh Mahananda, Telecom Research Analyst at GlobalData, said.

PLDT and Globe will continue to dominate the mobile services market in terms of subscriptions through 2028 given their strong focus on 5G network expansion across the country.

DITO Telecommunity will aim to gain market share by expanding its network reach and offering value packaged service plans.

Baburajan Kizhakedath